Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

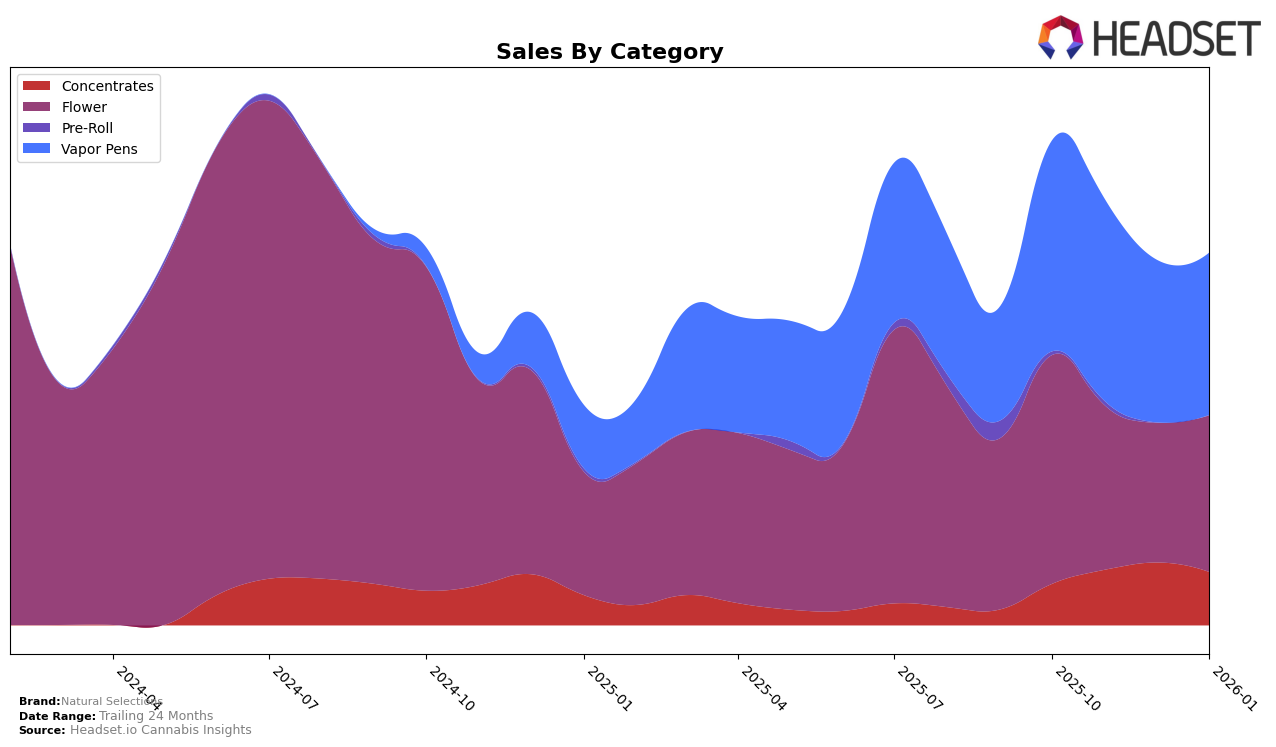

In the Massachusetts market, Natural Selections has shown a notable performance in the Concentrates category. From October 2025 to January 2026, the brand improved its ranking from 34th to 27th, indicating a steady upward trajectory. This positive movement is underscored by a significant increase in sales, peaking in December 2025. However, the brand's presence in the Flower category tells a different story. It consistently ranked outside the top 30, fluctuating between 79th and 96th, which suggests a struggle to gain a foothold in this competitive segment. The Vapor Pens category also saw a decline, with the brand dropping from 42nd to 50th over the same period, reflecting potential challenges in maintaining market share.

While Natural Selections has made strides in certain areas, the contrast between categories highlights the challenges of maintaining consistent performance across the board. The Flower category, where the brand did not break into the top 30, points to a potential area for strategic improvement. Meanwhile, the consistent ranking in the Vapor Pens category, despite a decrease in sales, suggests a stable yet competitive environment. These dynamics provide insights into the brand's market positioning and potential areas for future growth or reevaluation. The fluctuations across categories and rankings serve as a reminder of the ever-changing landscape of the cannabis industry in Massachusetts.

Competitive Landscape

In the Massachusetts Vapor Pens category, Natural Selections has experienced a noticeable decline in rank and sales over the past few months. From October 2025 to January 2026, the brand's rank slipped from 42nd to 50th, indicating a challenging competitive landscape. In contrast, Happy Valley (MA) maintained a relatively stable position, only dropping from 37th to 47th, while Harbor House Collective improved its rank from 50th to 49th, showcasing a positive trend. Meanwhile, Clear Gold Concentrates made significant strides, climbing from 98th to 55th, which could be attributed to a substantial increase in sales. These shifts suggest that Natural Selections faces increasing competition, particularly from brands that are either stabilizing or improving their market positions, potentially impacting its market share and necessitating strategic adjustments to regain momentum.

Notable Products

In January 2026, Natural Selections saw Melted Strawberries (3.5g) claim the top spot in sales, with a notable figure of 1030 units sold. Strawberry Guava (3.5g) maintained a strong presence, climbing to second place from its third position in the previous two months, with sales remaining steady around 810 units. Rainbow Guava Cured Resin Liquid Diamond Cartridge (1g) rose to third place, improving from its fourth position in December 2025. Superboof (3.5g) and LA Kush Cake (3.5g) were new entries in the top five, occupying the fourth and fifth spots, respectively. This shift indicates a growing consumer interest in diverse flower products from Natural Selections.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.