Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

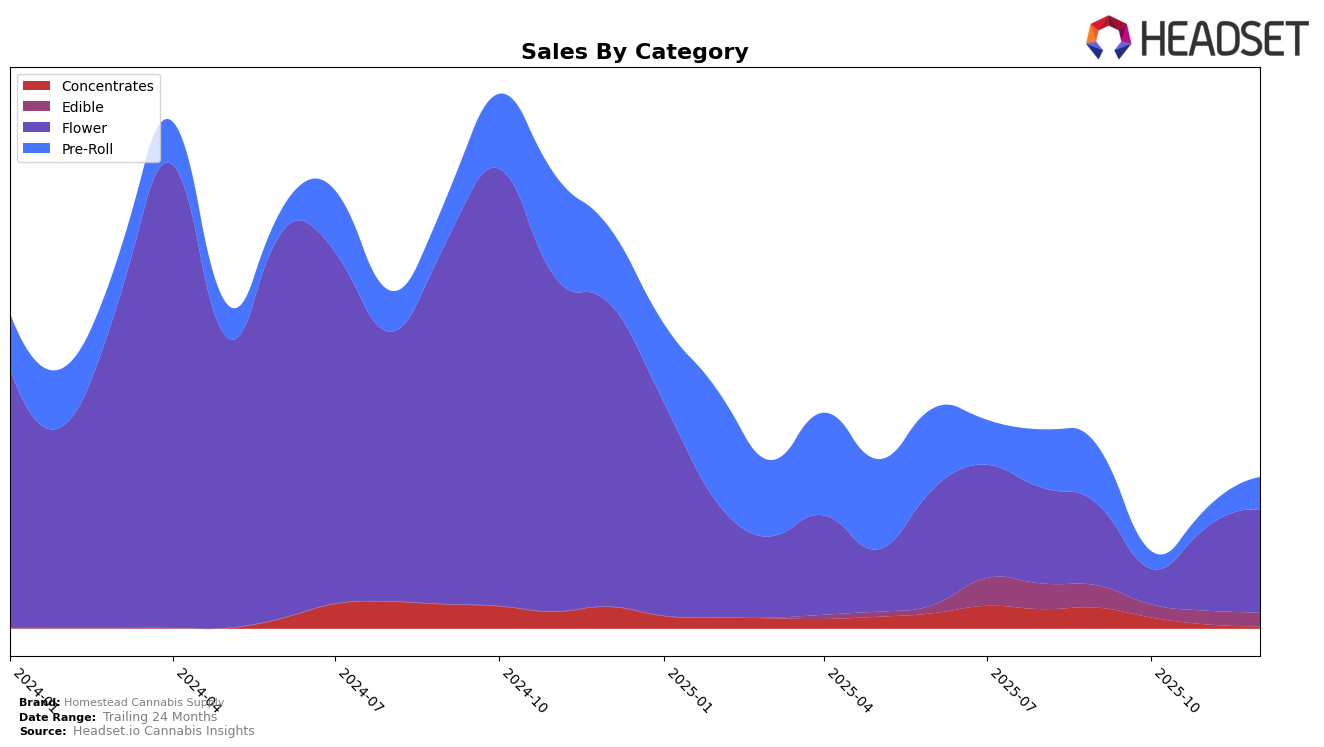

Homestead Cannabis Supply has demonstrated varied performance across different categories and regions. In Alberta, the brand did not make it to the top 30 in the Concentrates category from September to December 2025, indicating a potential area for improvement. Meanwhile, in British Columbia, the brand showed some promise in the Concentrates category by securing the 37th position in September 2025, although it did not maintain this position in subsequent months. The Flower category in British Columbia witnessed an interesting fluctuation, with Homestead Cannabis Supply moving from the 53rd position in September to the 87th in October, before climbing back to 52nd by December, suggesting a recovery and potential growth in this segment.

The performance in the Pre-Roll category within British Columbia was less consistent, with the brand appearing in the rankings only in September and December at positions 77 and 99, respectively. This inconsistency might point to challenges in maintaining market presence. In Ontario, Homestead Cannabis Supply showed more stability in the Edible category, maintaining a presence within the top 31 throughout the last four months of 2025. Despite some fluctuations, the brand's ability to remain in the top 31 in Ontario's Edible category suggests a steady market position, which could serve as a foundation for further growth in other categories and regions.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Homestead Cannabis Supply has experienced notable fluctuations in its market position from September to December 2025. Initially ranked 53rd in September, Homestead saw a decline to 87th in October before recovering to 60th in November and 52nd in December. This pattern suggests a volatile market presence, potentially impacted by aggressive competition and market dynamics. Notably, BLKMKT and Hiway have shown stronger resilience, maintaining relatively higher ranks and sales figures, with BLKMKT improving from 66th in October to 48th in December, and Hiway achieving a peak rank of 49th in November. Meanwhile, Good Buds demonstrated a significant comeback from 85th in November to 50th in December, indicating a potential threat to Homestead's market share. The absence of QWEST from the top 20 in October and November, despite a strong finish in December, highlights the competitive volatility in this market. These dynamics underscore the need for Homestead Cannabis Supply to strategize effectively to enhance its market position amidst fierce competition.

Notable Products

In December 2025, the Indica Triple Berry Resin Gummy (10mg) from Homestead Cannabis Supply maintained its top position in the Edible category, continuing its lead from November with sales reaching 2568 units. The Sativa Cherry Gummy (10mg) followed closely in second place, consistent with its ranking in November, with a notable sales figure of 2098 units. The Bandwagon Indica (7g) held steady at third place in the Flower category, showing an increase in sales from previous months. The Bangtail Pre-Roll 10-Pack (5g) climbed to fourth place, improving from its fifth position in November. Lastly, Bandwagon Sativa (7g) rounded out the top five, maintaining its ranking from November despite a slight increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.