Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

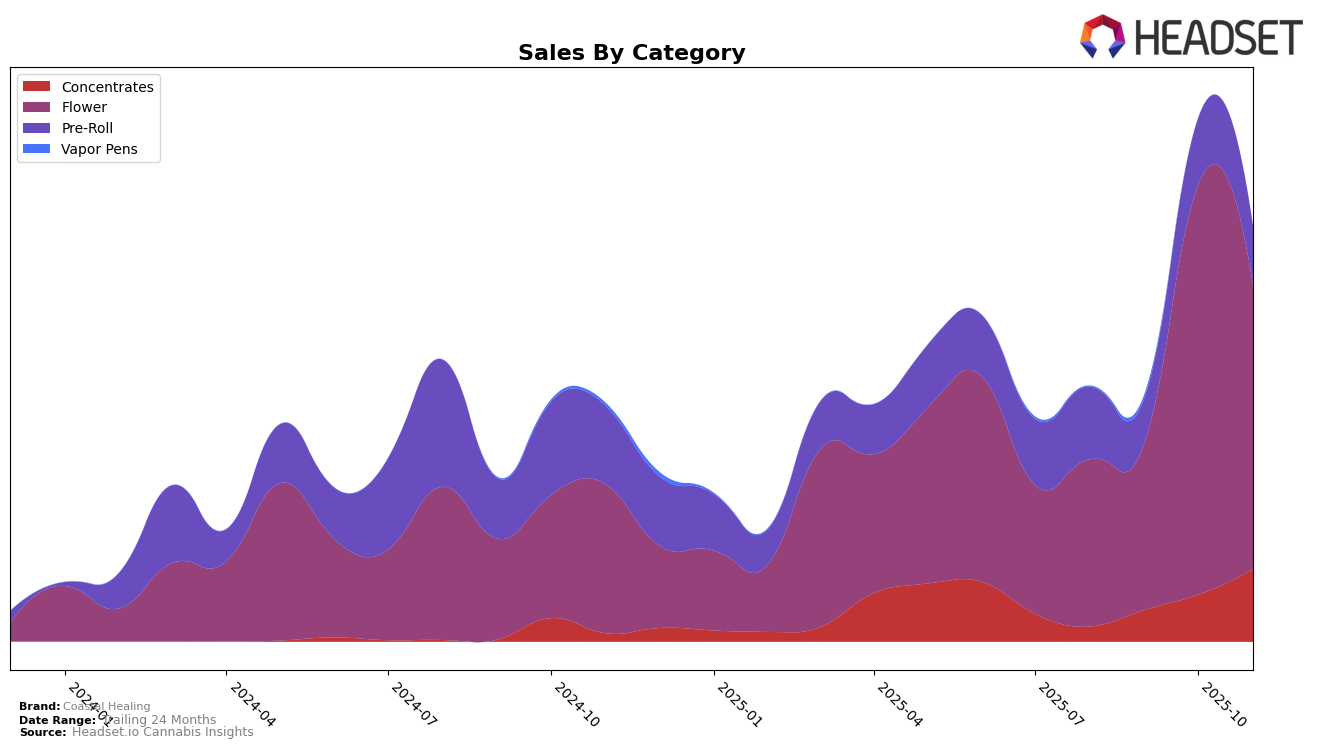

Coastal Healing has shown a promising upward trajectory in the concentrates category within Massachusetts. After not ranking in the top 30 in August 2025, the brand made a significant leap to 50th place in September, quickly climbing to 41st in October, and finally breaking into the top 30 by November. This steady rise in rankings is accompanied by a substantial increase in sales, suggesting that Coastal Healing's products are gaining traction and popularity among consumers in the state. Such a performance indicates a positive reception and growing market presence, which could potentially lead to further expansion or deeper market penetration if the trend continues.

