Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

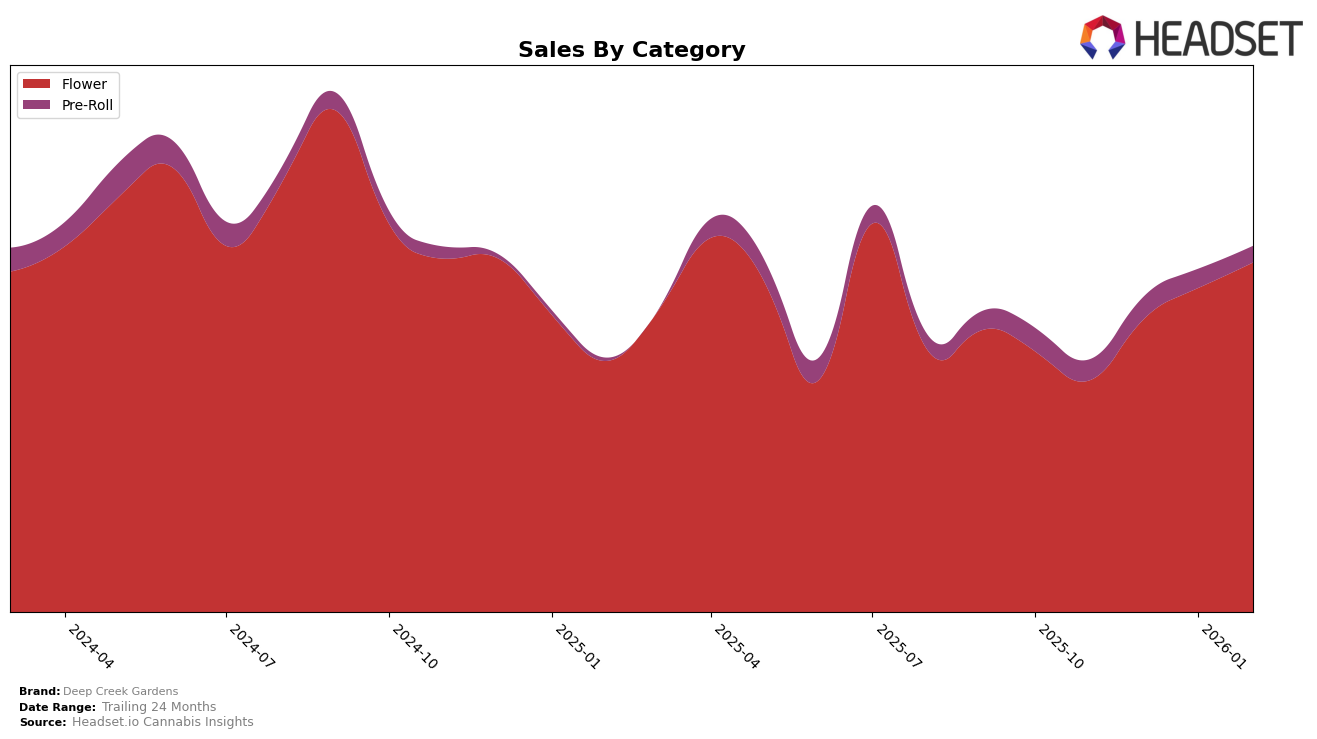

Deep Creek Gardens has shown a notable upward trend in the Flower category within the state of Oregon. From November 2025 to February 2026, the brand improved its ranking from 17th to 8th place, indicating a strong performance and growing popularity. This positive movement is also reflected in their sales figures, which have consistently increased over the same period. However, in the Pre-Roll category, Deep Creek Gardens has not managed to break into the top 30, maintaining a position in the mid-50s range. This indicates a potential area for growth, as their performance in this category has remained relatively stagnant.

Interestingly, the Flower category's success in Oregon suggests a strategic focus or consumer preference that Deep Creek Gardens has effectively tapped into. The consistent ranking improvement in this category contrasts with the Pre-Roll segment, where the brand has not achieved significant traction. The lack of top 30 presence in Pre-Rolls could be seen as a missed opportunity, or perhaps a strategic choice to focus resources on their more successful Flower products. This dual performance highlights the brand's strength in one category while suggesting the need for reevaluation or innovation in another.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Deep Creek Gardens has shown a promising upward trajectory in recent months. Starting from a rank of 17th in November 2025, Deep Creek Gardens climbed to 8th by February 2026, indicating a consistent improvement in market positioning. This rise is noteworthy when compared to competitors like Meraki Gardens, which fluctuated between 3rd and 10th place, and Panda Farms, which made a significant leap from 47th to 10th. Meanwhile, Urban Canna and High Tech maintained relatively stable positions within the top 10, with Urban Canna consistently outperforming Deep Creek Gardens in terms of sales. Despite this, Deep Creek Gardens' steady climb in rank suggests effective strategies in capturing market share, potentially driven by increased consumer preference or successful marketing initiatives. This positive trend positions Deep Creek Gardens as a formidable contender in the Oregon flower market, with the potential to further challenge higher-ranked brands if the momentum continues.

Notable Products

In February 2026, Deep Creek Gardens' top-performing product was GMO (Bulk) in the Flower category, maintaining its number one rank from January with sales reaching 1,271 units. Firebird (Bulk), also in the Flower category, rose to the second position from third in January, indicating a strong sales increase to 911 units. Supa Durban (Bulk) made a significant leap to third place from being unranked in January, showcasing a notable rise in popularity. GMO (1g) entered the rankings for the first time in February, securing the fourth spot. Meanwhile, Rip City Durban (Bulk) debuted in the rankings at fifth place, reflecting a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.