Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

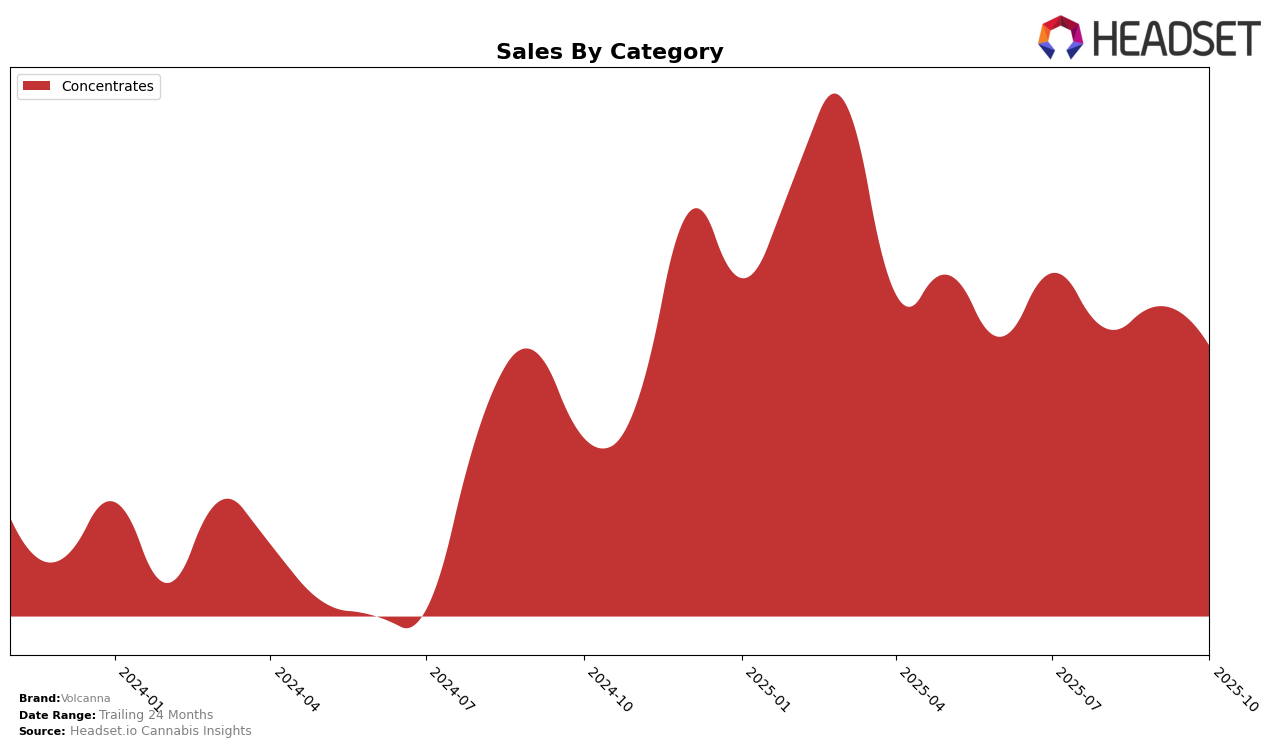

Volcanna's performance in the Massachusetts market, particularly in the Concentrates category, has shown some fluctuations over the past few months. In July 2025, the brand held the 14th position, maintaining it in August. However, September saw an improvement as Volcanna climbed to 13th place, only to drop back to 16th in October. This movement suggests a competitive landscape in Massachusetts, where Volcanna is striving to maintain its foothold. Despite these ranking shifts, the sales figures indicate a downward trend from July's high of $71,682 to October's $56,820, highlighting potential challenges in sustaining consumer interest or market share.

Interestingly, the absence of Volcanna from the top 30 brands in other states or categories might indicate either a focused strategy on the Massachusetts market or challenges in expanding their footprint. The brand's consistent presence in the Massachusetts Concentrates category, despite the fluctuations, suggests a certain level of brand loyalty or recognition. However, the drop in rankings in October could be a signal for the brand to reassess its strategies, perhaps exploring new marketing tactics or product innovations to regain momentum. The data hints at underlying dynamics that could be crucial for stakeholders looking to understand Volcanna's market positioning and potential growth opportunities.

Competitive Landscape

In the Massachusetts concentrates market, Volcanna experienced a fluctuating performance over the recent months, with its rank slipping from 13th in September 2025 to 16th in October 2025. This decline in rank is notable as it coincides with a decrease in sales, indicating potential challenges in maintaining market share. Meanwhile, Cloud Cover (C3) maintained a consistent position at 11th in July and August, before dropping to 15th in September and October, showing a similar downward trend in sales. Interestingly, Sweetgrass Botanicals improved its standing, moving from 22nd in July to 14th by October, reflecting a positive sales trajectory. Additionally, Dope Chemist made a significant leap from 48th in July to 19th in October, suggesting a strong upward momentum. These shifts highlight a competitive landscape where Volcanna faces pressure from both established and emerging brands, emphasizing the need for strategic adjustments to regain its competitive edge.

Notable Products

In October 2025, Volcanna's top-performing product was Lemon Meringue Crumble (1g) in the Concentrates category, which climbed to the number one spot from third place in September, achieving sales of $215. TK43 Crumble (1g) maintained its strong performance, securing the second rank after previously being unranked in September. Banana Markers Sauce (1g) entered the rankings in third place, showing significant sales momentum. Ztan Lee Crumble (1g) and Midnight Mass Crumble (1g) rounded out the top five, ranking fourth and fifth respectively. Notably, all top-ranked products in October were from the Concentrates category, indicating a strong consumer preference for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.