Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

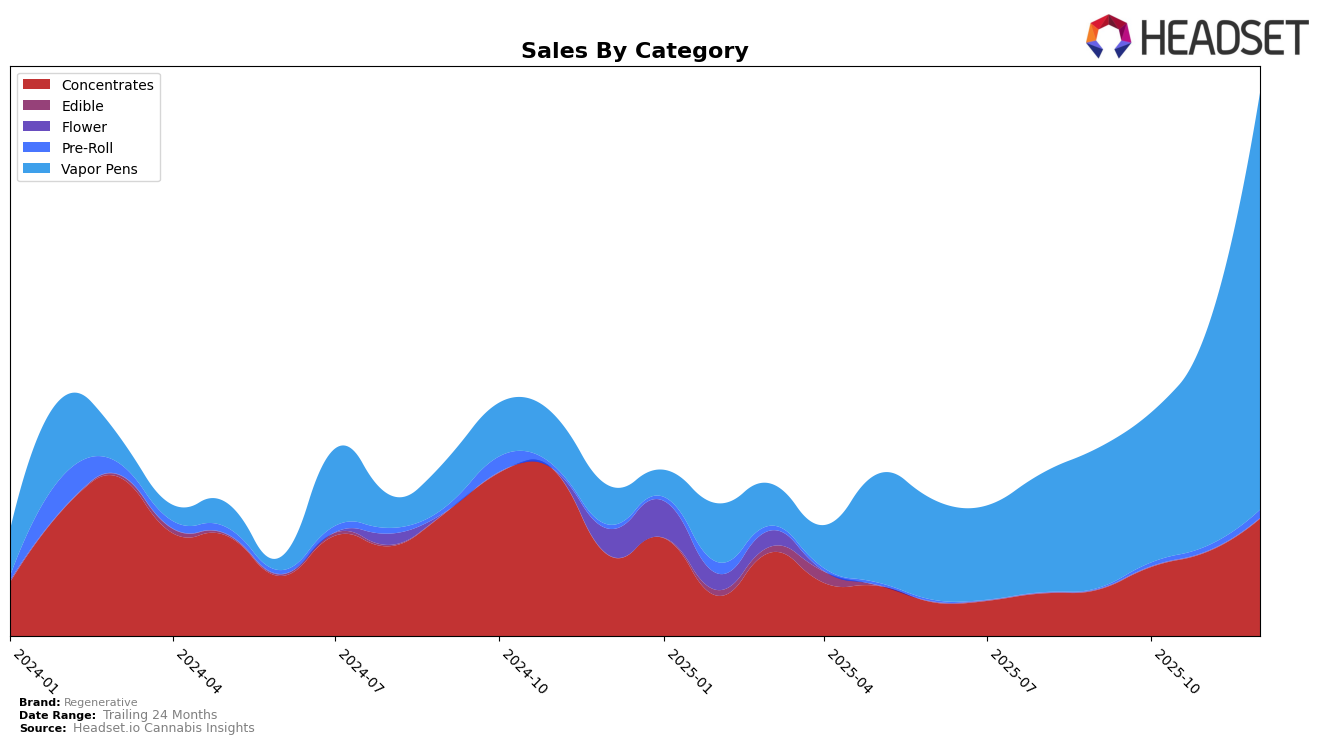

In the Massachusetts market, Regenerative has shown a notable upward trajectory in the Concentrates category. Starting from a rank of 40 in September 2025, the brand climbed to the 20th position by December 2025. This consistent improvement indicates a strong market presence and growing consumer preference for their concentrates. While the sales figures rose significantly from September to December, the brand's absence from the top 30 in earlier months highlights a commendable recovery and strategic market penetration in recent months.

Regenerative's performance in the Vapor Pens category in Massachusetts also reflects a positive trend, albeit with a more gradual climb. Beginning outside the top 30 in September 2025, Regenerative improved its standing to 36th by December. This progress suggests an increasing acceptance and demand for their vapor pen products, despite starting from a lower position. The steady ascent in rankings, alongside a significant jump in sales from October to December, underscores a strengthening foothold in this category, although the initial rankings indicate there is still room for improvement to compete with the leading brands.

Competitive Landscape

In the Massachusetts Vapor Pens category, Regenerative has shown a remarkable upward trajectory in its ranking from September to December 2025, moving from a rank of 65 to 36. This significant improvement suggests a strong increase in market presence and consumer preference. In contrast, Nature's Heritage and Happy Valley (MA) maintained relatively stable positions, with Nature's Heritage improving slightly from rank 39 to 34 and Happy Valley holding steady around rank 37. Meanwhile, Sparq Cannabis Company experienced a decline, dropping from rank 22 in September to 35 by December, indicating potential challenges in maintaining its earlier momentum. Regenerative's sales growth trajectory, especially in December, where it closely approached the sales figures of more established competitors, highlights its growing competitiveness in the market. This trend positions Regenerative as a rising contender in the Massachusetts Vapor Pens sector, potentially reshaping the competitive landscape.

Notable Products

In December 2025, the top-performing product for Regenerative was the Lemon Headz OG Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales reaching 2190 units. The Blueberry Muffin Distillate Cartridge (1g) secured the second position, marking its debut in the rankings, while the Pineapple Candy Distillate Disposable (1g) followed closely in third place. The Pineapple Candy Distillate Cartridge (1g) maintained a strong presence, ranking fourth, although it dropped from its second position in November. Meanwhile, the Blueberry Muffin Live Resin Cartridge (1g) fell from first place in November to fifth in December, indicating a notable shift in consumer preferences. These changes highlight a dynamic market where new entrants and existing products vie for the top spots each month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.