Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

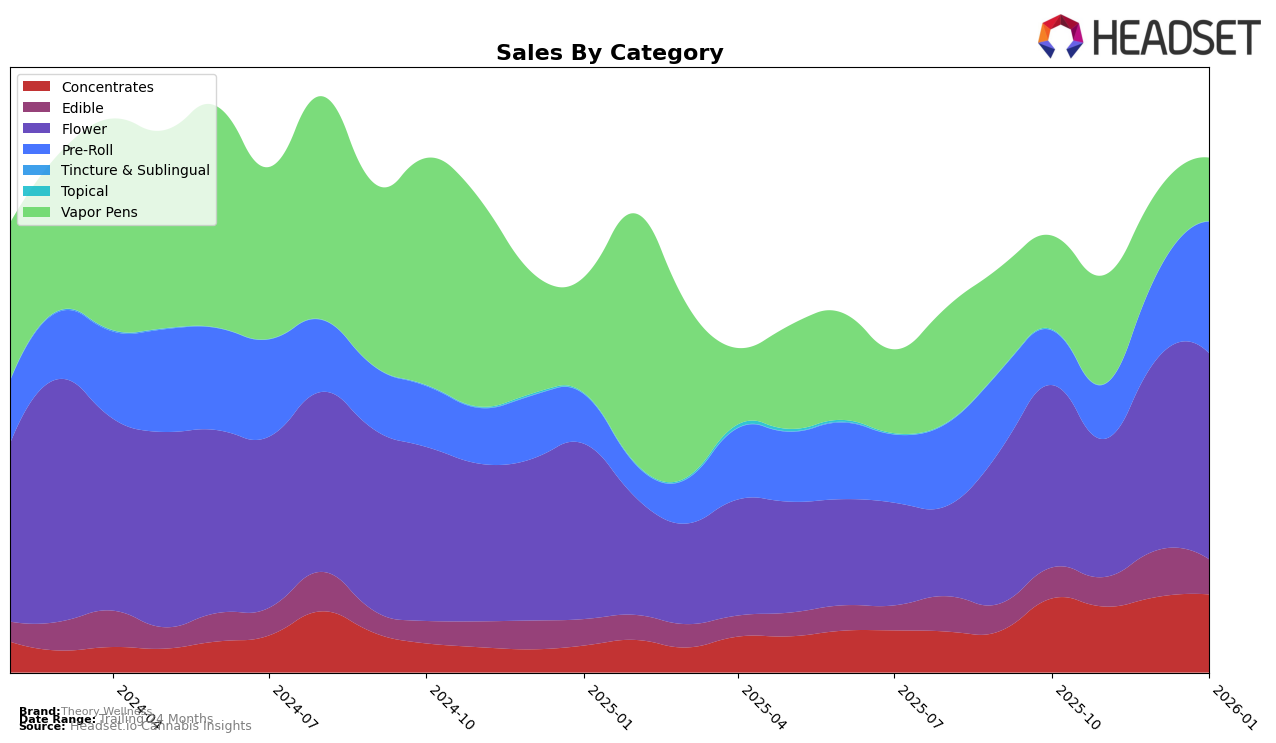

In the Massachusetts market, Theory Wellness has demonstrated a steady performance across various categories, with notable movements in the Concentrates and Flower segments. Concentrates have seen a consistent ranking at 14th place from October to December 2025, with a slight improvement to 13th in January 2026, indicating a positive trend in consumer preference and sales, which increased from $64,264 in October to $67,754 in January. In contrast, the Flower category showed a more dynamic shift, improving from 76th in October to 61st by January, suggesting a growing market presence. However, the Pre-Roll category only gained visibility in December 2025, ranking 87th, before making a significant leap to 57th in January 2026, highlighting a potential area of growth.

On the other hand, Theory Wellness's performance in the Edible and Vapor Pens categories presents a mixed picture. The Edibles segment, while not breaking into the top 30, improved its rank from 48th in October to 41st in December, before slightly declining to 43rd in January 2026. This fluctuation suggests challenges in maintaining a consistent upward trajectory, despite a notable sales increase in December. Vapor Pens experienced a drop from 53rd in November to 64th in January, coupled with a decrease in sales from $94,427 to $54,955, indicating potential issues in sustaining consumer interest. The absence of Theory Wellness in the top 30 for Edibles and Vapor Pens highlights areas that may require strategic adjustments to enhance their competitive position in the Massachusetts market.

Competitive Landscape

In the Massachusetts flower category, Theory Wellness has shown a notable upward trend in rankings from October 2025 to January 2026, moving from 76th to 61st position. This improvement is significant given the competitive landscape, where brands like Khalifa Kush consistently maintained a mid-50s rank, and Glorious Cannabis Co. experienced a decline from 29th to 60th. Despite starting with lower sales in October 2025 compared to competitors, Theory Wellness's sales have shown a positive trajectory, culminating in a January 2026 figure that surpasses Berkshire Roots. This indicates a strengthening market position, potentially driven by increased consumer recognition and preference. However, Theory Wellness still trails behind some competitors in sales volume, suggesting room for growth and the need for strategic marketing efforts to further capitalize on its upward momentum.

Notable Products

In January 2026, the top-performing product for Theory Wellness was World Star (3.5g) in the Flower category, maintaining its first-place ranking from December 2025 with sales of 2143 units. Sour Diesel Pre-Roll (1g) emerged as the second top product, making its debut in the rankings. Dosido Pre-Roll (1g) followed closely as the third top product, also newly ranked this month. Rainbow Pie Pre-Roll (1g) and Ghost OG Pre-Roll (1g) secured the fourth and fifth positions, respectively, both appearing for the first time in the rankings. The introduction of these pre-roll products marks a significant shift in consumer preference from previous months, where only flower products were ranked.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.