Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

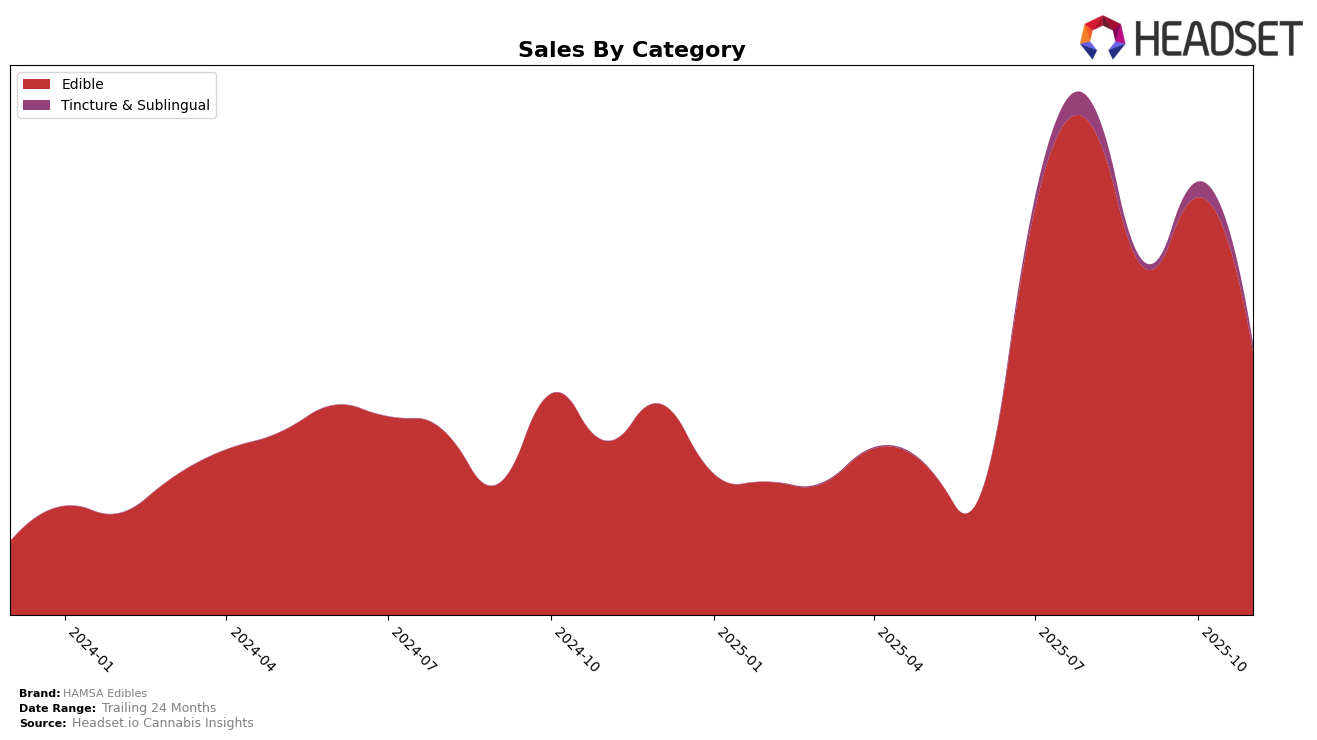

HAMSA Edibles has experienced varying performance across different states and categories in recent months. In California, the brand has seen a consistent decline in its rankings within the Edible category, moving from the 62nd position in August 2025 to the 76th position by November 2025. This downward trend is mirrored in their sales figures, which have decreased steadily from $20,416 in August to $12,341 in November. The consistent drop in both ranking and sales could be indicative of increased competition or shifts in consumer preferences within California's edible market.

Conversely, in New Jersey, HAMSA Edibles has shown a more fluctuating performance. The brand did not make it into the top 30 rankings for November 2025, which suggests a significant challenge in maintaining a competitive edge. However, the brand did see a rebound in sales in October, indicating potential for recovery or a successful promotional effort. The absence from the top 30 in November could be a temporary setback or a sign of more profound market dynamics at play in New Jersey's edible sector. These contrasting performances across states highlight the importance of regional strategies and market adaptation for HAMSA Edibles.

Competitive Landscape

In the competitive landscape of the California edibles market, HAMSA Edibles has experienced a notable decline in its ranking from August to November 2025, dropping from 62nd to 76th place. This downward trend in rank is mirrored by a consistent decrease in sales over the same period. In contrast, competitors such as UP! have maintained a strong position, consistently ranking 43rd in August and September, which suggests stability and possibly a more loyal customer base. Meanwhile, Tyson 2.0 and Not Your Father's Root Beer have shown stronger sales figures, with Tyson 2.0 notably ranking 66th in November, indicating a more favorable market reception compared to HAMSA Edibles. The absence of Day Dreamers / Liquid Dreams from the top 20 in November further highlights the competitive challenges within this category. These insights suggest that HAMSA Edibles may need to reassess its market strategy to regain its competitive edge and improve its standing in the California edibles market.

Notable Products

In November 2025, the top-performing product from HAMSA Edibles was Watermelon Gummies 10-Pack (100mg), maintaining its number one position from September, with sales reaching 364 units. Mango Gummies 10-Pack (100mg) secured the second spot, dropping from its previous top position in October. Indica Nano Blueberry Gummies 10-Pack (100mg) ranked third, consistently remaining in the top three despite fluctuating ranks in prior months. Green Apple Gummies (100mg) held onto the fourth position, showing a decline in sales from earlier months. THC:CBN 2:1 Elderberry Sleep Gummies (100mg THC, 50mg CBN) returned to the rankings in fifth place, with notable sales of 153 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.