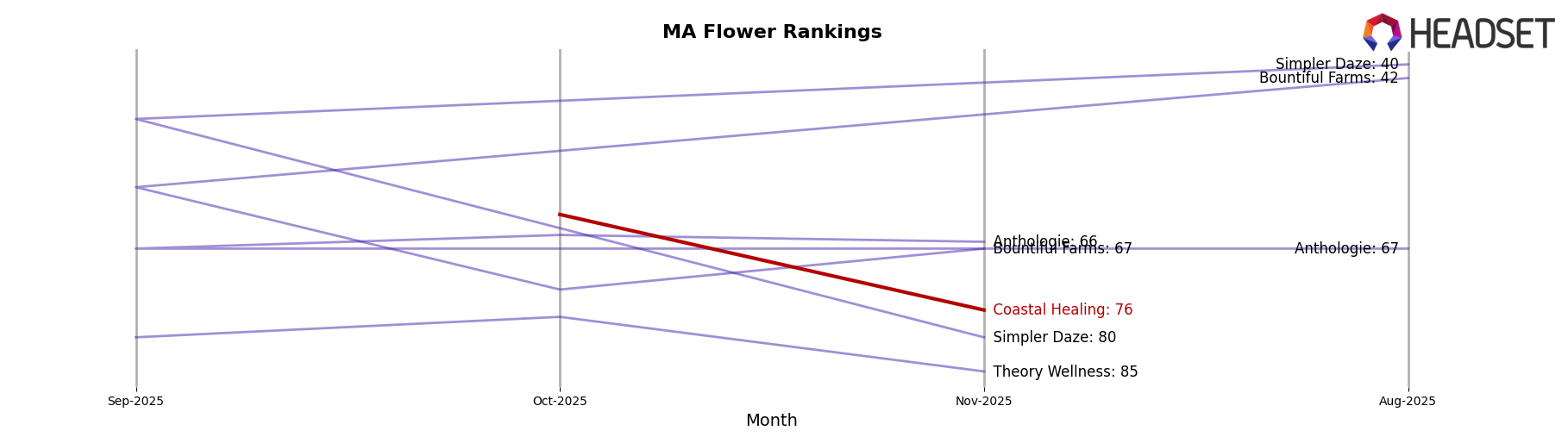

In contrast, Coastal Healing's performance in the flower category in Massachusetts has been more challenging. The brand did not rank in the top 30 for either August or September 2025, and when it did enter the rankings in October, it was at 62nd place, slipping further to 76th by November. This decline, despite having notable sales in October, may reflect increased competition or shifting consumer preferences. The disparity between the brand's success in concentrates versus its struggles in the flower category highlights the importance of strategic focus and perhaps the need for targeted improvements or marketing efforts in the latter segment to capture a larger share of the market.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Coastal Healing has shown a dynamic shift in its market presence. After not ranking in the top 20 for August and September 2025, Coastal Healing made a notable entry at rank 62 in October, before slightly dropping to rank 76 in November. This entry and subsequent ranking indicate a positive trend in sales performance, suggesting a strategic push or market acceptance that has allowed Coastal Healing to gain traction. In comparison, Anthologie maintained a stable position, hovering between ranks 65 and 67, while Bountiful Farms experienced a decline from rank 42 in August to 67 in November, reflecting a downward sales trend. Meanwhile, Simpler Daze re-entered the rankings at 80 in November after a previous absence, indicating volatility. Coastal Healing's recent entry and performance suggest a competitive edge that could be leveraged for further growth in the Massachusetts flower market.

Notable Products

In November 2025, Gorilla Punch (28g) emerged as the top-performing product for Coastal Healing, achieving the number one rank with sales of 1850 units. Raspberry Sunset (3.5g) slipped to the second position after leading in October, indicating a decrease in sales momentum from a previous high of 2877 units. Dante's Inferno (3.5g) made a strong debut in the rankings, securing the third spot. Purple Punch (3.5g) fell to fourth place, a significant drop from its first-place ranking in September. Lemon Zephyr x Atteberries Badder (1g) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.