Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

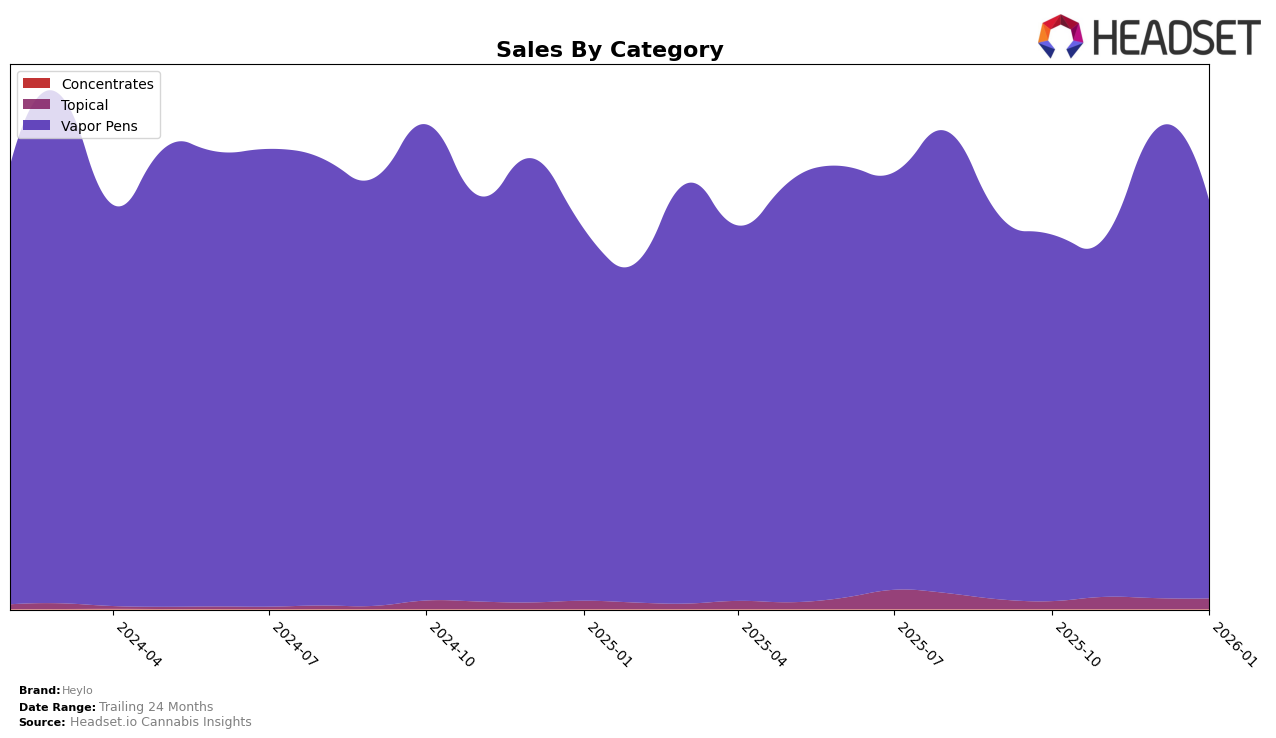

In the state of Washington, Heylo has shown a consistent presence in the Vapor Pens category, although it hasn't broken into the top 30 brands. Over the past few months, the brand has experienced some fluctuations in its rankings. In October 2025, Heylo was positioned at 71st place, and by January 2026, it improved slightly to 61st. This movement suggests a positive trend, although the brand still remains outside the top tier. The sales figures reflect this trend as well, with a notable increase in December 2025, which could indicate a successful holiday season strategy or product launch.

The absence of Heylo in the top 30 rankings across other states or provinces may highlight a potential area for growth or a strategic focus on the Washington market. The brand's performance in Washington, despite not being in the top 30, suggests that Heylo could be concentrating its efforts locally, possibly due to market familiarity or consumer loyalty. This focus might be beneficial in building a stronger brand presence before expanding aggressively into other regions. Overall, while Heylo is making strides in Washington, its limited visibility in other markets could be either a strategic choice or an area ripe for development.

Competitive Landscape

In the Washington Vapor Pens category, Heylo has shown a promising upward trend in its rankings from October 2025 to January 2026, moving from 71st to 61st position. This improvement is noteworthy when compared to competitors like Walden Cannabis, which remained relatively stable but lower in sales, and Treats, which fluctuated and ended at 65th. Heylo's sales surged notably in December 2025, surpassing Treats and closing the gap with Stingers, which held a slightly better rank. Meanwhile, Method maintained a stronger position but experienced a decline in sales, indicating potential vulnerabilities that Heylo could capitalize on. Overall, Heylo's consistent rank improvement and sales growth highlight its competitive potential in the market.

Notable Products

In January 2026, the top-performing product for Heylo was the Raw x - Strawberry Cough Full Spectrum Cartridge (1g) in the Vapor Pens category, maintaining its number one rank consistently from previous months despite a slight decrease in sales to 262 units. The Wedding Cake CO2 Cartridge (1g) held steady at the second position, with sales figures matching December 2025 at 192 units. The Fruity Pebbles CO2 Cartridge (1g) debuted strongly in January, securing the third rank in the Vapor Pens category. RawX - White Widow CO2 Cartridge (1g) improved its position, moving up to fourth place from fifth in December 2025. Meanwhile, Green Runtz CO2 Cartridge (1g) dropped from fourth to fifth place, reflecting a decrease in sales volume to 141 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.