Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

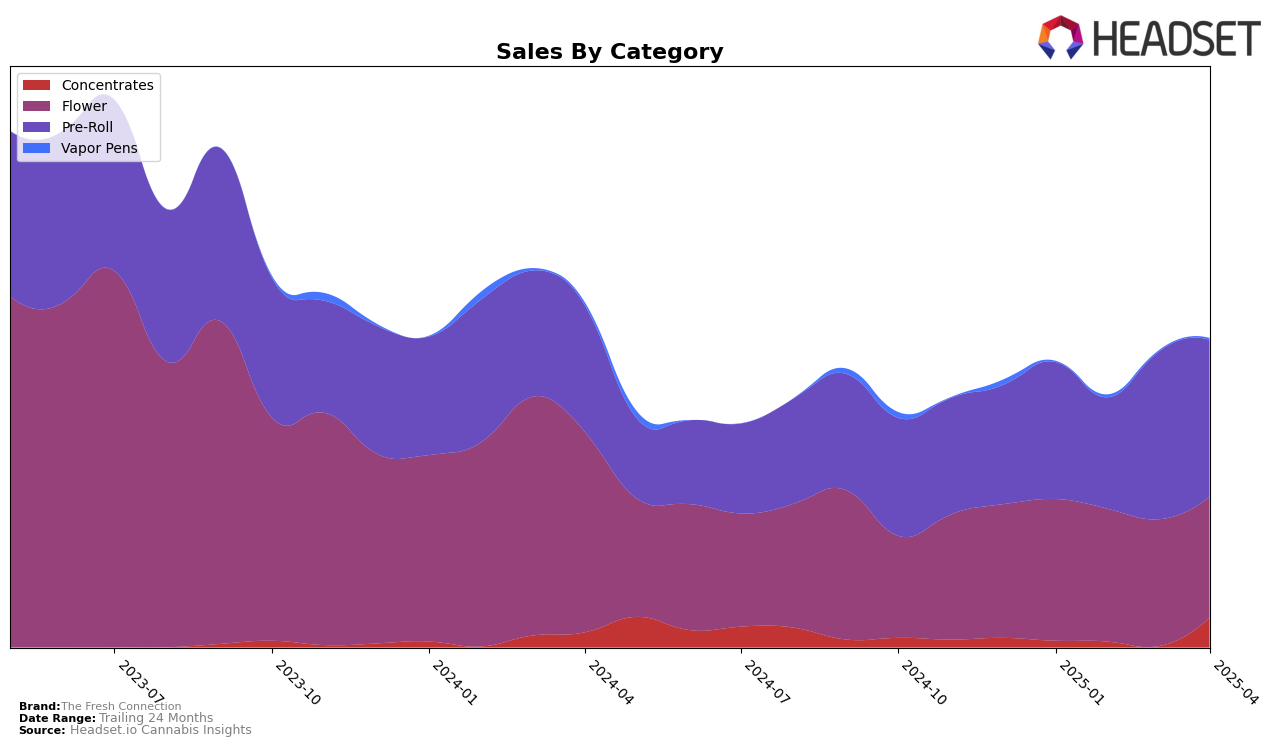

The Fresh Connection has shown varied performance across different product categories and states. In Massachusetts, the brand made a notable entry into the Concentrates category in April 2025, securing a rank of 27th. This marks a significant achievement for the brand as it was not ranked in the top 30 in the preceding months, indicating a positive reception in this category. Conversely, their performance in the Flower category has seen a downward trend from January to April 2025, with a decline in rank from 54th to 67th. This suggests challenges in maintaining their competitive edge in this segment within Massachusetts.

In the Pre-Roll category, The Fresh Connection has maintained a consistent presence in Massachusetts, consistently ranking 33rd in March and April 2025 after a slight dip to 37th in February. Despite fluctuations in sales figures, this stability in ranking indicates a steady demand for their Pre-Roll products. However, the absence of top 30 rankings in other states or categories suggests areas for potential growth and market penetration. This mixed performance highlights both opportunities and challenges for The Fresh Connection as they navigate the competitive cannabis market landscape.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, The Fresh Connection has shown a consistent performance, maintaining its rank at 33rd place from March to April 2025. This stability comes amidst fluctuations from competitors such as Cloud Cover (C3), which saw a slight improvement from 40th to 37th place, and Shaka Cannabis Company, which experienced a decline from 27th to 32nd place. Notably, Trees Co. (TC) has been a strong performer, although it dropped from 23rd to 30th place in April. Despite these shifts, The Fresh Connection's sales have remained robust, with a slight decrease from March to April, yet still outperforming Local Roots, which ranked lower at 39th place in April. This suggests that while The Fresh Connection holds a steady position, there is room for strategic growth to climb higher in the rankings, especially considering the competitive advancements and declines of its peers.

Notable Products

In April 2025, the top-performing product for The Fresh Connection was Gas Leak Pre-Roll (1g) in the Pre-Roll category, maintaining its position as the number one ranked product since March. This product achieved impressive sales of 3903 units. Perfect Pair Pre-Roll (1g) followed as the second-ranked product, showing a consistent improvement from its fifth-place ranking in January. Peanut Butter Frosting Pre-Roll (1g) secured the third position, marking its first appearance in the top ranks since February. Cobra Milk Pre-Roll (1g) climbed to fourth place from fifth in March, while Melon Ball Pre-Roll (1g) entered the ranks for the first time, achieving a fifth-place position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.