Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

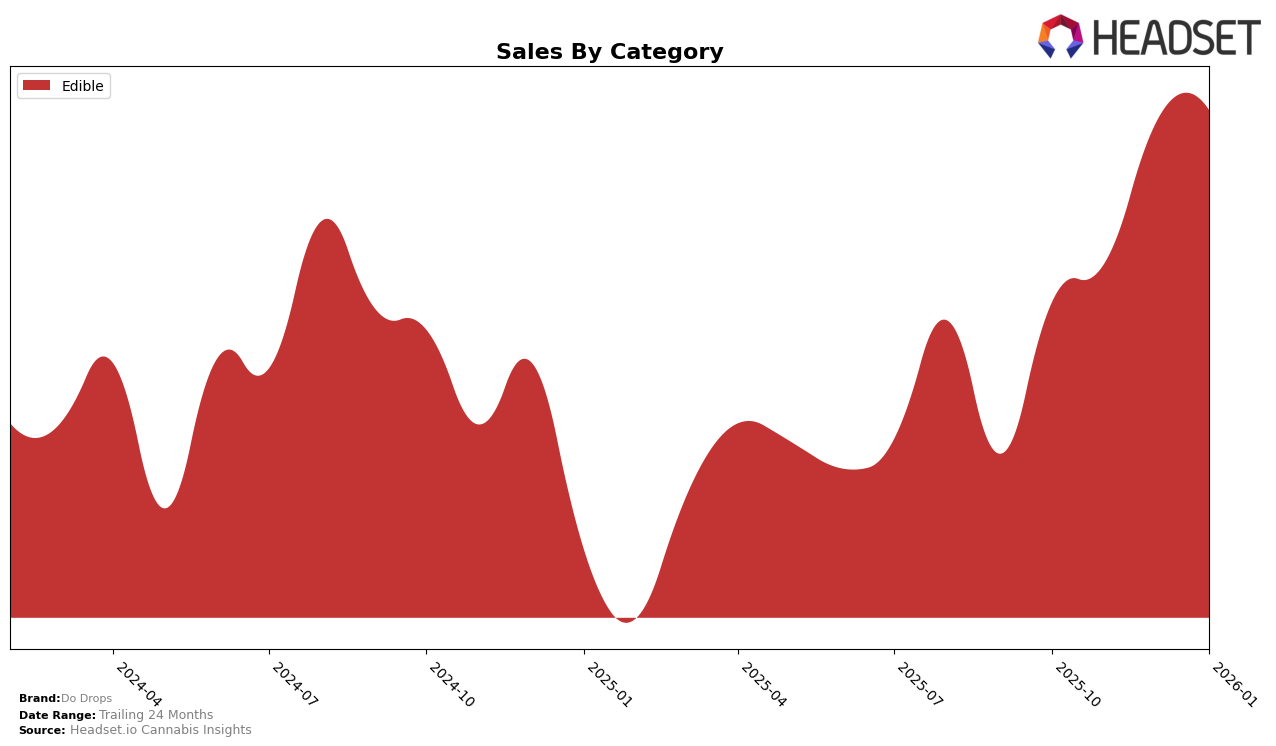

In the Maryland market, Do Drops has shown a consistent presence in the Edible category, maintaining a steady rank of 11th in both October and November of 2025, and improving slightly to 10th place in December 2025 and January 2026. This upward trend in rankings is accompanied by a notable increase in sales, indicating a strong performance and growing consumer preference for Do Drops in the state. Such consistency in rank and sales growth highlights the brand's effective market strategies and product appeal within Maryland's competitive edible landscape.

Conversely, in Massachusetts, Do Drops did not make it into the top 30 edible brands from November 2025 to January 2026, after being ranked 60th in October 2025. This drop suggests challenges in market penetration or competition within the state. The absence from the top rankings in subsequent months could point to the need for strategic adjustments to improve brand visibility and appeal in Massachusetts. This contrast between states underscores the varying market dynamics and consumer preferences that Do Drops must navigate to optimize its performance across different regions.

Competitive Landscape

In the Maryland edibles market, Do Drops has shown a steady presence, maintaining its rank at 10th place from December 2025 to January 2026, after a slight improvement from 11th in the preceding months. This stability is notable given the competitive dynamics in the market. Encore Edibles experienced a decline from 4th to 8th place over the same period, indicating potential opportunities for Do Drops to capture market share from competitors facing challenges. Meanwhile, Wana improved its position from 7th to 6th in December before dropping to 9th in January, suggesting fluctuations that Do Drops could capitalize on. Although HiColor dropped from 9th to 11th, Do Drops maintained its rank, highlighting its resilience. Overall, while Do Drops' sales figures are lower than some competitors, its consistent ranking amidst these shifts suggests a solid foundation and potential for growth in the Maryland edibles category.

Notable Products

In January 2026, the top-performing product from Do Drops was Sleep - CBN/THC 1:1 Slumberberry Gummies 10-Pack, maintaining its first-place ranking consistently since October 2025 with sales of 6,283 units. Energy - CBD/CBG/THC 2:2:1 Lemon Citrus Gummies 10-Pack moved up to second place, showing a significant increase in sales from previous months. Focus - CBG/THC/THCV 1:1:1 Watermelon Gummies 10-Pack, which had been in second place in November and December 2025, dropped to third place in January 2026. Pride - Starfruit Gummies 10-Pack maintained a steady fourth position, while the Relax - CBD/THC 1:1 Peach Gummies 10-Pack entered the ranking in fifth place. Overall, the sales figures indicate a strong preference for the Slumberberry Gummies, while the Lemon Citrus Gummies showed notable growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.