Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

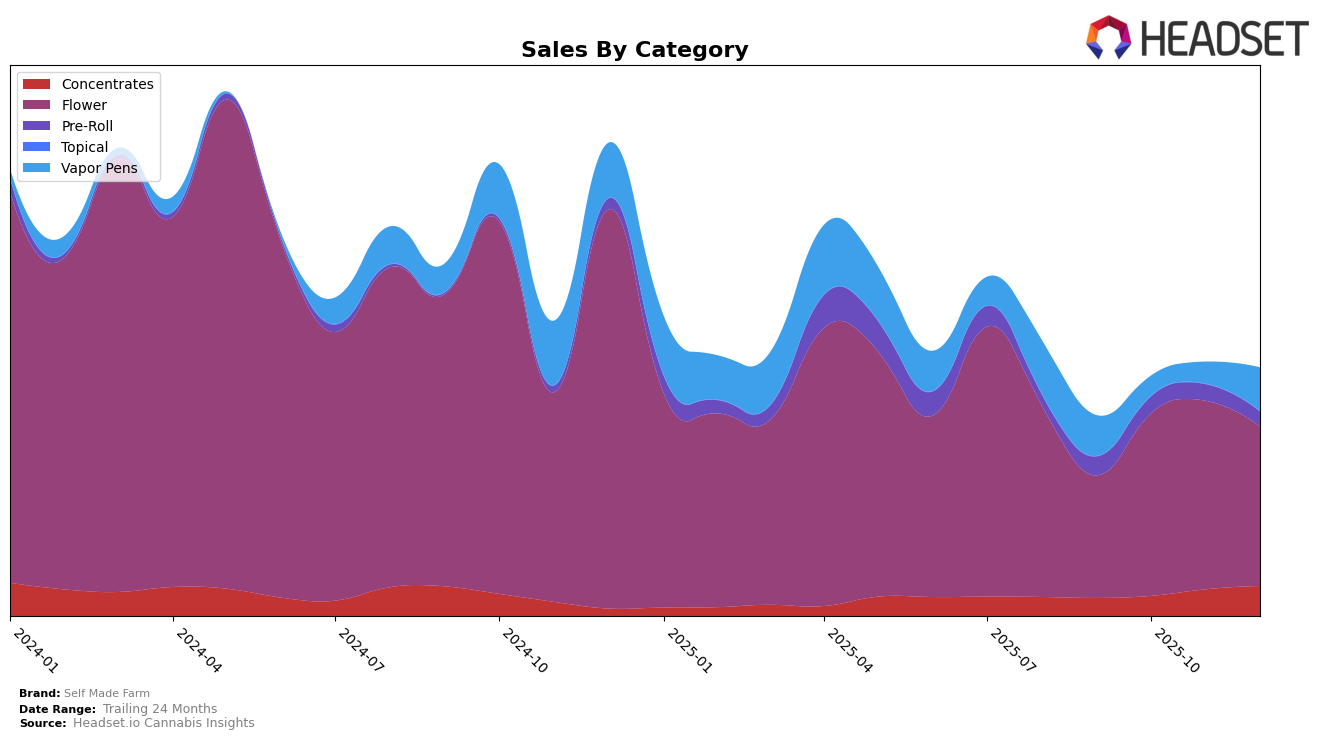

Self Made Farm has shown a promising upward trajectory in the Concentrates category within Oregon. Over the last four months of 2025, the brand improved its ranking from 56th in September to 41st by December. This positive movement is accompanied by a steady increase in sales, indicating a growing consumer interest and market penetration in this category. However, the brand's performance in the Pre-Roll category did not exhibit the same upward trend, remaining outside the top 70 throughout the same period, which suggests a potential area for improvement or strategic realignment.

In the Flower category, Self Made Farm experienced some fluctuations in Oregon, achieving its peak rank at 25th in November before slipping back to 30th in December. This movement suggests a competitive landscape where maintaining a top position requires consistent effort and adaptation. Meanwhile, the Vapor Pens category saw a notable dip in October, falling to 67th, but the brand quickly rebounded to 51st by December. This rebound could be indicative of successful marketing strategies or product adjustments that resonated with consumers during the holiday season. Despite these fluctuations, the brand's ability to remain within the top 30 in the Flower category highlights its strong presence in that segment.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Self Made Farm has shown a notable fluctuation in its ranking over the last few months of 2025. Starting from a rank of 38 in September, Self Made Farm improved to 25 by November, before slipping back to 30 in December. This indicates a dynamic market position, with sales peaking in November before a slight decline in December. In comparison, Luvli PDX experienced a significant jump in December, moving from a rank of 62 in November to 28, suggesting a strong competitive push. Meanwhile, Gud Gardens saw a drop from a solid rank of 16 in November to 36 in December, potentially opening opportunities for Self Made Farm to capture more market share. Garden First maintained a relatively stable position, ending December at rank 29, close to Self Made Farm, indicating a tight competition. Lastly, Piff Stixs showed a consistent performance, maintaining its rank at 47 from November to December, suggesting a steady but less competitive threat. These dynamics highlight the importance for Self Made Farm to strategize effectively to capitalize on the fluctuations and opportunities in the Oregon flower market.

Notable Products

In December 2025, the top-performing product from Self Made Farm was Super Boof Pre-Roll, maintaining its number one rank from November with impressive sales of 7,087 units. Chem Bros Pre-Roll followed as the second best-seller, showing a consistent demand as it regained its second position after not being ranked in November. Ice Cream Cake Pre-Roll moved up to the third spot, climbing from its previous rank of two in November. Hashburger Pre-Roll saw a decline, moving from third in November to fourth in December. Sour Sundae Flower, a new entrant in the rankings, secured the fifth position, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.