Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

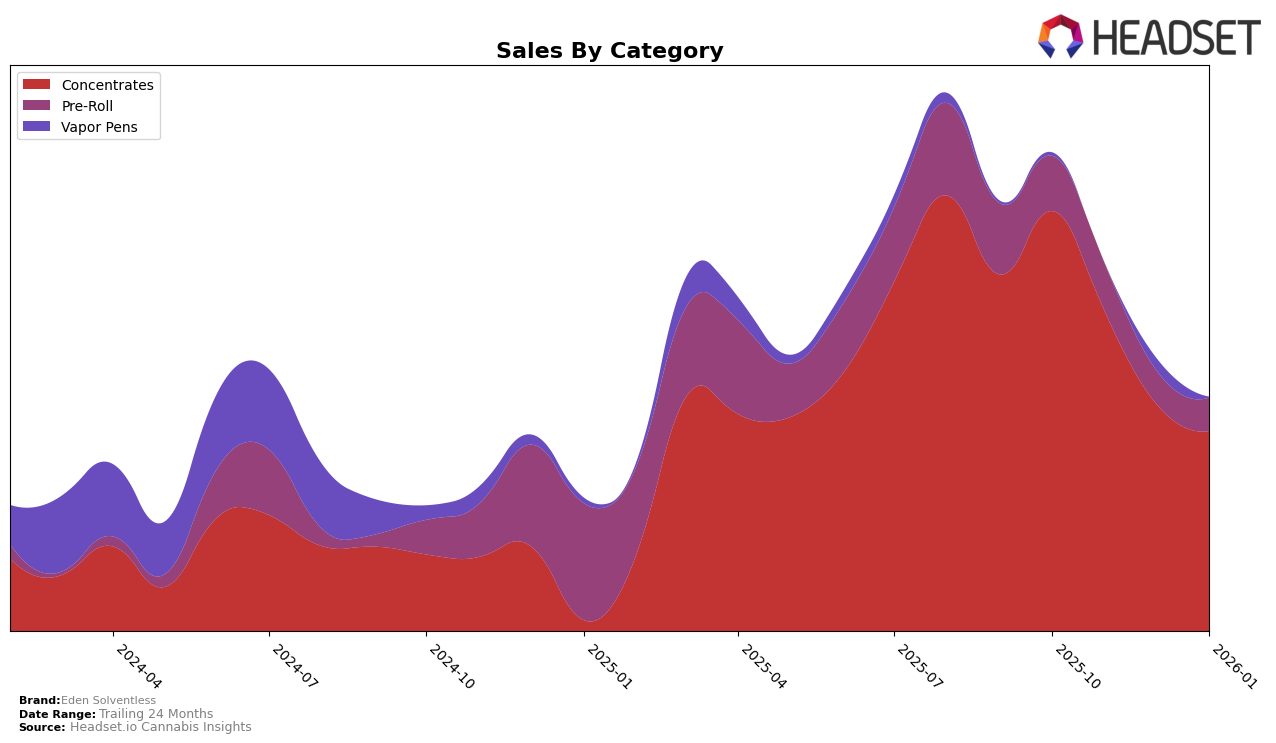

Eden Solventless has shown notable performance in the Maryland market, particularly in the Concentrates category. Over the last few months, the brand has experienced a gradual decline in its ranking, moving from 7th place in October 2025 to 13th by January 2026. This shift is mirrored by a decrease in sales, with January 2026 figures showing a significant drop compared to October 2025. Despite this downward trend, maintaining a position within the top 15 indicates a strong presence in the market. The brand's performance in the Pre-Roll category, however, has been less impressive, consistently ranking outside the top 30, which suggests room for improvement in this segment.

In the Vapor Pens category, Eden Solventless did not appear in the top 30 rankings until December 2025, when it entered at 55th place. Although this indicates a late entry into the competitive landscape, it also highlights potential for growth if the brand can leverage its strengths in other categories. The absence from the top 30 in the preceding months could have been due to a strategic focus on other product lines or a recent entry into this product category. Overall, while Eden Solventless has a solid foothold in some areas, there are opportunities to enhance its market position through strategic adjustments and expanded offerings.

Competitive Landscape

In the Maryland concentrates market, Eden Solventless has experienced a notable decline in rank from October 2025 to January 2026, dropping from 7th to 13th place. This downward trend is accompanied by a significant decrease in sales, which have fallen consistently over the months. In contrast, MPX - Melting Point Extracts has shown an upward trajectory, improving its rank from 13th to 11th and maintaining higher sales figures than Eden Solventless by January 2026. Similarly, Organic Remedies has also surpassed Eden Solventless, climbing from 14th to 12th place, although their sales figures are generally lower. Meanwhile, CULTA has entered the top 20, rising to 14th place by January 2026, indicating increased competition. These shifts suggest that Eden Solventless may need to reassess its market strategies to regain its competitive edge in the Maryland concentrates category.

Notable Products

In January 2026, Eden Solventless saw Apple Runtz Infused Pre-Roll (1g) leading the sales as the top-performing product with a notable sales figure of 433 units. Following closely, Banana Split Infused Pre-Roll (1g) secured the second spot, while Soul Safari Moroccan Hash (1g) took the third position. Dirty Kush Breath Cold Cure Live Rosin (1g) was ranked fourth, showing a decline from its previous second position in November 2025. Firecracker Cold Cure Live Rosin (1g) rounded out the top five, dropping from its first-place ranking in November 2025. The rankings reflect a shift in consumer preference towards pre-rolls, as seen by the rise of infused pre-rolls to the top spots.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.