Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

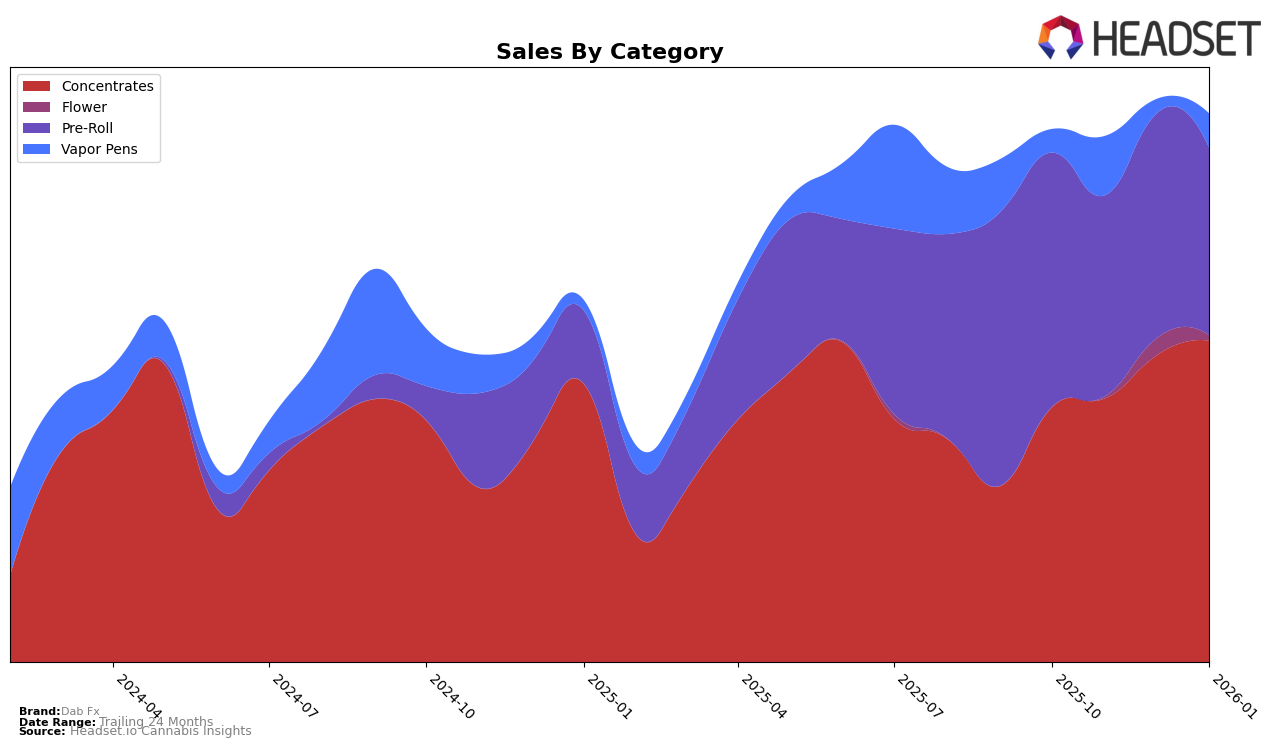

In the realm of cannabis concentrates, Dab Fx has shown notable progress in the state of Massachusetts. Over the months from October 2025 to January 2026, the brand has consistently improved its ranking, moving from 17th to 14th place. This upward trajectory is indicative of a strong market presence and growing consumer preference. The brand's sales figures also reflect this positive trend, with a significant increase from $53,314 in October to $67,354 in January. This suggests that Dab Fx is successfully capturing a larger share of the Massachusetts concentrates market, although the specifics of what is driving this growth remain undisclosed.

Despite the encouraging performance in Massachusetts, Dab Fx's absence from the top 30 rankings in other states or provinces could be seen as a potential area for growth or concern. The lack of presence in these markets might point to either a strategic focus on Massachusetts or challenges in expanding their footprint. While the data provides a glimpse into the brand's success in a single state, it leaves questions about their strategy and performance in other regions. This selective presence could be an opportunity for Dab Fx to explore new markets or to consolidate their strengths in Massachusetts before venturing further afield.

Competitive Landscape

In the Massachusetts concentrates market, Dab Fx has shown a steady improvement in its ranking, moving from 17th place in October 2025 to 14th place by January 2026. This upward trend is indicative of a positive shift in sales performance, with Dab Fx seeing a consistent increase in sales from October through January. Despite this progress, Dab Fx faces stiff competition from brands like Local Roots, which jumped from 16th to 12th place, and Dabl, which experienced a fluctuating rank but managed to outperform Dab Fx in December with a notable sales spike. Meanwhile, Theory Wellness and Sweetgrass Botanicals have also been key players, with Theory Wellness maintaining a stable position and Sweetgrass Botanicals experiencing a rank drop in November but recovering by December. Dab Fx's ability to climb the ranks amidst such dynamic competition highlights its growing presence in the market, although it must continue to innovate and adapt to maintain this momentum against its agile competitors.

Notable Products

In January 2026, the top-performing product for Dab Fx was the Tarantula Mango Rush Infused Pre-Roll (1g), which maintained its number one rank from December 2025, with sales reaching 728 units. The Tarantula Pineapple Kush Infused Pre-Roll (1g) climbed to the second position, showing a notable increase from its consistent third-place ranking in the prior months. Tarantula Moon Blend Infused Pre-Roll (1g) rose to third place from fourth in December, while Tarantula Banana Land Infused Pre-Roll (1g) dropped to fourth after being second in December. A new entry, the Tropical Dream Infused Single Pre-Roll (1g), secured the fifth rank, marking its debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.