Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

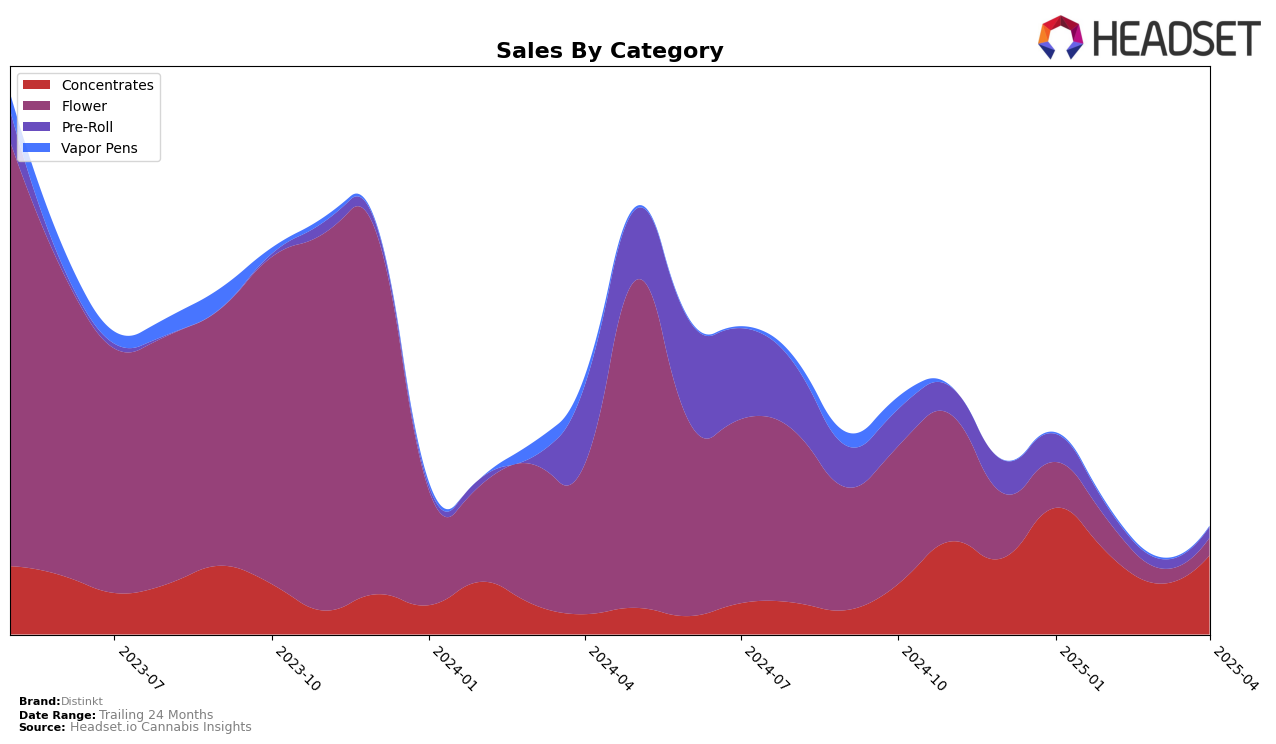

Distinkt has shown varied performance across different categories and states, with notable movements in the Concentrates category in Alberta. In January 2025, Distinkt was ranked 21st, but by March, it had slipped to 33rd, indicating a decline in its competitive standing. However, the brand made a comeback in April, improving its rank to 25th. This fluctuation suggests that while Distinkt faced challenges in maintaining a top position, it has the potential to recover and improve its market presence. The decline in sales from January to March, followed by a recovery in April, highlights the brand's resilience and ability to adapt to market conditions.

The absence of Distinkt from the top 30 rankings in March could be seen as a setback, particularly in a competitive market like Alberta. This drop out of the top 30 indicates a need for strategic adjustments to regain market share. On the positive side, the brand's ability to re-enter the rankings in April suggests that such strategies might already be in motion. The overall trend for Distinkt in the Concentrates category underscores the dynamic nature of the cannabis market, where brands must continuously innovate and adapt to stay relevant. The data points to a brand that is actively navigating its challenges and working to solidify its position in the market.

Competitive Landscape

In the Alberta concentrates market, Distinkt has experienced fluctuating rankings and sales, indicating a dynamic competitive landscape. Starting the year strong in January 2025 with a rank of 21, Distinkt saw a decline to 24 in February and further to 33 in March, before recovering slightly to 25 in April. This volatility contrasts with competitors like Frootyhooty, which maintained relatively stable rankings, only dropping from 16 to 23 over the same period. Meanwhile, Phyto Extractions showed a positive trend, improving from 25 in January to 22 in April, suggesting a potential threat to Distinkt's market position. Additionally, Good Buds re-entered the top 20 in March, indicating a resurgence that could further impact Distinkt's sales. Despite these challenges, Distinkt's sales rebounded in April, suggesting resilience and potential for growth if strategic adjustments are made.

Notable Products

In April 2025, Guava Cool Live Rosin Jam (1g) maintained its top position in the Concentrates category for the fourth consecutive month with a notable sales figure of 942 units. Temple Ball Hash (1g) also held steady at the second rank in the same category, showing consistent performance. Nebulous Pre-Roll 5-Pack (2.5g) entered the rankings in April, securing the third position in the Pre-Roll category. Vanilla Kush (3.5g) remained in fourth place in the Flower category, showing a slight increase in sales from the previous month. Meanwhile, Monaco Octane Pre-Roll 5-Pack (2.5g) dropped to fifth place in the Pre-Roll category after previously being ranked third in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.