Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

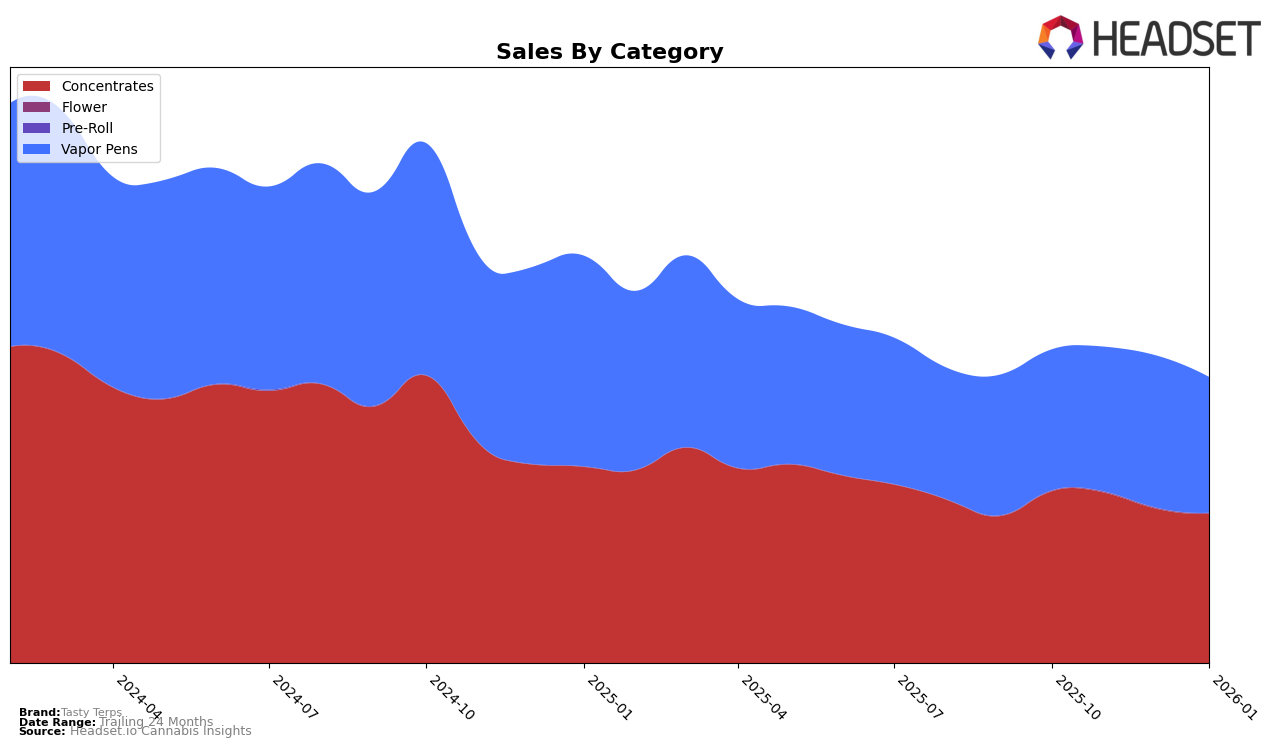

Tasty Terps has shown a dynamic performance in the Washington market, particularly within the Concentrates category. Their ranking fluctuated from 9th in October 2025 to 11th by January 2026. This movement suggests a slight decline in their market presence, although they consistently remained within the top 15. The sales numbers reflect this trend as well, with a gradual decrease over the months. Such a pattern could indicate increasing competition or a shift in consumer preferences within the state's concentrates market.

In contrast, Tasty Terps' performance in the Vapor Pens category in Washington has been relatively stable, albeit outside the top 30 brands, as they maintained a consistent ranking in the early 40s. Despite not breaking into the top 30, there was a slight improvement from 43rd in October 2025 to 41st in January 2026. Interestingly, their sales experienced a peak in December 2025, which might suggest a seasonal demand or a successful promotional effort. This stability and slight upward trend could point to a potential area of growth if the brand can leverage its position effectively.

Competitive Landscape

In the Washington concentrates market, Tasty Terps experienced a slight decline in its ranking from 9th in October 2025 to 11th by January 2026. Despite maintaining a strong position, Tasty Terps faced increased competition from brands like Pacific & Pine, which improved its rank from 14th to 9th over the same period, and Snickle Fritz, which consistently held a top 10 position, moving from 13th to 10th. Meanwhile, Mama J's showed a notable rise, jumping from 28th to 13th, indicating a significant increase in sales momentum. Tasty Terps' sales showed a downward trend, decreasing from October to January, which may have contributed to its drop in rank. This competitive landscape suggests that while Tasty Terps remains a key player, it must strategize to counter the upward trends of its competitors and regain its higher ranking.

Notable Products

In January 2026, Tasty Terps' top-performing product was the Gummy Bears Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank consistently since October 2025 with sales of 1231 units. The Gummy Bears BHO Wax (1g) in Concentrates also held its steady second-place position throughout the same period. Notably, the Blueberry Yum Yum Sugar Wax (1g) climbed to third place in January, marking its first appearance in the top three since October. Caprizun Wax (1g) in the Concentrates category saw a slight dip, moving to fourth place from its previous third-place rank in November. The Fruit Snax Distillate Cartridge (1g) made its debut in the rankings in January, securing the fifth position in Vapor Pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.