Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

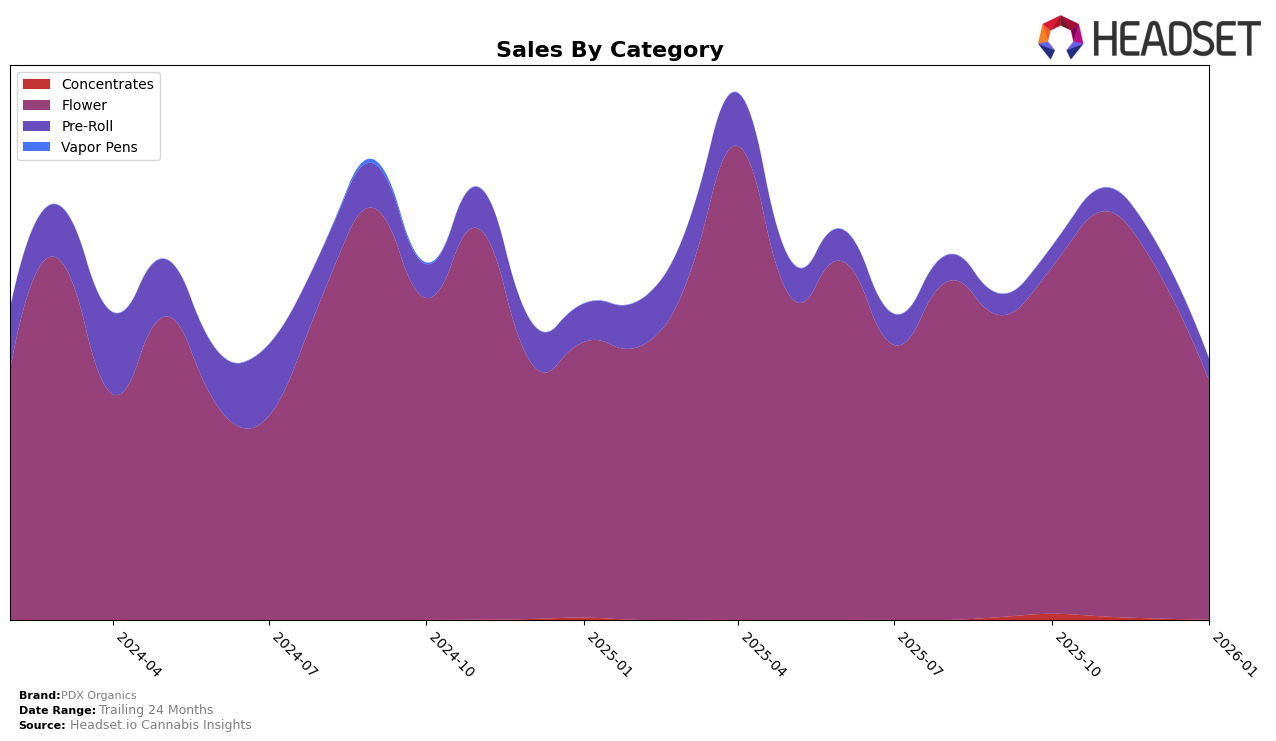

In the state of Oregon, PDX Organics has shown varied performance across different product categories over the recent months. In the Flower category, PDX Organics experienced a notable fluctuation in their rankings, starting from 15th place in October 2025, peaking at 9th in November, and then sliding down to 29th by January 2026. This decline in ranking was accompanied by a decrease in sales, dropping from over $365,000 in November to approximately $214,000 by January. This trend suggests a potential challenge in maintaining market share in the Flower category, despite a strong performance earlier in the quarter.

Meanwhile, in the Pre-Roll category, PDX Organics did not make it into the top 30 brands, with rankings hovering in the 60s range throughout the observed months. Specifically, the brand was ranked 72nd in October 2025, improving slightly to 65th by December, before slipping back to 67th in January 2026. Although sales figures in this category showed some growth from October to December, the brand's continued absence from the top 30 suggests room for improvement. The consistent sales figures, despite the lower rankings, indicate a stable but relatively small presence in the Pre-Roll market within Oregon.

Competitive Landscape

In the competitive landscape of Oregon's flower category, PDX Organics has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 15th in October, PDX Organics climbed to 9th in November, showcasing a strong performance, before experiencing a decline to 29th by January. This volatility is contrasted by competitors like Dog House, which, despite not ranking in the top 20, showed a recovery in sales by January, and The Crop Shop, which maintained a relatively stable presence, peaking at 18th in December. Meanwhile, Derby's Farm and Panda Farms demonstrated gradual improvements, with Panda Farms notably closing the gap with PDX Organics by January. These dynamics suggest that while PDX Organics had a strong start, the brand may need to strategize to regain its earlier momentum amidst rising competition.

Notable Products

In January 2026, Blizzard King (Bulk) emerged as the top-performing product for PDX Organics, achieving the number one rank with sales reaching 2493 units. Blue Dream (Bulk) followed closely in second place, improving from its previous absence in the top ranks in November and December 2025. Flex Panther (1g) secured the third position, marking its first appearance in the rankings. Blue Dream (1g) experienced a slight decline, dropping to fourth place from its consistent top-two positions in the preceding months. Black Dolphin (28g) rounded out the top five, making its debut in the rankings for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.