Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

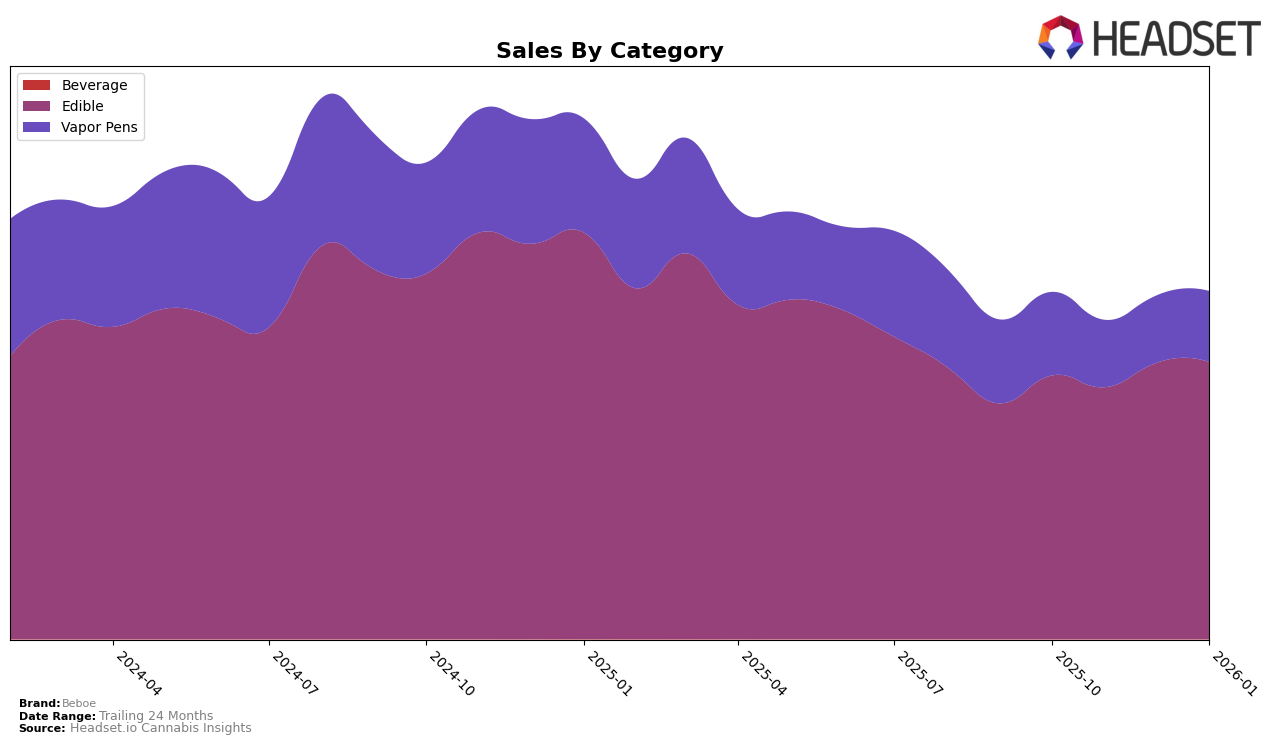

Beboe has shown varied performance across different states and product categories. In the Illinois market, Beboe's edible products have maintained a presence within the top 30, though their ranking has slightly decreased from 22nd in October 2025 to 25th by January 2026. In contrast, their vapor pens have not been able to break into the top 30, with the rank slipping from 62nd to 73rd over the same period, indicating a need for a strategic rethink in this category. Meanwhile, in Maryland, Beboe's edibles have shown a positive trend, climbing from 15th to 13th, while their vapor pens improved from 39th to 31st, suggesting a stronger market presence in this state.

In Massachusetts, Beboe's edibles have struggled to maintain a consistent top 30 presence, with their ranking dropping from 44th to 50th by January 2026. However, in Ohio, Beboe's edibles have consistently performed well, holding a steady position around the 15th rank. Notably, in Nevada, the brand's edibles have shown resilience, maintaining a rank between 11th and 15th, while their vapor pens have remained within the top 40. These movements highlight Beboe's varying levels of success across different states, suggesting potential areas for growth and strategic focus.

