Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

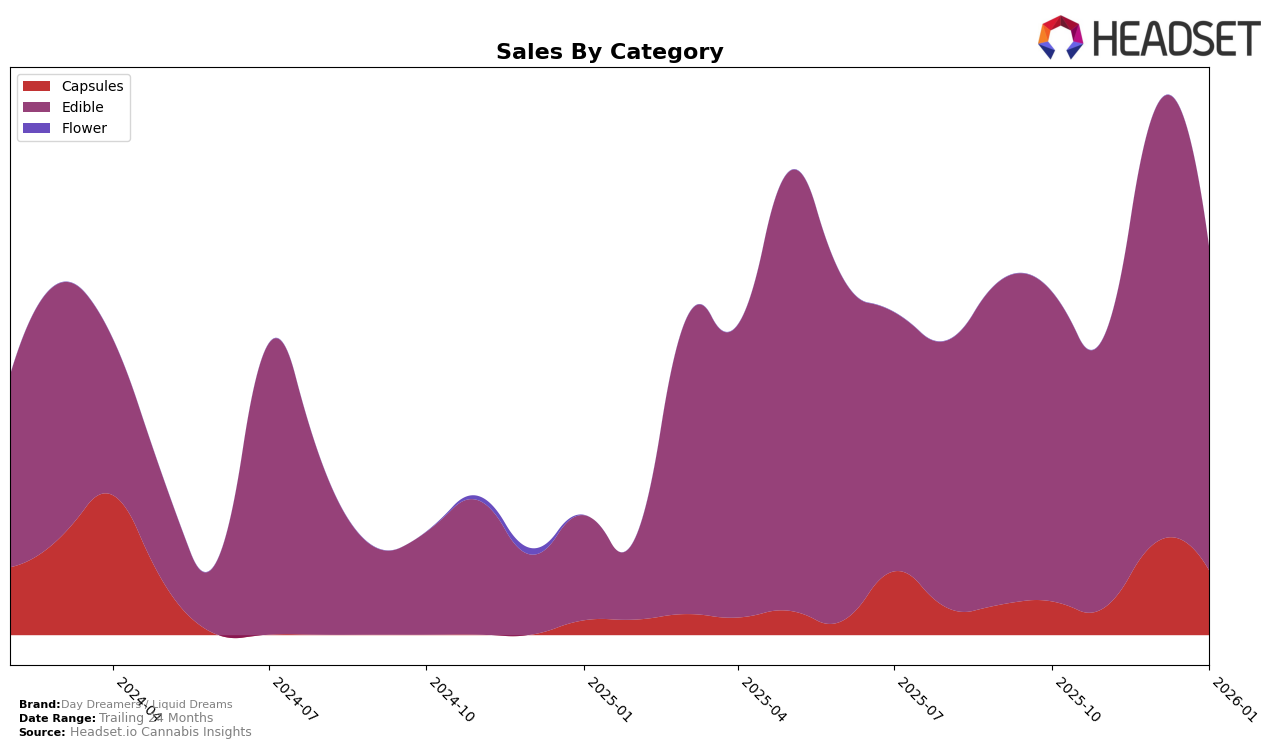

Day Dreamers / Liquid Dreams has experienced notable fluctuations in its category rankings across different states, particularly in the Edible category. In California, the brand did not make it into the top 30 Edible brands from October 2025 through January 2026, with rankings of 69th in December and slipping further to 73rd in January. This downward trend indicates challenges in maintaining a competitive edge in a densely populated and highly competitive market. The absence of a ranking in the top 30 for multiple months could be a signal of either increased competition or a need for strategic adjustments in product offerings or marketing efforts.

Despite these challenges, Day Dreamers / Liquid Dreams managed to generate sales in California, although there was a noticeable decline from December to January. The brand's performance in other states or provinces is not detailed here, but the available data from California suggests that Day Dreamers / Liquid Dreams may need to reassess its approach to remain relevant in the Edible category. The lack of top 30 rankings in other states or provinces might suggest similar competitive pressures or differing consumer preferences, which could provide insights into potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of the edible cannabis market in California, Day Dreamers / Liquid Dreams has faced significant challenges in maintaining its rank and sales performance. As of January 2026, the brand ranked 73rd, indicating a decline from its position in December 2025, where it was 69th. This downward trend is notable when compared to competitors such as HaHa, which improved its rank from 68th in December 2025 to 63rd in January 2026, and Spinello Cannabis Co., which saw fluctuations but remained competitive with a rank of 67th in January 2026. Meanwhile, Tyson 2.0 was not ranked in January 2026, suggesting a potential opportunity for Day Dreamers / Liquid Dreams to capitalize on any gaps left by competitors. Despite these challenges, the brand's sales figures indicate a need for strategic marketing efforts to regain market share and improve its standing in the competitive California edible market.

Notable Products

In January 2026, the Sativa Semi-Sweet Chocolate Bar 10-Pack (100mg) maintained its position as the top-performing product for Day Dreamers / Liquid Dreams, with sales reaching 450 units. The CBN/THC 1:2 Bedtime Berry Chocolate Bar (50mg CBN, 100mg THC) consistently held the second spot, demonstrating stable performance over the past months. The Indica Chocolate Bar 10-Pack (100mg) improved its rank to third place, showing a slight recovery in sales. The Sativa Chocolate Bar (100mg) slipped to fourth place, while the Indica Capsules 10-Pack (250mg) re-entered the rankings at fifth position. Overall, the top products have shown some fluctuations in rankings, but the Sativa Semi-Sweet Chocolate Bar 10-Pack remains a clear leader in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.