Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

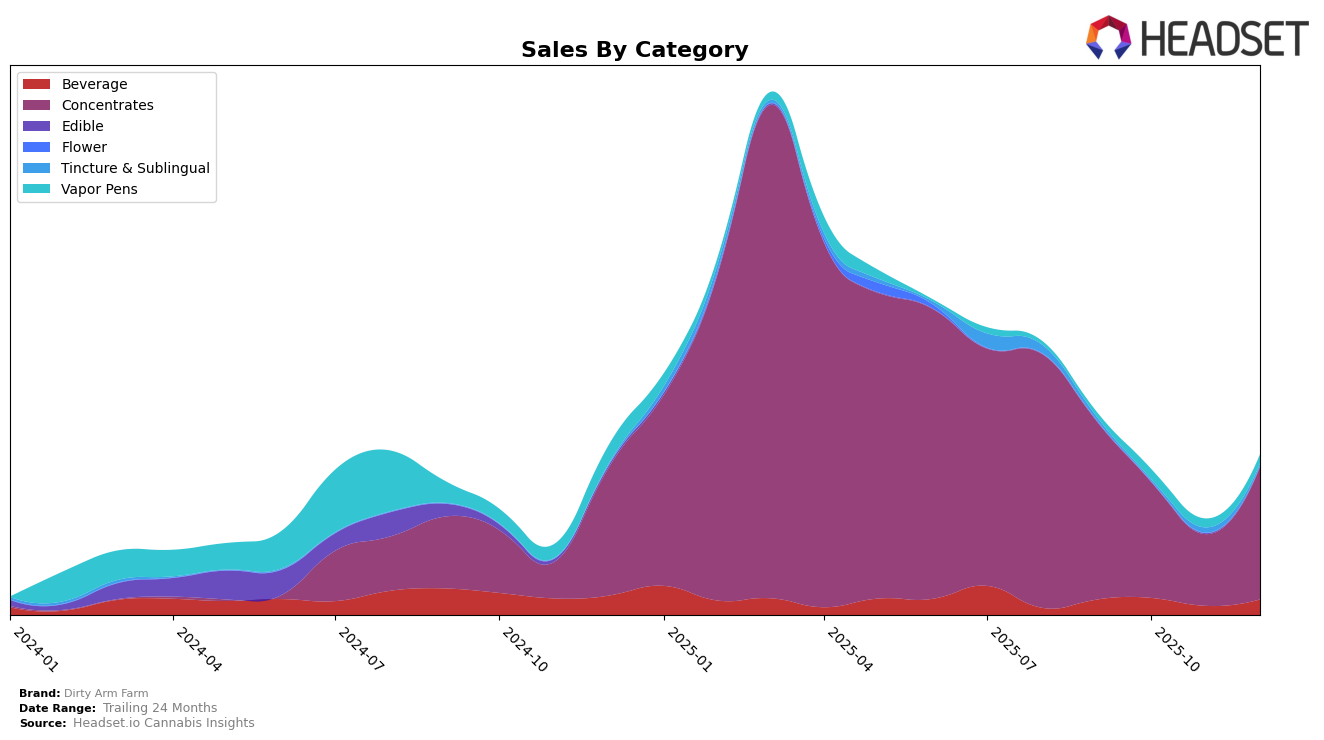

Dirty Arm Farm has experienced notable fluctuations in its performance across different states and product categories. In the state of Oregon, the brand has shown a significant rollercoaster in the Concentrates category. After ranking 22nd in September 2025, Dirty Arm Farm fell out of the top 30 in November, only to climb back to 30th place in December. This pattern suggests a volatile market presence, influenced perhaps by seasonal demand or competitive pressures. The drop in rankings in October and November could be seen as a challenge for the brand, indicating the need for strategic adjustments to regain consistent traction in the Oregon market.

Despite the fluctuating rankings, Dirty Arm Farm's sales figures reveal some interesting trends. The brand's sales in Oregon started at $76,223 in September, dropped significantly in October and November, but saw a recovery in December. This rebound in December could indicate a successful marketing campaign or a seasonal uptick in consumer interest. While these movements in rankings and sales figures provide valuable insights, they also highlight the competitive nature of the cannabis market in Oregon, where maintaining a steady position requires continuous effort and adaptation to market trends. The absence of Dirty Arm Farm from the top 30 in November is a crucial point for analysis, suggesting areas for potential improvement.

Competitive Landscape

In the competitive landscape of Oregon's concentrates market, Dirty Arm Farm has experienced notable fluctuations in its ranking and sales performance from September to December 2025. Initially ranked 22nd in September, Dirty Arm Farm saw a decline to 32nd in October and further slipped to 43rd in November, before rebounding to 30th in December. This volatility contrasts with the more stable performance of competitors like Sand Castle Hash Co., which maintained a consistent rank around the high 20s. Meanwhile, Alta Gardens showed a significant rise, particularly in October, where it achieved a rank of 26th, outperforming Dirty Arm Farm. Another competitor, Eugreen Farms, demonstrated a strong upward trend, climbing from 45th in September to 30th in November, surpassing Dirty Arm Farm during that period. These dynamics suggest that while Dirty Arm Farm remains a key player, it faces intense competition and potential challenges in maintaining its market position amidst the evolving landscape of Oregon's concentrates sector.

Notable Products

In December 2025, the top-performing product from Dirty Arm Farm was Honey Donut Live Rosin (2g) in the Concentrates category, securing the number one rank with sales reaching 175 units. Following closely, GMO x Poison Mimosa Live Rosin (2g) took the second position, while TT5 Live Rosin (1g) held the third rank. Tropicanna Live Rosin (2g) and Coconut Candy Live Rosin (1g) rounded out the top five, ranking fourth and fifth respectively. This marks the first month these products were ranked, indicating a significant surge in sales for December compared to previous months. The strong performance of these products highlights a growing preference for live rosin concentrates among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.