Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the Illinois market, Dabl's performance in the concentrates category has shown a consistent struggle to break into the top 30 brands. Throughout the months from October 2025 to January 2026, Dabl's ranking remained just outside the top 30, indicating a challenge in gaining a competitive edge in this state. The sales figures reflect this struggle, as there was a noticeable decline from $31,164 in October 2025 to $19,635 in January 2026. This downward trend suggests that Dabl may need to reevaluate its strategy or product offerings in Illinois to improve its market position.

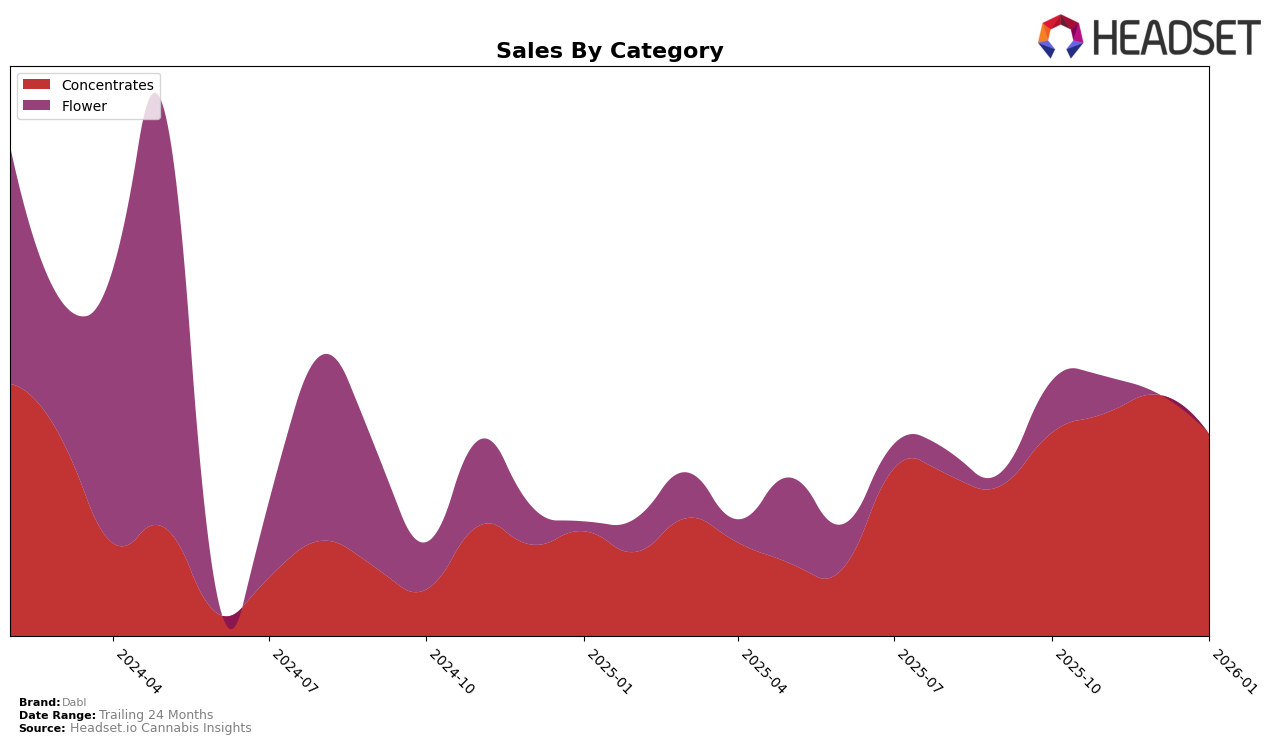

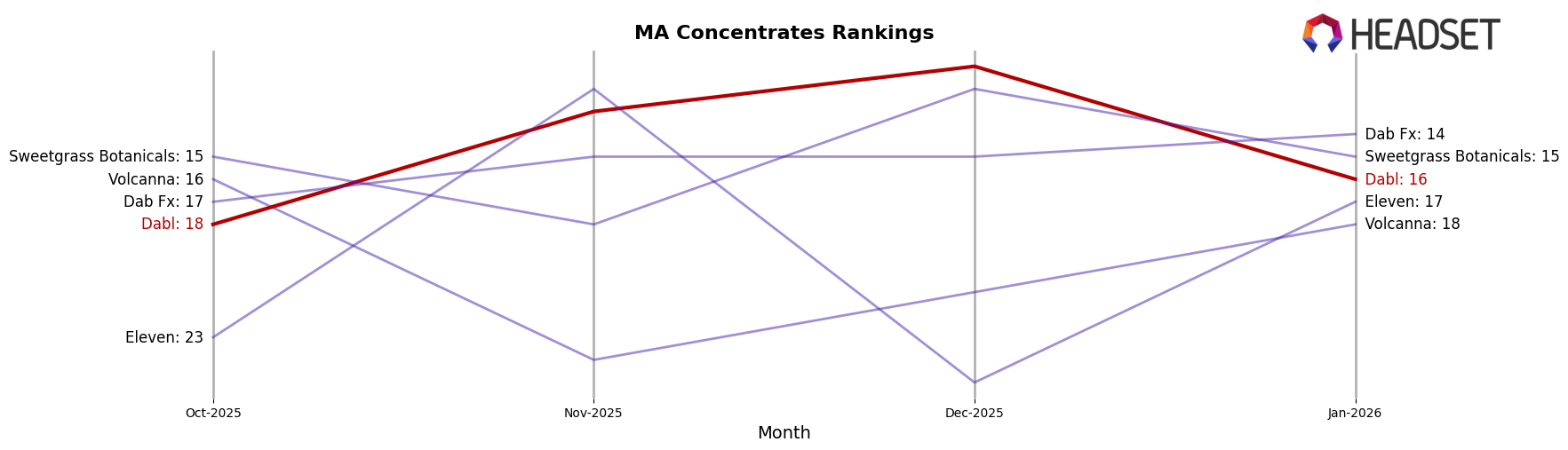

Conversely, in Massachusetts, Dabl has demonstrated a more favorable performance trajectory in the concentrates category. The brand improved its ranking from 18th in October 2025 to an impressive 11th by December 2025, before experiencing a slight dip to 16th in January 2026. This upward movement, particularly the peak in December, aligns with a significant increase in sales, which reached $75,715 during that month. The ability to climb the ranks and achieve higher sales in Massachusetts suggests that Dabl is resonating well with consumers in this state, potentially due to successful marketing strategies or product appeal. However, maintaining this momentum will be crucial for continued success.

Competitive Landscape

