Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

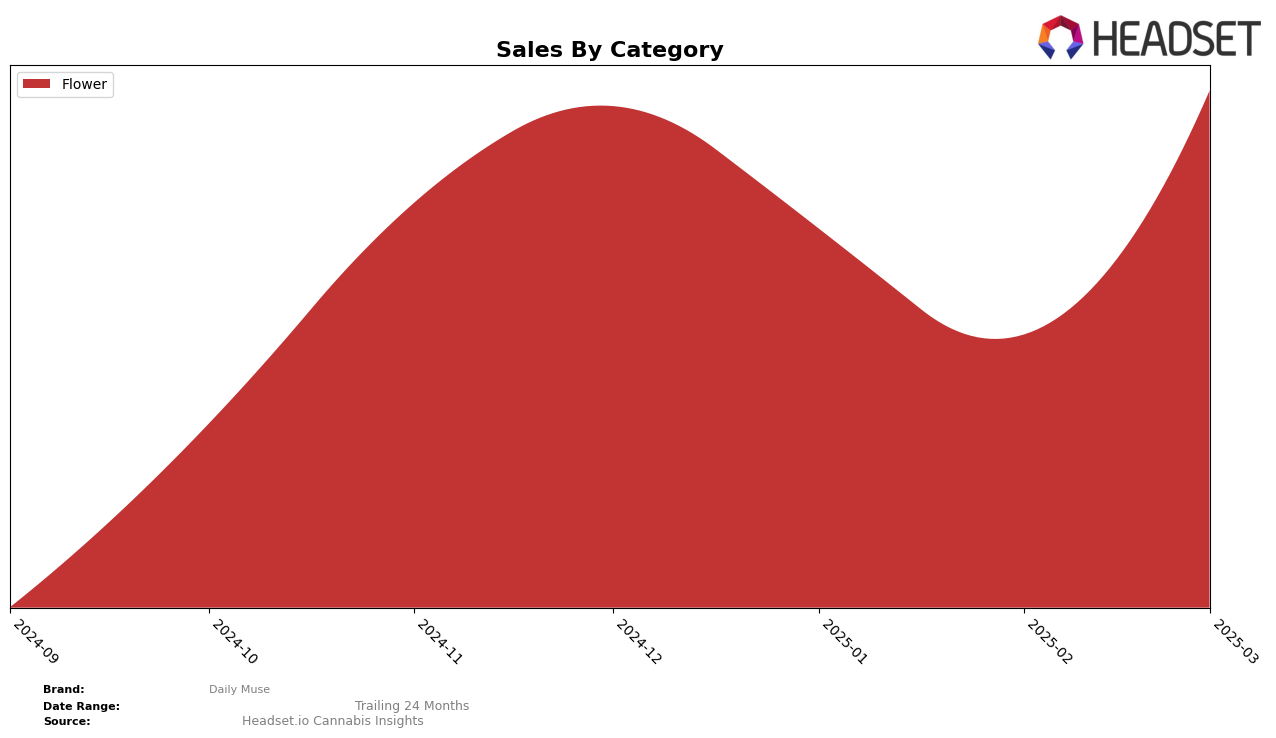

Daily Muse's performance in the Flower category across different states reveals some intriguing trends. In New Jersey, the brand showed a notable fluctuation in its rankings from December 2024 to March 2025. Starting at rank 21 in December 2024, Daily Muse dropped to 27 in January 2025 and further slipped out of the top 30 in February, only to recover to rank 23 by March. This recovery is particularly interesting given the sales figures, which saw a dip from December to February before rebounding strongly in March, indicating a potential resurgence in consumer interest or strategic adjustments by the brand.

The absence of Daily Muse in the top 30 rankings for February in New Jersey's Flower category might be viewed as a setback, suggesting competitive pressures or other market dynamics at play during that period. However, the brand's ability to climb back to a higher rank by March demonstrates resilience and adaptability. While specific sales numbers for February highlight a low point, the subsequent increase in March sales indicates a positive trend that could suggest effective marketing strategies or a shift in consumer preferences. Observing these movements can provide insights into how Daily Muse might continue to navigate the competitive landscape in New Jersey and potentially other states.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Daily Muse has experienced notable fluctuations in its market rank over recent months. Starting from a rank of 21 in December 2024, Daily Muse saw a decline to 27 in January 2025 and further to 31 in February 2025, before recovering slightly to 23 by March 2025. This volatility contrasts with competitors like The Botanist, which maintained a relatively stable position, fluctuating between ranks 17 and 21 during the same period. Meanwhile, Good Green showed a significant improvement, moving from outside the top 20 to rank 24 by March 2025. Additionally, Later Days demonstrated consistent performance, maintaining a rank around 22. Despite the competitive pressure, Daily Muse's sales rebounded in March 2025, indicating potential for recovery and growth amidst the dynamic market conditions.

Notable Products

In March 2025, La Bomba (3.5g) reclaimed its position as the top-performing product for Daily Muse, with sales reaching 2300 units. Gelato #41 (3.5g) emerged as a strong contender, securing the second spot in its debut month. Jokerz (3.5g) followed closely, ranking third, while Sherbanger 22 (3.5g) slipped from its previous third position in February to fourth in March. Blue 33 (3.5g) made a notable entry into the rankings, climbing to fifth place from its absence in February. The shifts in rankings indicate a dynamic market with new entries and returning favorites reshaping the competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.