Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

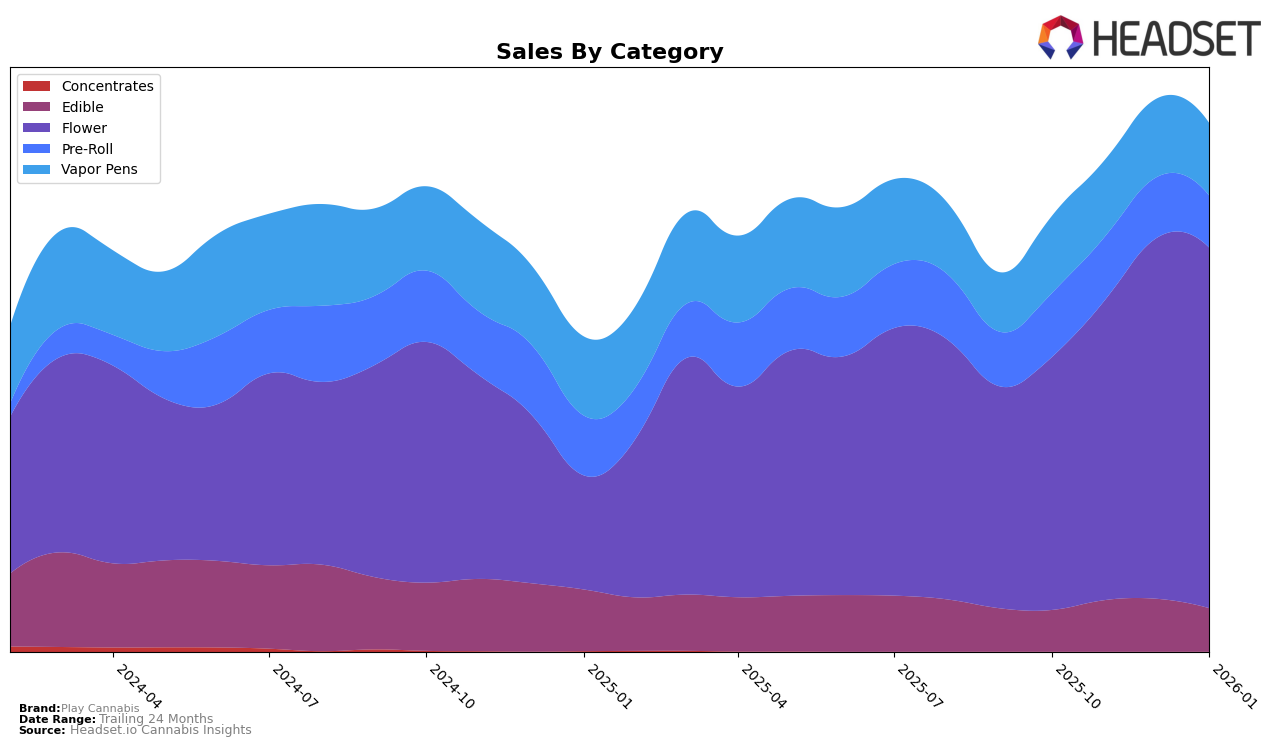

Play Cannabis has shown notable performance across various categories in the state of Michigan, with significant movements in rankings and sales trends. In the Flower category, the brand achieved a remarkable rise, reaching the top position in November 2025 before settling at the second rank in the following months, demonstrating consistent demand and market presence. On the other hand, the Edible category saw Play Cannabis maintaining a steady ninth rank from November 2025 through January 2026, despite a slight decline in sales in January. This stability in ranking suggests a solid consumer base for their edible products, even when sales figures fluctuate.

In contrast, the Pre-Roll category has presented some challenges for Play Cannabis, with a gradual decline in rankings from 11th in October 2025 to 13th by January 2026. This downward trend indicates potential competitive pressures or shifting consumer preferences that the brand may need to address. Meanwhile, the Vapor Pens category exhibited a positive trajectory, with Play Cannabis improving its position from 10th in October 2025 to 8th by January 2026. This upward movement, despite a dip in sales in January, suggests an increasing acceptance and popularity of their vapor pen products among consumers in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Play Cannabis has demonstrated a strong upward trajectory in recent months. Starting from a rank of 4th in October 2025, Play Cannabis surged to the top position in November 2025, before settling at 2nd place in both December 2025 and January 2026. This impressive performance highlights Play Cannabis's ability to capture market share and compete effectively against leading brands. Notably, High Minded consistently held the top rank, except for November 2025, indicating a robust market presence with sales figures significantly higher than others. Meanwhile, Society C maintained a stable 2nd or 3rd position throughout the period, showcasing steady sales. NOBO, on the other hand, experienced a notable jump from 10th to 4th place by January 2026, suggesting a potential rise in competitiveness. These dynamics suggest that while Play Cannabis is performing well, it faces stiff competition from established brands, necessitating strategic efforts to maintain and enhance its market position.

Notable Products

In January 2026, the top-performing product from Play Cannabis was the Pineapple Express Infused Pre-Roll (1.2g) in the Pre-Roll category, which ascended from a previous fifth place in November 2025 to first place, achieving sales of $42,568. Blue Razz Gummies 4-Pack (200mg) in the Edible category maintained a strong performance, moving up from third place in December 2025 to second place in January. Berry Burst Gummies 4-Pack (200mg) emerged in the rankings for the first time, securing the third position. Cherry Hash Rosin Gummies 4-Pack (200mg) experienced a drop from first place in December 2025 to fourth in January 2026. Strawberry Gummies 4-Pack (200mg) saw a decline in its ranking, moving from second place in December 2025 to fifth in January 2026.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.