Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

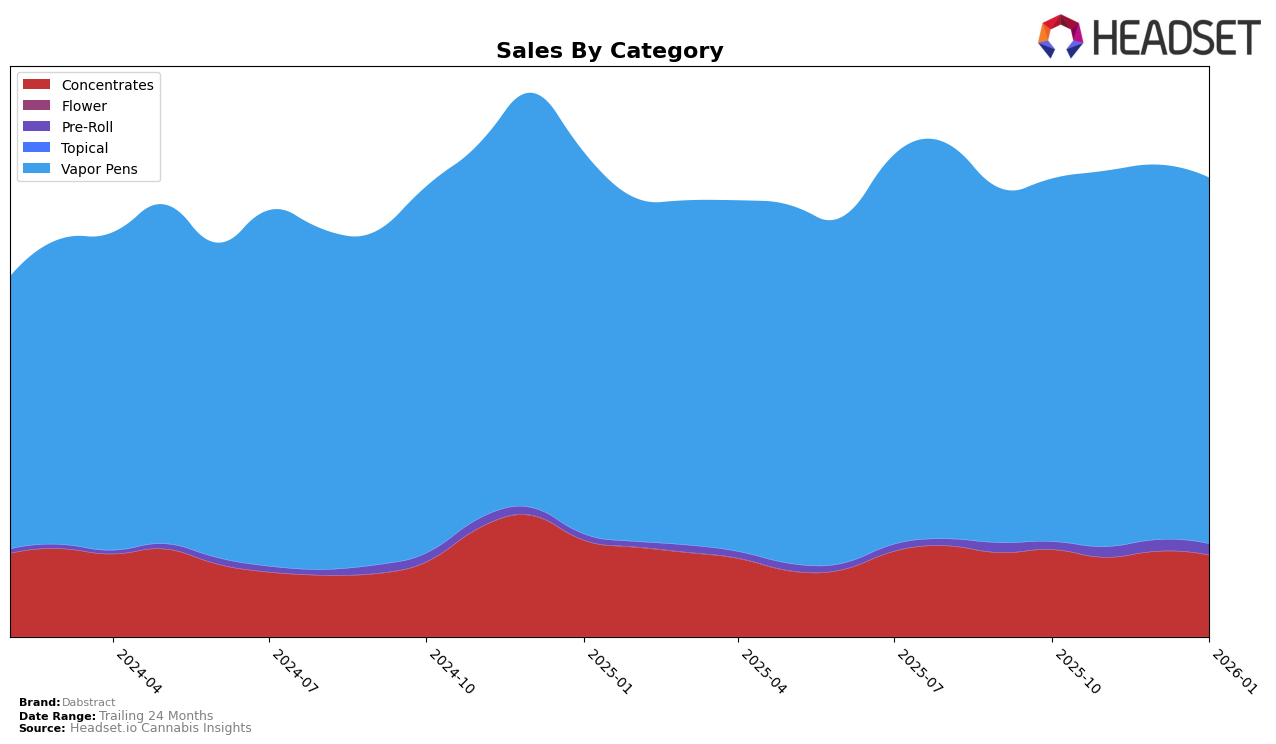

In the state of Illinois, Dabstract has shown a steady performance in the Concentrates category, maintaining a rank within the top 30, specifically fluctuating between 21st and 25th position from October 2025 to January 2026. This consistency is indicative of a stable market presence, although not exceptionally dominant. However, in the Vapor Pens category, Dabstract's rank has seen a decline, dropping to 34th in January 2026, which indicates potential challenges in maintaining a competitive edge in this segment. The fluctuation in rankings suggests a need for strategic focus to regain or improve its standing in the Vapor Pens market.

Meanwhile, in Washington, Dabstract has cemented its position in the Concentrates category, consistently holding the 3rd rank over the observed months. This suggests a strong brand presence and consumer preference in this category. However, the Pre-Roll category presents a different scenario, with Dabstract not appearing in the top 30 until December 2025, where it ranked 95th, and subsequently improving to 78th by January 2026. This late entry into the top rankings could indicate recent strategic efforts to penetrate the Pre-Roll market, showing some positive initial results. The Vapor Pens category in Washington shows a stable 7th rank, highlighting a strong and consistent performance in this segment.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Dabstract consistently maintained its 7th rank from October 2025 to January 2026, showcasing a stable position amidst fluctuating market dynamics. Despite this consistency, Dabstract faces stiff competition from brands like Plaid Jacket and Micro Bar, which have shown more variability in their rankings, with Plaid Jacket bouncing between 5th and 6th place, and Micro Bar dropping from 4th to 6th over the same period. This indicates a dynamic market where Dabstract's steady rank could either be seen as a strength in maintaining a loyal customer base or a challenge in terms of growth potential. Notably, Snickle Fritz and Flipside have consistently ranked lower than Dabstract, suggesting that while Dabstract holds a competitive edge over some, it must strategize to climb higher against top contenders. The sales trends indicate that while Dabstract experienced a slight dip in December 2025, it rebounded in January 2026, reflecting resilience and potential for upward momentum in the market.

Notable Products

In January 2026, the top-performing product for Dabstract was the Sour Gorilla Live Resin Cartridge (1g) in the Vapor Pens category, achieving the number 1 rank with sales of 1612 units. The Super Lemon Haze x Ghost Train Live Resin Cartridge (1g) maintained its position at rank 2, showing a slight increase from 1558 units in December to 1587 units in January. The OG Chem Live Resin Disposable (1g) climbed to the third spot, improving from its absence in December rankings. Meanwhile, the OG Chem Live Resin Distillate Cartridge (1g) slipped to fourth place, continuing its downward trend from October. Finally, the Trophy Wife Live Resin HTE Cartridge (1g) held steady at rank 5, despite a decrease in sales from December to January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.