Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

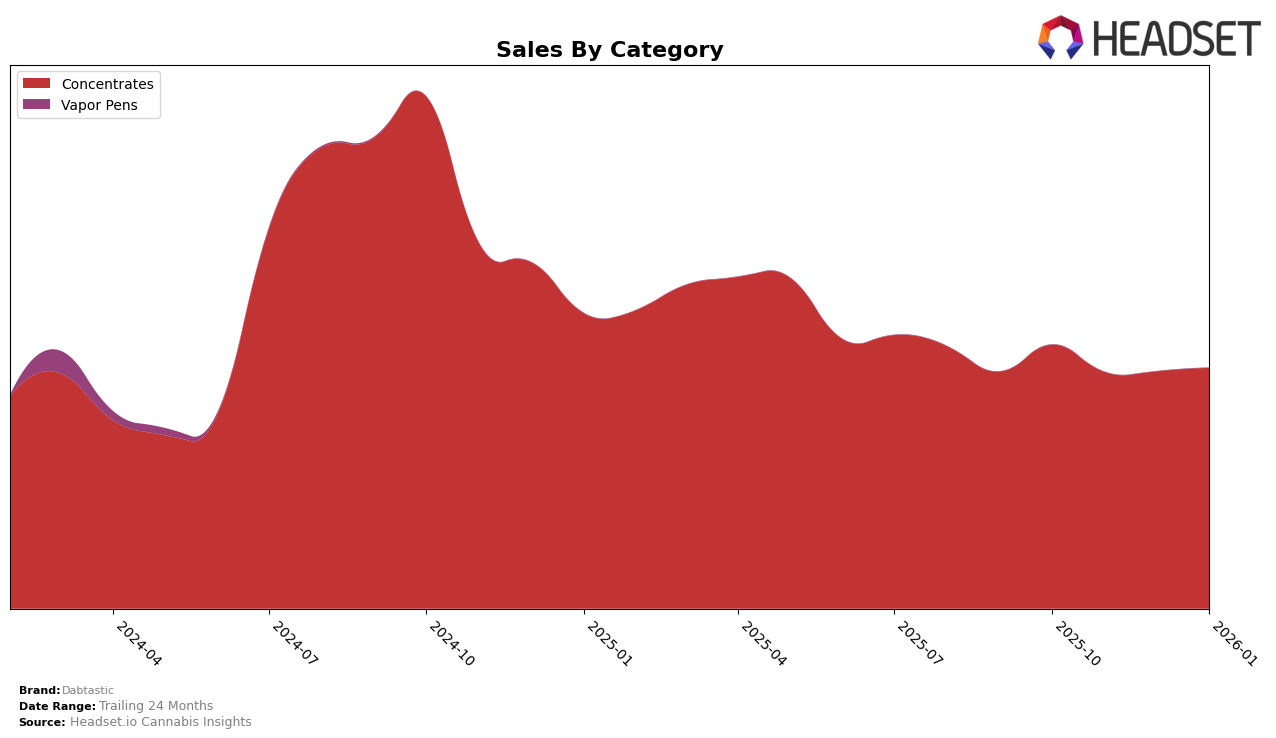

Dabtastic has shown a dynamic presence in the Washington market, particularly in the Concentrates category. Over the months from October 2025 to January 2026, the brand experienced a slight decline in its rankings, moving from 11th place in October to 16th place by January. This downward trend in rankings might seem concerning at first glance; however, the brand's sales figures tell a more nuanced story. Although there was a dip in sales from October to November, the figures stabilized and even showed a slight increase by January 2026, suggesting a potential resilience in market presence despite the competitive landscape.

In terms of category performance, Dabtastic's position within the top 30 brands in Washington's Concentrates sector is notable, indicating a solid footing in a highly competitive market. The fact that they maintained their presence in the rankings throughout these months is significant, especially when considering that many brands do not appear in the top 30 consistently. This consistency could imply a loyal customer base and effective product offerings. However, exploring other states or categories might reveal further insights into Dabtastic's overall market strategy and potential areas for growth or improvement.

Competitive Landscape

In the Washington concentrates market, Dabtastic has experienced a notable shift in its competitive positioning from October 2025 to January 2026. Initially ranked 11th in October, Dabtastic's rank slipped to 15th in November and further to 17th in December, before slightly recovering to 16th in January. This downward trend in rank correlates with a decrease in sales from October to November, followed by a modest recovery by January. Meanwhile, competitors such as Hustler's Ambition and Full Spec have shown upward momentum, with Hustler's Ambition improving from 26th to 15th and Full Spec climbing from 23rd to 17th over the same period. Crystal Clear maintained a stable position around the 14th rank, indicating consistent performance. The ascent of Buddy Boy Farms from 53rd to 18th is particularly striking, showcasing a significant increase in sales and competitive rank. These dynamics suggest that while Dabtastic remains a strong player, it faces increasing competition from brands that are rapidly gaining market share, necessitating strategic adjustments to maintain its competitive edge.

Notable Products

In January 2026, Dabtastic's top-performing product was the Sativa Wax 3-Pack (3g), maintaining its consistent first-place rank across the previous months with sales of 4150. The Alien Rock Candy Sugar Wax (1g) secured the second position, climbing back from its third-place rank in December 2025. Indica Wax 3-Pack (3g) held steady at third place, showing a slight decrease in sales compared to December. The Hybrid Wax 3-Pack (3g) improved its rank to fourth, indicating a positive trend from its previous fifth-place position. Pink Certz Wax (1g) entered the top five in January, despite not being ranked in December, showcasing its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.