In the Massachusetts concentrates market, Dabl has shown a dynamic shift in its competitive positioning over the past few months. Starting from October 2025, Dabl was ranked 18th, but it climbed to 13th in November and further improved to 11th in December, before slightly dropping to 16th in January 2026. This fluctuation in rank reflects a robust increase in sales, particularly notable in December when Dabl's sales surged, surpassing competitors like Volcanna and Eleven, who were not consistently in the top 20 during this period. Meanwhile, Dab Fx maintained a steadier rank, hovering around the 14th to 17th positions, indicating a more stable but less aggressive growth compared to Dabl. Sweetgrass Botanicals also presented strong competition, particularly in December, where it ranked 12th, just ahead of Dabl. These insights suggest that while Dabl is experiencing a positive sales trajectory, the competitive landscape remains challenging, necessitating strategic efforts to sustain and enhance its market position.

Notable Products

In January 2026, the top-performing product from Dabl was the Dabl RSO Dablicator (1g) in the Concentrates category, climbing to the number one rank with sales of 268 units. The Yuck Mouth Liquid Diamonds (1g) debuted impressively at the second spot in the same category. Planet of the Grapes Live Resin Badder (0.5g) returned to the rankings at third place, having previously been unranked in December 2025. Lemon Fatman Live Resin Badder (0.5g) dropped from its top position in November 2025 to fourth place. Super Boof Live Resin Budder (0.5g) maintained a presence in the top five, albeit with a slight decline to fifth place from its fourth position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.