Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

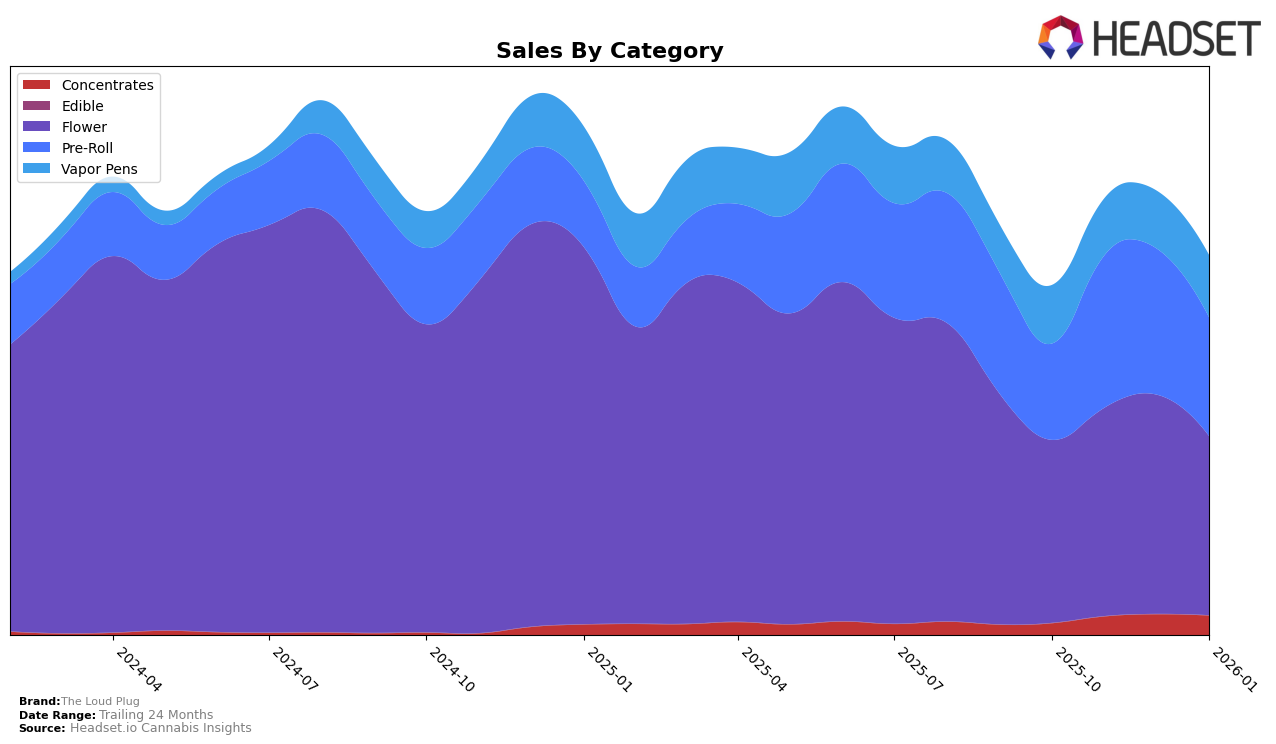

The Loud Plug has demonstrated notable performance across various categories in the Canadian cannabis market, particularly in British Columbia. In the Flower category, the brand climbed from the 22nd position in October 2025 to a peak at 9th in December 2025, before slightly dropping to 11th in January 2026. This upward trend indicates a strong consumer demand, with sales peaking in December. However, their presence in the Vapor Pens category was limited, only appearing in the rankings in November 2025, suggesting either a nascent market presence or a need for strategic repositioning in this segment.

In Ontario, The Loud Plug's performance in the Concentrates category is noteworthy, as it emerged in the rankings only in December 2025 at 26th place and improved to 24th by January 2026. This indicates a growing acceptance or strategic push in this segment. Conversely, in the Flower category, the brand experienced a decline, moving from 14th in October 2025 to 21st by January 2026, which could be indicative of increased competition or shifting consumer preferences. Meanwhile, in Saskatchewan, The Loud Plug maintained a strong presence in the Flower category, consistently holding a top 6 position, which underscores its strong market foothold in this region. However, the brand's absence in the Pre-Roll category in December 2025 and its late entry into the Vapor Pens category in January 2026 may highlight areas for potential growth or strategic development.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, The Loud Plug has experienced a notable decline in its rank, dropping from 14th in October 2025 to 21st by January 2026. This downward trend in rank is mirrored by a decrease in sales over the same period, suggesting potential challenges in maintaining market share. In contrast, brands like Pure Laine have shown resilience, improving their rank from 21st to 19th, despite a slight dip in sales. Meanwhile, LowKey has maintained a consistent 20th rank, indicating stable performance. The fluctuating ranks of Jonny Chronic and Tribal highlight the competitive volatility in this market. These dynamics suggest that The Loud Plug may need to strategize effectively to regain its competitive edge and counteract the upward momentum of its rivals.

Notable Products

In January 2026, The Loud Plug's top-performing product was the Drippyz Liquid Diamonds & Kief Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, maintaining its number one rank for four consecutive months with sales of 13,304 units. The Exotic Gas Live Resin Cartridge (1g) in the Vapor Pens category also held steady at the second rank, showing consistent performance over the same period. The Exotic Gas (28g) in the Flower category remained at the third rank, unchanged since December 2025. The Exotic Gas Pre-Roll 5-Pack (2.5g), newly ranked at fourth in January, indicates a strong entry into the top performers. Meanwhile, the Venom OG Live Resin Cartridge (1g) re-entered the rankings at fifth place, showcasing a resurgence in popularity after not being ranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.