Competitive Landscape

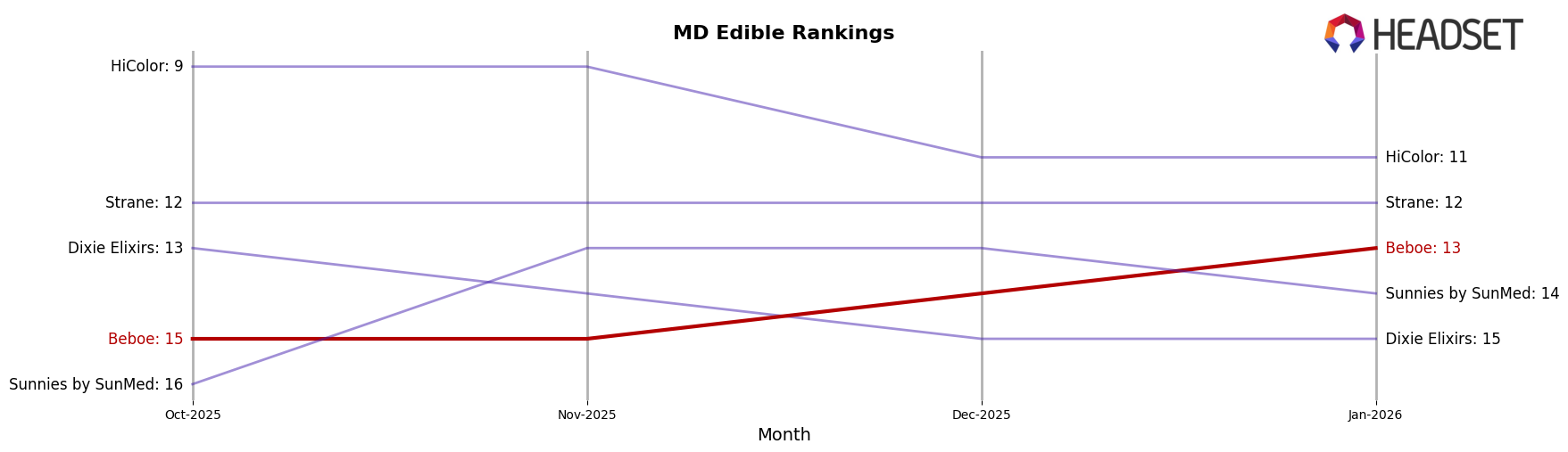

In the Maryland edible cannabis market, Beboe has demonstrated a notable upward trend in its ranking and sales over the past few months. Starting from the 15th position in October 2025, Beboe improved its rank to 13th by January 2026, showcasing a consistent rise in consumer preference. This positive trajectory contrasts with Dixie Elixirs, which maintained a steady decline in sales, resulting in a drop from 13th to 15th place. Meanwhile, Strane consistently held the 12th position, indicating stable performance, but Beboe's sales growth suggests it is closing the gap. HiColor, although experiencing a slight dip in rank from 9th to 11th, still maintains a strong sales lead over Beboe. Interestingly, Sunnies by SunMed showed fluctuations, peaking at 13th in November and December before falling to 14th in January, indicating potential volatility. Overall, Beboe's upward movement in both rank and sales highlights its growing competitiveness and appeal in the Maryland edibles category.

Notable Products

In January 2026, Beboe's THC/CBG 1:1 Sparkling Pear Cloud 9 Gummies 20-Pack maintained its top position from the previous months, achieving sales of 8012 units. The CBD/THC 1:1 Downtime Blackberry Gummies 20-Pack rose to second place, showing a significant increase from fourth place in December 2025. The THC/CBN 5:1 Sweet Dreams Raspberry Plum Berry Gummies 20-Pack held steady in third place, consistent with its December ranking. The CBD/THC 2:1 Sour Golden Peach Remedy Gummies 20-Pack moved up one spot to fourth place, reversing a declining trend seen in the previous months. Finally, Inspired Blood Orange Gummies 20-Pack dropped to fifth place, reflecting a decrease in sales performance compared to December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.