Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

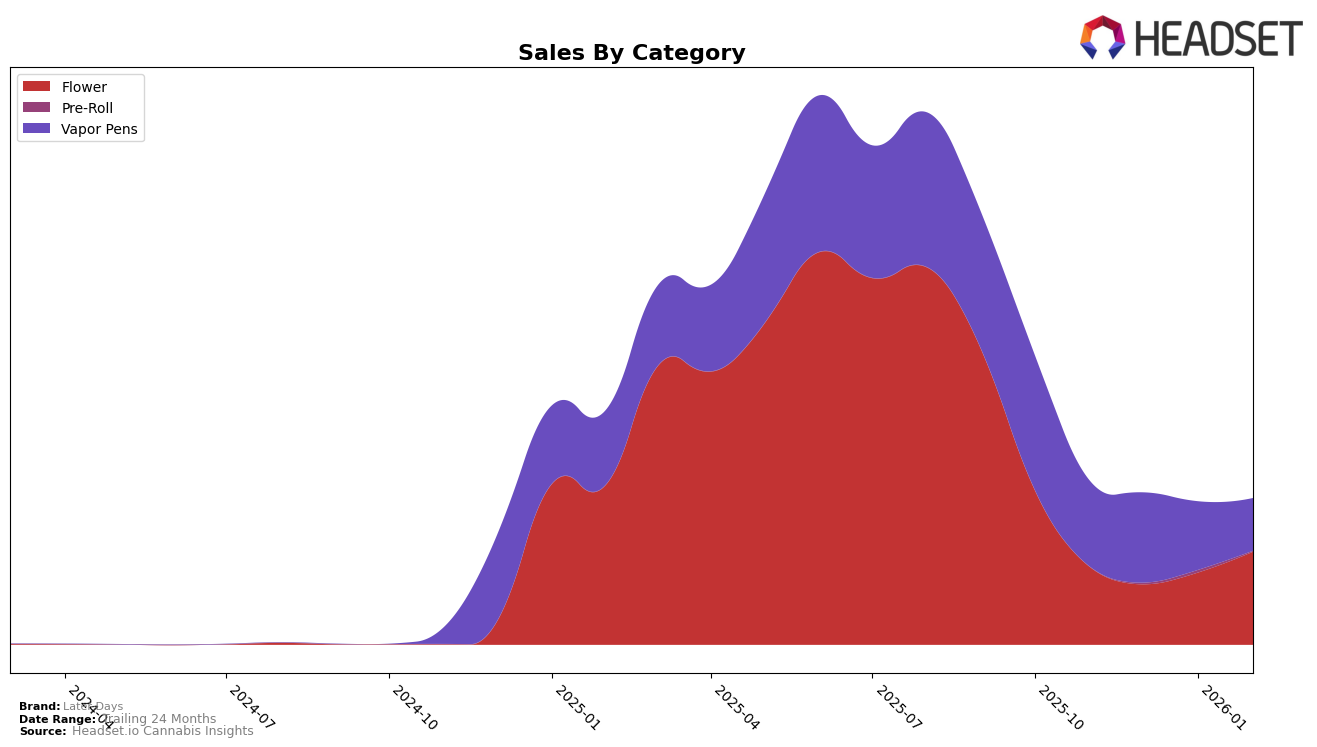

Later Days has shown varied performance across different states and product categories. In Massachusetts, the brand's presence in the Flower category has waned, dropping out of the top 30 by February 2026 after being ranked 51st in November 2025. This decline suggests a significant reduction in market penetration or competition from other brands. Conversely, in the Vapor Pens category, Later Days has maintained a presence within the top 100, albeit with a downward trend from 34th to 81st place over the same period. Such shifts indicate challenges in maintaining market share, possibly due to increased competition or changing consumer preferences.

In New Jersey, Later Days has experienced a resurgence in the Flower category, climbing from 99th in January 2026 to 61st by February 2026, which demonstrates a strong recovery and potential growth in this market. Meanwhile, the Vapor Pens category in New Jersey shows a steady improvement, moving from 62nd in November 2025 to 50th by February 2026, reflecting a positive trend in consumer acceptance or strategic marketing efforts. In Ohio, the brand has made notable gains in the Flower category, advancing from 54th to 29th place, indicating a robust increase in consumer demand or successful market strategies. However, the Vapor Pens category experienced a slight decline, with rankings fluctuating but remaining within the top 30, suggesting a stable yet competitive market environment.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Later Days has shown a remarkable upward trend in its rankings over the past few months. Starting from a rank of 54 in November 2025, Later Days climbed to 29 by February 2026, indicating a significant improvement in market presence. This upward trajectory is notable when compared to competitors like Modern Flower, which fluctuated between ranks 23 and 40, and Roll One / R.O., which maintained a relatively stable position around the 30s. Meanwhile, Pure Ohio Wellness experienced a decline from rank 13 to 31, suggesting a potential shift in consumer preference towards emerging brands like Later Days. The sales growth for Later Days, especially in January and February 2026, further underscores its rising popularity, contrasting with the declining sales of some higher-ranked competitors, hinting at a promising future for Later Days in the Ohio market.

Notable Products

In February 2026, Later Days' top-performing product was Melonade (2.83g) in the Flower category, securing the number one rank with notable sales of 1,446 units. Cherry Flamingo (14.15g), also in the Flower category, followed closely in second place. Melonade Shake (14.15g) ranked third, maintaining a strong position in the Flower category. SinMintz (14.15g) dropped from third place in January to fourth in February, despite a slight increase in sales. Georgia Peach Distillate Disposable (1g) in the Vapor Pens category consistently held the fifth position since December 2025, showing stable performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.