Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

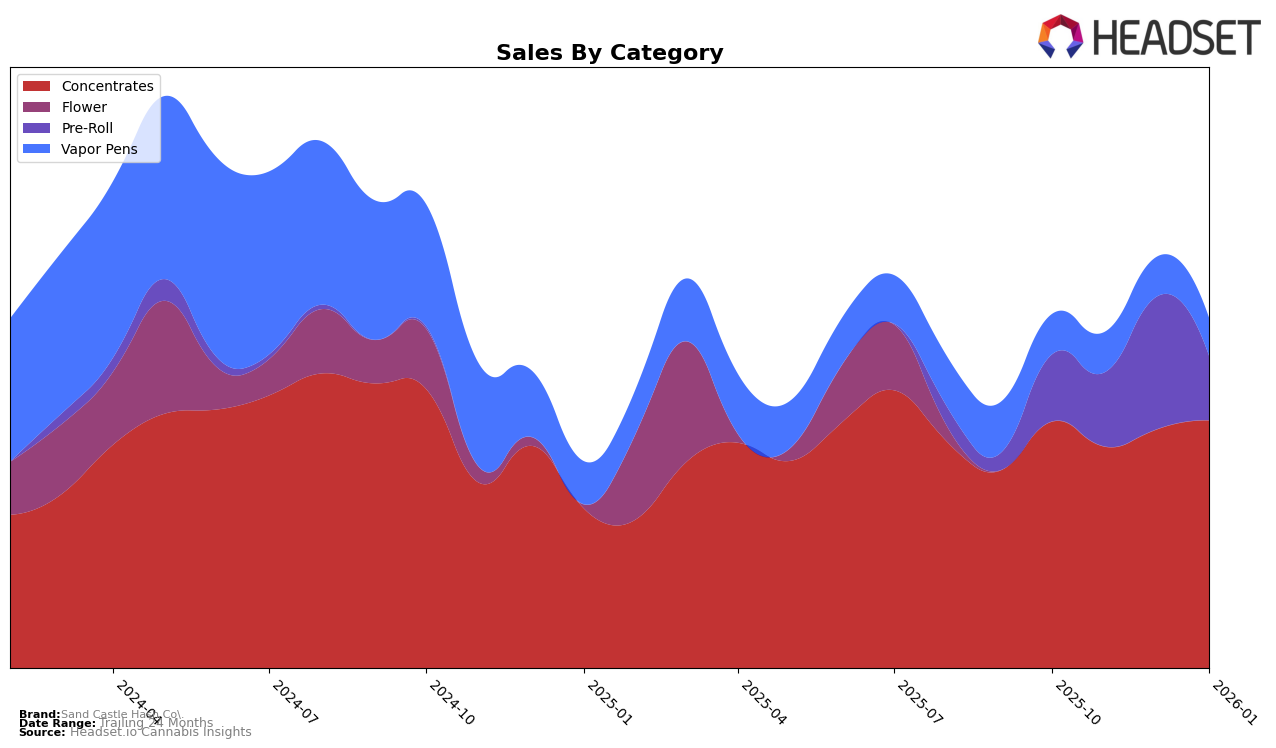

Sand Castle Hash Co. has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand has experienced a notable upward movement, improving its ranking from 30th in December 2025 to 24th by January 2026. This indicates a positive trend and suggests that the brand is gaining traction in this category. However, in the Vapor Pens category, Sand Castle Hash Co. did not manage to break into the top 30 rankings by January 2026, highlighting a potential area for improvement. The stable ranking around the 87th to 90th positions from October to December 2025 suggests that while there is consistency, there is also room for growth.

In the Pre-Roll category, Sand Castle Hash Co. saw a significant jump in rankings from 77th in October 2025 to 56th in December 2025, only to drop back to 70th by January 2026. This fluctuation indicates a volatile market presence, where the brand experienced a temporary boost in sales before facing a decline. Despite these fluctuations, the brand's sales figures in this category showed a substantial increase in December, suggesting a temporary surge in demand or successful promotional efforts. These movements across categories and rankings highlight areas of both opportunity and challenge for Sand Castle Hash Co. as it navigates the competitive landscape in Oregon.

