Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

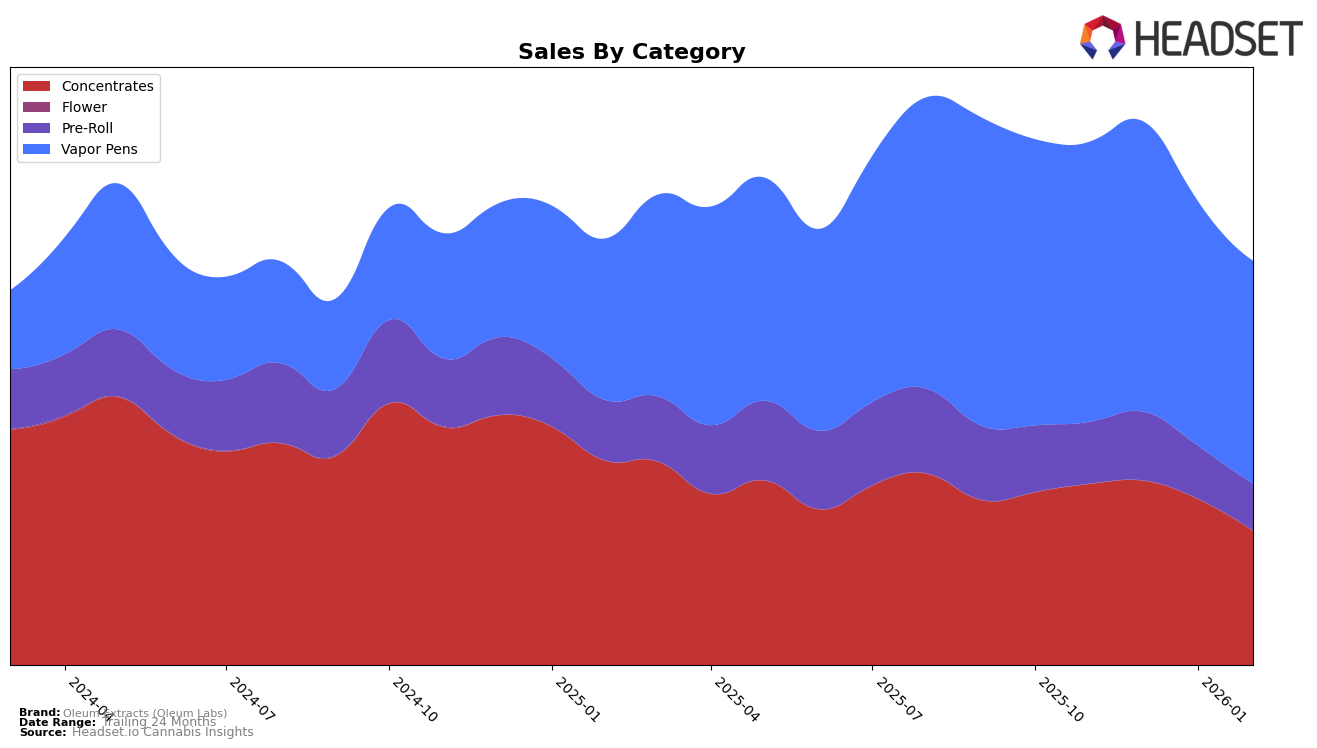

Oleum Extracts (Oleum Labs) has shown a consistent presence in the Washington cannabis market, particularly in the Concentrates category. Over the months from November 2025 to February 2026, their rank in this category experienced a slight decline, moving from 4th to 6th place. This movement suggests a competitive landscape and potential shifts in consumer preferences or market dynamics. In terms of sales figures, there was a noticeable decrease from November to February, indicating possible seasonal trends or increased competition. Despite these challenges, maintaining a top 10 position highlights the brand's resilience and established customer base in the concentrates segment.

In contrast, Oleum Extracts (Oleum Labs) faced more significant challenges in the Pre-Roll category, where they did not consistently rank within the top 30 brands. Their rankings fluctuated from 45th in December 2025 to 52nd in February 2026, suggesting that the brand may need to reassess its strategy in this segment. The Vapor Pens category showed more stability, with rankings hovering between 16th and 20th place over the same period. Although sales in this category also experienced a decline, the brand's ability to remain within the top 20 indicates a solid foothold in the market. These insights underscore the importance of strategic adjustments and market analysis to maintain and improve standings across different product categories.

Competitive Landscape

In the Washington vapor pens category, Oleum Extracts (Oleum Labs) experienced fluctuating rankings over the observed months, indicating a competitive landscape. Starting at rank 18 in November 2025, Oleum Extracts improved to 16th in December but slipped back to 18th in January 2026, and further to 20th in February. This decline in rank suggests increased competition, particularly from brands like Slusheez, which consistently maintained a higher rank, peaking at 17th in January. Despite these challenges, Oleum Extracts' sales figures remained relatively robust compared to Forbidden Farms and O'Geez (WA), both of which did not surpass Oleum in rank or sales during this period. However, the brand faces pressure from Regulator, which, despite a significant drop to 22nd in February, had higher sales in the earlier months. Oleum Extracts' ability to regain and maintain a higher rank will likely depend on strategic marketing and product differentiation in this competitive market.

Notable Products

In February 2026, the top-performing product from Oleum Extracts (Oleum Labs) was the Wedding Cake Live Resin Cartridge (1g) in the Vapor Pens category, achieving the number 1 rank with sales of 809 units. The Wedding Cake Honey Crystal (1g) in the Concentrates category maintained its position at rank 2, showing consistent performance from January 2026. The Sugar Cone - GSC Infused Pre-Roll 2-Pack (1g) entered the rankings at position 3, marking its first appearance as a top performer. Meanwhile, the Wedding Cake Liquid Diamond HTE Disposable (1g) dropped to rank 4 from its peak position in January. The Sugar Cone - Bahama Bussdown Infused Pre-Roll 2-Pack (1g) remained at rank 5, consistent with its performance in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.