Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

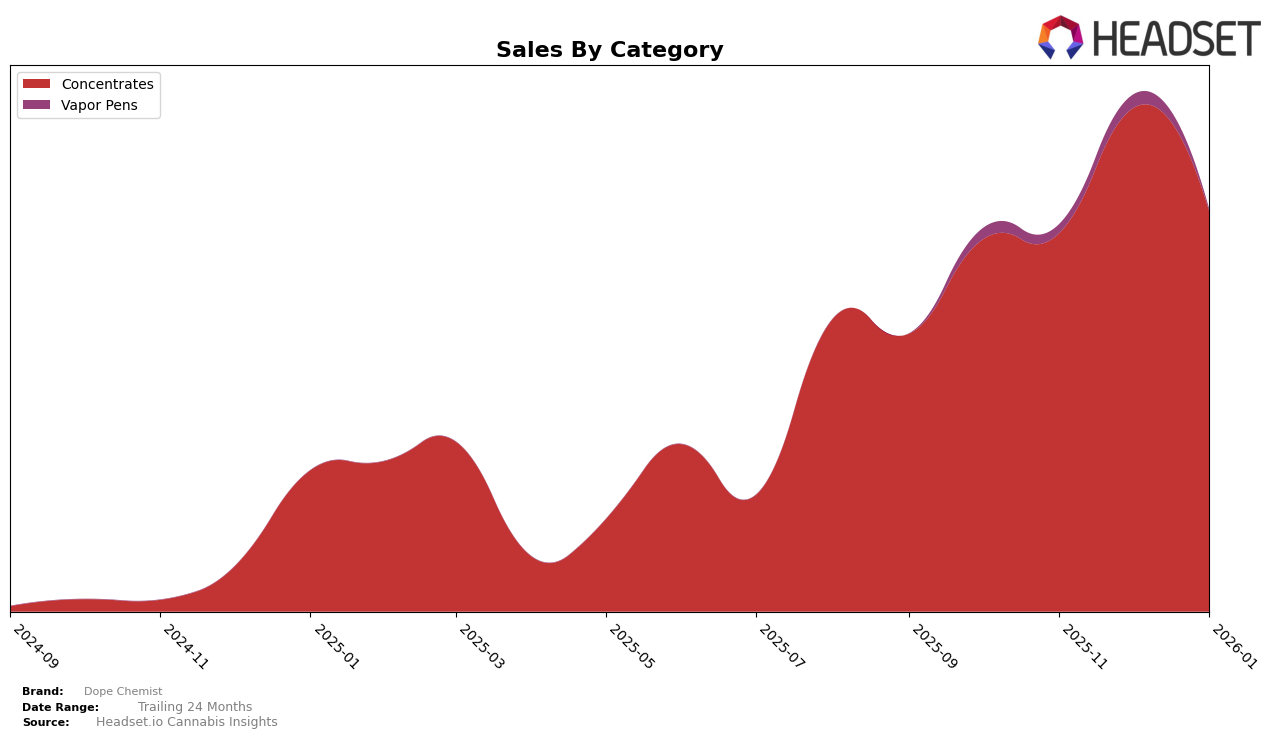

In the Massachusetts market, Dope Chemist has shown some interesting movement in the Concentrates category over the past few months. Starting from October 2025, the brand was ranked 22nd, maintaining this position into November. However, December brought a significant boost as they climbed to the 17th spot, only to see a drop back to 24th in January 2026. This fluctuation suggests a competitive environment where Dope Chemist managed to briefly capture increased consumer interest, potentially due to seasonal demand or successful marketing strategies during the holiday season.

While the brand's sales figures in Massachusetts reflect some volatility, with a notable peak in December, it's worth noting that Dope Chemist did not appear in the top 30 rankings in any other state or category during this period. This absence from other markets could indicate either a strategic focus on Massachusetts or challenges in penetrating other regions. Such insights could be crucial for stakeholders looking to understand the brand's market positioning and potential areas for expansion or improvement.

Competitive Landscape

In the Massachusetts concentrates market, Dope Chemist has experienced notable fluctuations in its ranking and sales over the past few months. While it achieved a peak rank of 17th in December 2025, it slipped to 24th by January 2026. This decline in rank coincided with a decrease in sales from December to January, suggesting potential challenges in maintaining its competitive edge. Competitors such as Cloud Cover (C3) have consistently ranked higher, although their sales have shown a downward trend, which could indicate an opportunity for Dope Chemist to capitalize on any market shifts. Meanwhile, Clear Gold Concentrates has shown a positive trajectory, improving its rank and sales, which might pose a growing threat to Dope Chemist's market position. Brands like Natural Selections and Discount Canna Club have also demonstrated varying performance, with the latter showing a significant sales increase in December, suggesting a dynamic and competitive landscape that Dope Chemist must navigate strategically.

Notable Products

In January 2026, Ice Cream Cake Live Hash Rosin (1g) emerged as the top-performing product for Dope Chemist, maintaining its number one rank from November 2025, with a notable sales figure of 260. Moroccan Peaches Live Hash Rosin (1g) held steady at the second position, despite a decrease in sales from December. MAC 1 Live Hash Rosin (1g) made its debut in the rankings at the third position, showing promising sales figures. Durban Lemons Cured Badder (1g) entered the rankings at fourth place, adding diversity to the top products. Cranberry Zkittles Live Hash Rosin (1g) returned to the rankings at fifth place, although its sales were lower compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.