Competitive Landscape

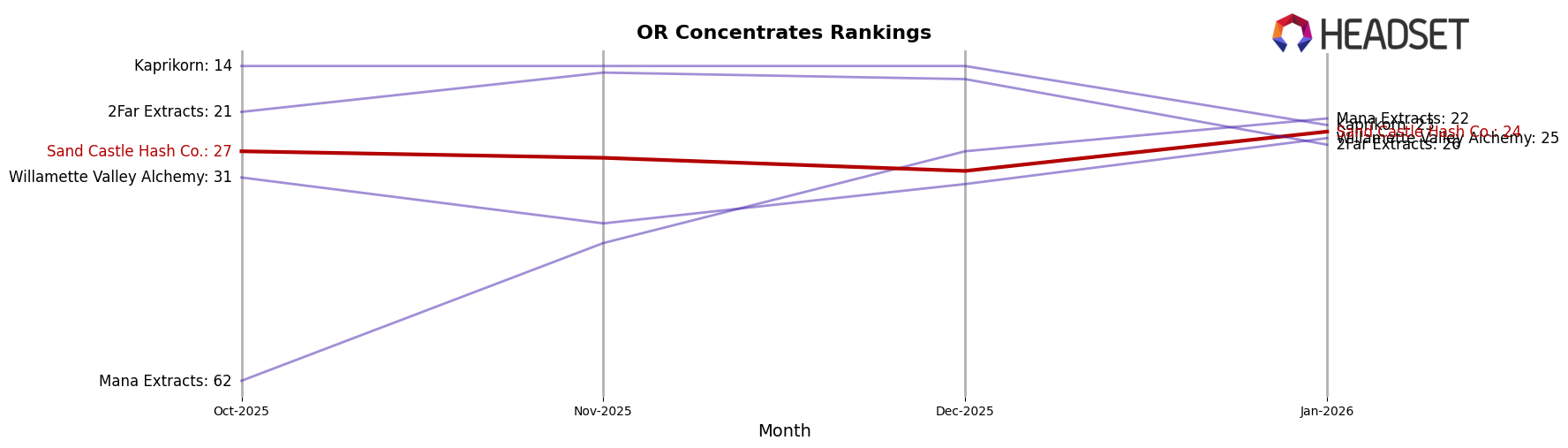

In the Oregon concentrates market, Sand Castle Hash Co. has shown a steady presence with a rank fluctuating between 24th and 30th from October 2025 to January 2026. Despite a consistent sales performance, competitors like Mana Extracts and Kaprikorn have demonstrated notable rank improvements, with Mana Extracts climbing from 62nd in October 2025 to 22nd by January 2026, and Kaprikorn maintaining a strong position before a slight dip in January. Meanwhile, 2Far Extracts experienced a decline from 21st to 26th, which could present an opportunity for Sand Castle Hash Co. to capitalize on any market share shifts. The competitive landscape indicates that while Sand Castle Hash Co. remains stable, the dynamic movements of its competitors suggest a need for strategic initiatives to enhance its market position and capitalize on any emerging opportunities in the Oregon concentrates category.

Notable Products

In January 2026, the top-performing product for Sand Castle Hash Co. was Trinity Temple Ball Hash (1g) in the Concentrates category, securing the number one rank with sales reaching 491 units. Malibu Sunset x Wedding Cake Infused Pre-Roll (1g) followed closely as the second top product in the Pre-Roll category, demonstrating strong performance with 471 units sold. Portofino Temple Ball Hash (1g) climbed from fifth place in December 2025 to third place in January 2026, highlighting a significant improvement in its sales trajectory. Amnesia Haze x Superboof Infused Pre-Roll (1g) maintained its position at fourth rank, showing consistent demand. Swamp Water Fumez Temple Ball Hash (1g) experienced a slight decline, dropping from fourth to fifth place, indicating a competitive market among Concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.