Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

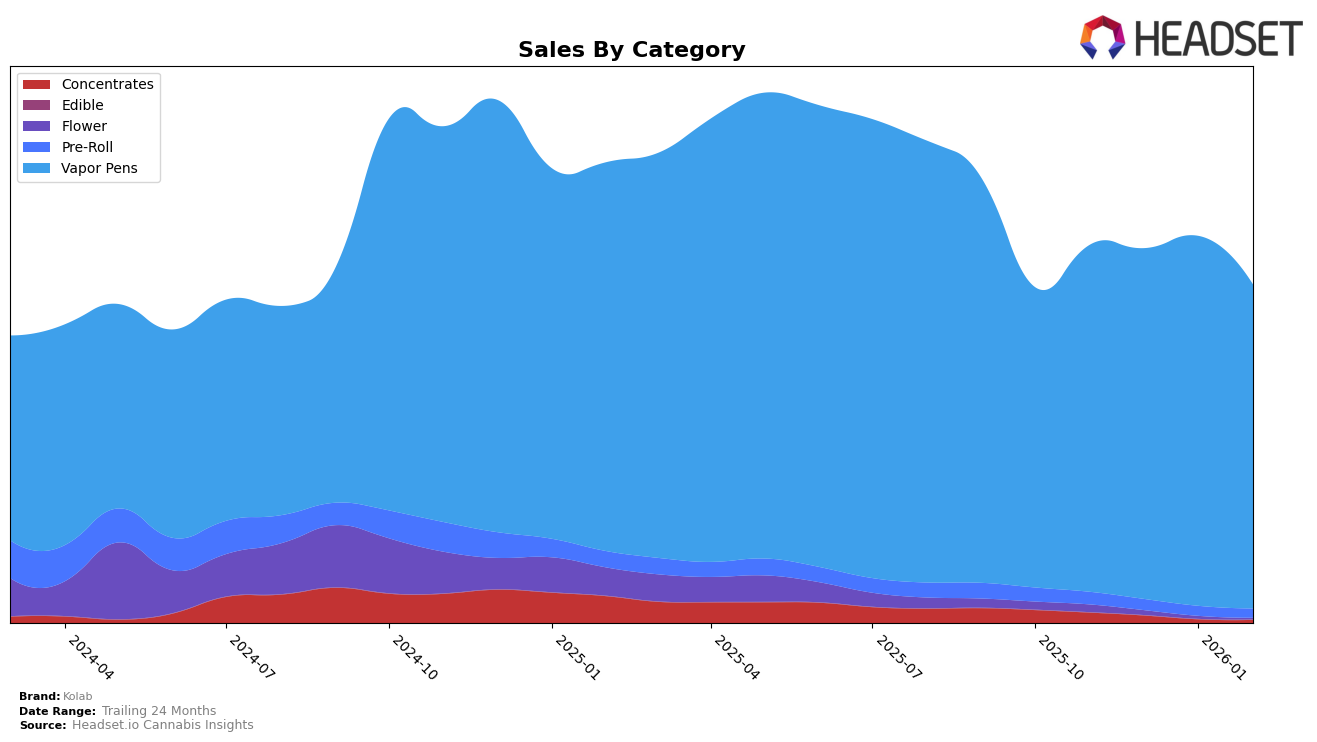

Kolab has shown varied performance across different Canadian provinces, particularly in the Vapor Pens category. In Alberta, the brand has demonstrated a positive upward trend, rising from the 11th position in November 2025 to the 7th position by February 2026. This indicates a strengthening presence in the market, likely supported by a significant increase in sales during this period. Conversely, in British Columbia, Kolab's ranking has fluctuated, peaking at 6th place in January 2026 before dropping back to 11th in February. This volatility suggests that while there is potential for growth, the brand faces challenges in maintaining consistent performance in this province.

In Ontario, Kolab has maintained a relatively stable presence in the Vapor Pens category, hovering between the 16th and 18th positions over the observed months. Despite this stability, the brand has not broken into the top 15, indicating potential room for improvement in market penetration or brand recognition. In Saskatchewan, Kolab's performance has improved slightly, moving from 20th place in November 2025 to 16th in February 2026. This incremental progress suggests a slow but steady increase in market share, although the brand still remains outside the top 10. Overall, Kolab's performance across these provinces highlights both opportunities and challenges, with certain markets showing promising growth while others remain more competitive.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Kolab has demonstrated a notable upward trajectory in recent months. While Kolab consistently held the 11th rank from November 2025 to January 2026, it made a significant leap to the 7th position by February 2026. This improvement in rank is particularly impressive given the competitive pressure from brands like 1964 Supply Co, which fluctuated between the 8th and 10th positions, and DEBUNK, which saw a decline from 7th to 9th place over the same period. Kolab's sales growth, culminating in a substantial increase in February 2026, indicates a positive trend and suggests that it is gaining traction against competitors such as Sticky Greens and XPLOR, both of which have experienced fluctuating sales and rankings. This momentum positions Kolab as a rising player in the Alberta vapor pen market, potentially attracting more consumer interest and market share.

Notable Products

In February 2026, the top-performing product from Kolab was the Strawberry Ice Diamonds Distillate Cartridge (1g) in the Vapor Pens category, which ascended from the fourth position in January to first place, achieving a notable sales figure of 10246. The Pink Lychee Diamonds Distillate Cartridge (1g), also in the Vapor Pens category, slipped to the second position after leading in December and January. The Yuzu Honey Diamonds Distillate Cartridge (1g) maintained its third position from January, showcasing consistent performance. The White Grape Liquid Diamonds Disposable (1g) experienced a decline, moving from first place in November to fourth in February. Pure Liquid Diamonds Disposable (1g) remained stable in the fifth position, demonstrating consistent, albeit lower, sales performance compared to its peers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.