Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

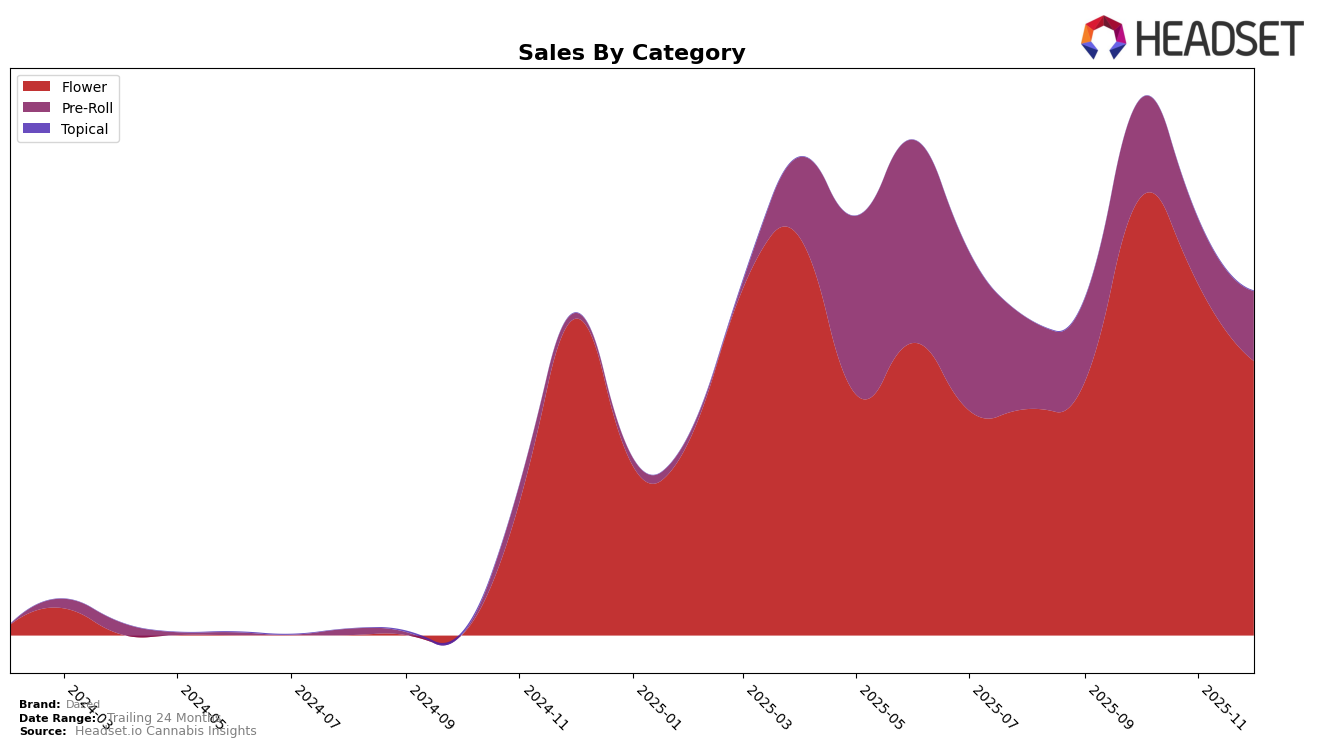

In the state of Massachusetts, Dazed has shown fluctuating performance in the Flower category over the last few months of 2025. Starting from a rank of 87 in September, the brand climbed to 65 in October, suggesting a significant gain in market traction. However, this upward trend did not maintain its momentum, as the rankings slipped to 74 in November and further down to 84 by December. This volatility indicates that while Dazed had a moment of increased popularity, sustaining that growth in Massachusetts proved challenging. The sales figures reflect this pattern, with a noticeable peak in October followed by a decline in the subsequent months.

When examining the broader implications of these rankings, it's essential to note that Dazed's absence from the top 30 brands in the Flower category in Massachusetts suggests a competitive market environment. The inability to consistently break into the top tier might point to either aggressive competition or potential areas for strategic improvement within the brand's marketing or distribution efforts. This pattern of rank fluctuation could be indicative of seasonal demand variations or specific market dynamics unique to Massachusetts, offering a valuable insight into the brand's regional performance challenges.

Competitive Landscape

In the Massachusetts flower category, Dazed has experienced notable fluctuations in its ranking and sales over the last few months of 2025. Starting from a rank of 87 in September, Dazed improved significantly to 65 in October, indicating a positive reception or successful marketing strategies. However, by December, its rank slipped to 84, suggesting increased competition or market challenges. In comparison, Simpler Daze showed a volatile pattern, dropping from 48 in September to 95 in October, but then recovering to 78 by December. Meanwhile, Natural Selections and Fathom Cannabis have maintained relatively stable positions, with Fathom Cannabis making a notable entry into the top 100 by November. The competitive landscape suggests that while Dazed has seen periods of growth, maintaining a consistent upward trajectory remains challenging amidst dynamic market conditions.

Notable Products

In December 2025, Dazed's top-performing product was Strawberry Dream (3.5g) in the Flower category, which climbed to the number one spot from its previous second-place ranking in October 2025, with sales reaching 1672 units. King Louie 13 (3.5g) entered the rankings for the first time, securing the second position. Lucky Charmz Infused Pre-Ground (3.5g) and Bubbliciouz Infused Shake (3.5g) followed, taking the third and fourth spots, respectively. Darryl Strawberry Infused Pre-Ground (3.5g) maintained its fifth position from November to December 2025, despite a previous drop from third place in October. These shifts highlight a dynamic change in consumer preferences towards infused products within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.