Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

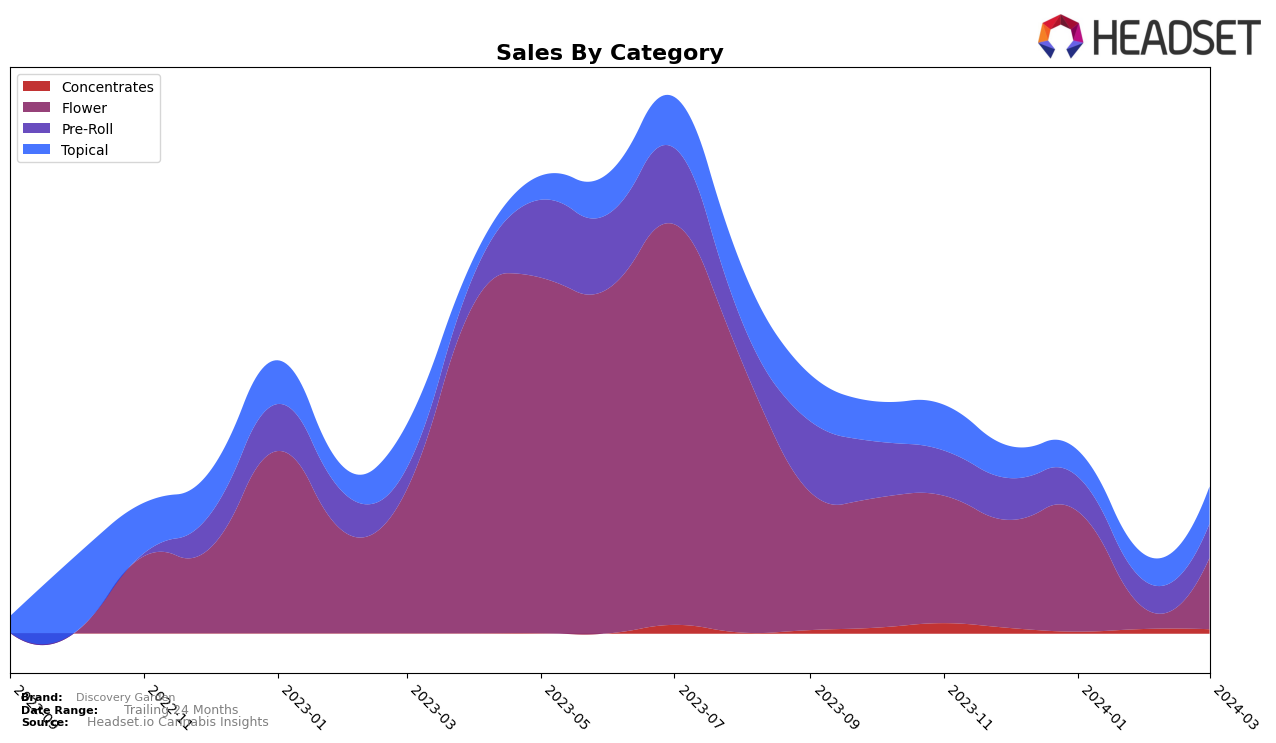

In the Topical category within Washington, Discovery Garden has shown a consistent presence, albeit with slight fluctuations in rankings over the recent months. Starting at rank 14 in December 2023, the brand maintained its position into January 2024, improved to rank 13 in February 2024, but then slightly dipped to rank 15 in March 2024. This movement indicates a stable demand for Discovery Garden's topical products in the Washington market, with a minor setback in March. Notably, sales increased from 1,621 units in December 2023 to 1,898 units in March 2024, suggesting a growing consumer interest or seasonal demand fluctuations that the brand could capitalize on further.

However, the brand's consistent ranking within the top 15, yet not breaking into the top 10, suggests room for growth and potential competitive pressures in the Topical category. The slight drop in ranking from February to March 2024, despite an increase in sales, could indicate a more competitive market or changes in consumer preferences. Discovery Garden's performance in the Washington market is a good indicator of its foothold in the Topical category, but the brand may need to explore strategic initiatives to climb higher in the rankings and capture a larger market share. The absence of Discovery Garden in other states or provinces in the provided data points to a concentrated market presence, which could be both a strength and a limitation depending on the brand's expansion strategies and market dynamics.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Washington, Discovery Garden has shown a consistent performance, maintaining its position within the top 15 brands from December 2023 through March 2024. Despite a slight dip to the 15th rank in March 2024, Discovery Garden's sales have shown an upward trajectory, indicating a growing consumer preference. Competitors such as SnacMe and Yield Farms have demonstrated significant volatility in their rankings but have managed to secure positions just above and below Discovery Garden, respectively, by March 2024. SnacMe, in particular, has seen a notable increase in sales, surpassing Discovery Garden in March. On the other hand, Heylo and Flex-All have struggled to consistently break into the top 15, with Flex-All not ranking in December 2023 but showing improvement in the following months. This competitive analysis highlights the dynamic nature of the topical cannabis market in Washington, with Discovery Garden maintaining a strong position amidst fluctuating rankings and sales of its competitors.

Notable Products

In March 2024, Discovery Garden saw the Grapefruit Pre-Roll 2-Pack (1g) from the Pre-Roll category climb to the top of their sales chart with a notable 127 units sold, marking a significant rise from its fourth-place position in February. Following closely, the CBD:THC 1:1 Meta Heal Salve (26mg CBD, 26mg THC, 2oz) from the Topical category moved up one rank to secure the second position, demonstrating consistent growth in consumer interest. The newly introduced Moroccan Kush (3.5g) from the Flower category made a strong entry directly into the third spot, indicating a successful launch. Meanwhile, Grapefruit (3.5g), also from the Flower category, experienced a slight dip, falling to the fourth position after not being ranked in February. Sour Space Candy (3.5g), which had dominated the sales in previous months, saw a significant drop to the fifth position, highlighting shifting consumer preferences within Discovery Garden's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.