Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

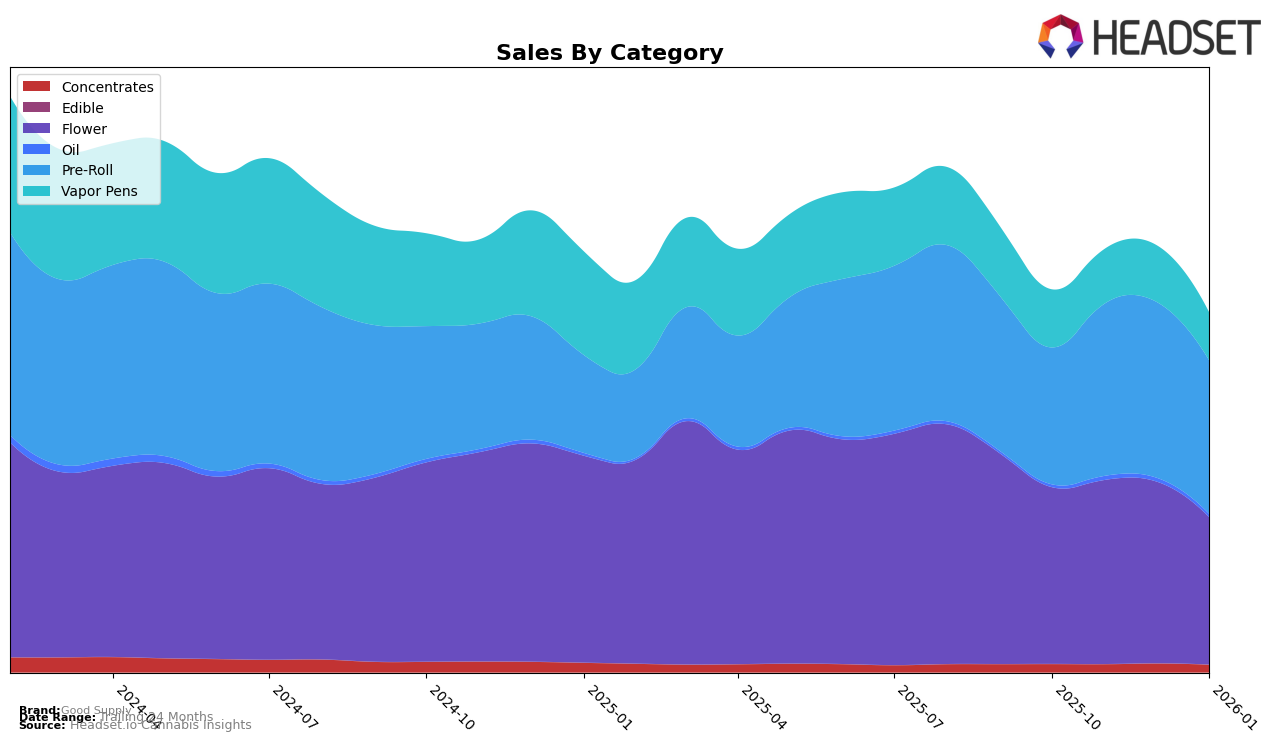

In the Canadian cannabis market, Good Supply has shown varied performance across different provinces and categories. In Alberta, the brand's Flower category experienced a notable decline from the top position in October 2025 to sixth place by January 2026. This downward trend is mirrored in the sales figures, which dropped significantly from approximately 1.68 million CAD to 842,744 CAD over the same period. The Pre-Roll category maintained a steady eighth position throughout these months, indicating a consistent market presence despite fluctuations in sales. However, the brand's Vapor Pens category saw a decline in rank from ninth to fourteenth, reflecting a potential challenge in maintaining its market share in this segment.

In British Columbia, Good Supply's Flower category improved in rank, moving up from fifteenth in October 2025 to sixth by January 2026, suggesting a strengthening position. The Pre-Roll category also showed positive movement, climbing from an unranked position in October to fifth place by January 2026. This indicates a significant gain in market traction. Conversely, in Ontario, while the Pre-Roll category maintained a strong position, improving slightly to fifth place, the Vapor Pens category faced challenges, dropping out of the top 20 by January 2026. In Saskatchewan, the Flower category experienced a decline in rank from first to sixth, which aligns with a decrease in sales figures, potentially signaling increased competition or shifting consumer preferences.

Competitive Landscape

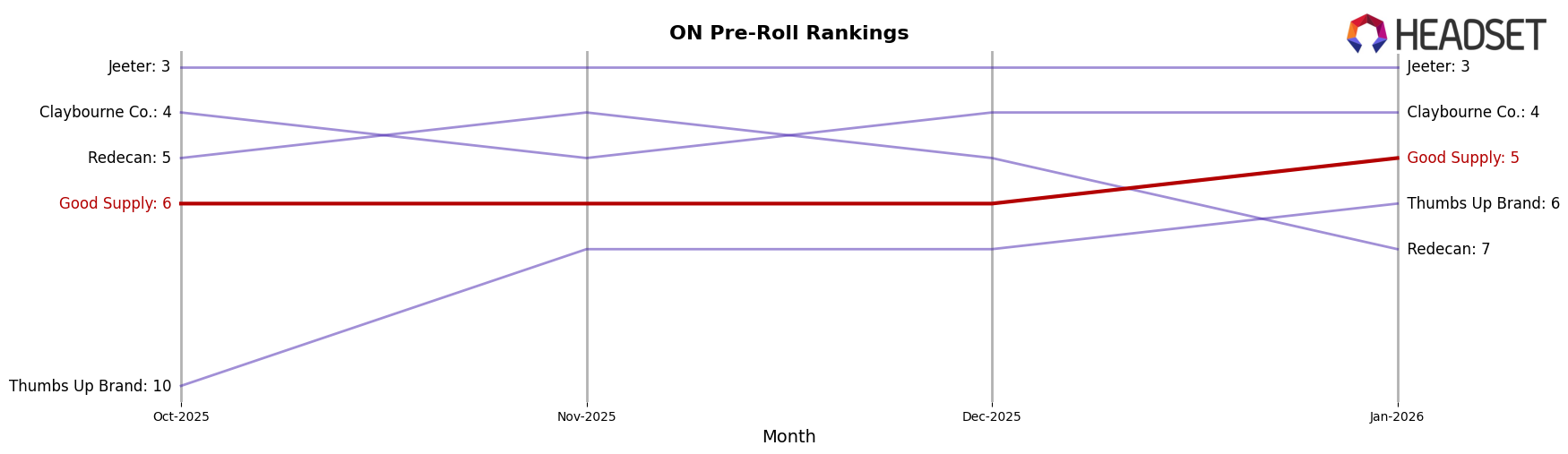

In the competitive landscape of the Pre-Roll category in Ontario, Good Supply has shown resilience and strategic growth. Over the four-month period from October 2025 to January 2026, Good Supply maintained a steady rank, starting at 6th place and climbing to 5th place by January 2026. This upward movement is notable, especially considering the competitive pressure from brands like Redecan and Claybourne Co., which have experienced fluctuations in their rankings. For instance, Redecan dropped from 4th to 7th place, while Claybourne Co. maintained a consistent 4th place. Despite the presence of strong competitors like Jeeter, which held a steady 3rd place, Good Supply's ability to improve its rank suggests effective market strategies and growing consumer preference. Additionally, Good Supply's sales trajectory shows a positive trend, with a noticeable increase in sales from November to December 2025, indicating a successful holiday season strategy. This growth trajectory, coupled with the decline in sales for some competitors, positions Good Supply as a formidable player in the Ontario Pre-Roll market.

Notable Products

In January 2026, the top-performing product for Good Supply was Double Dutchies - Double Up Pre-Roll 2-Pack (2g), maintaining its leading position from the previous months with sales of 109,655. Double Dutchies - Double Down Pre-Roll 2-Pack (2g) held steady in the second position, showing consistent performance since November 2025. Jean Guy Pre-Roll (1g) remained in third place, although its sales have gradually decreased over the months. Grand Daddy Purps (3.5g) and Neon Lotus (7g) secured the fourth and fifth positions, respectively, with Grand Daddy Purps improving its rank from fifth in November to fourth in December and January. Overall, the rankings remained relatively stable, with minor shifts primarily in the flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.