Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

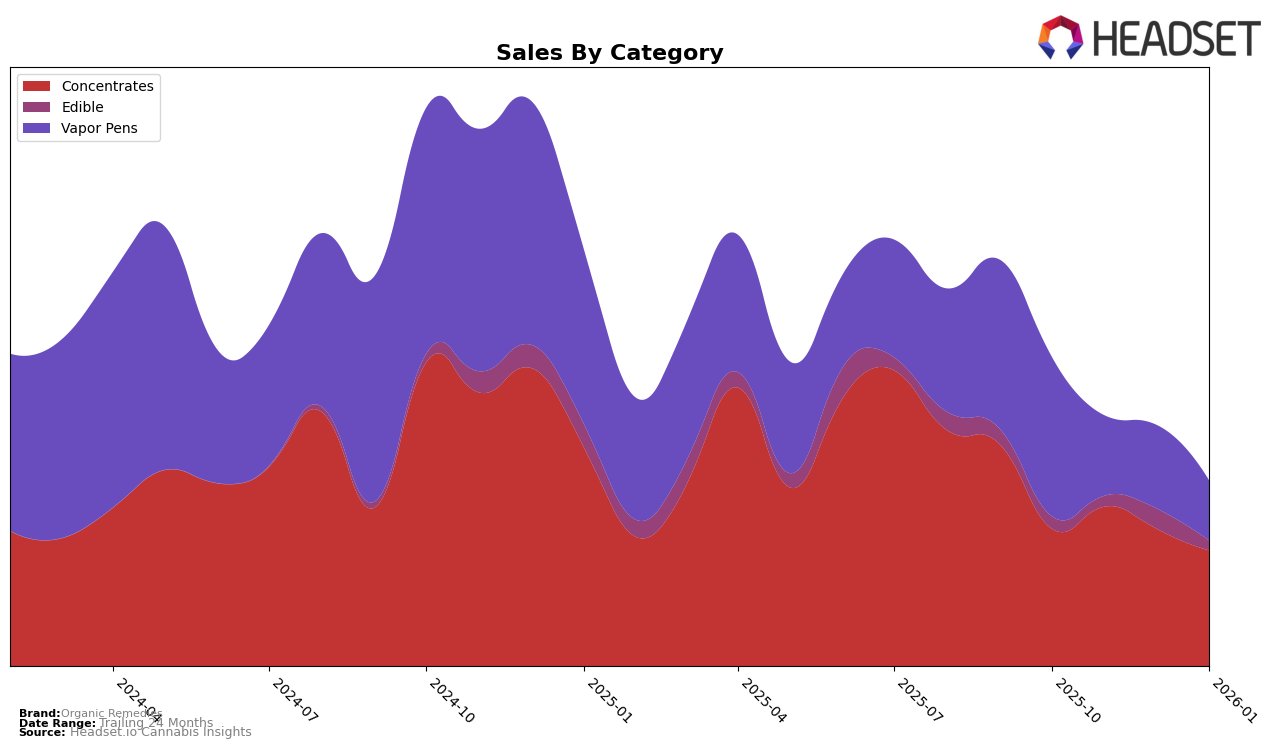

In the state of Maryland, Organic Remedies has demonstrated varying performance across different product categories. In the concentrates category, the brand maintained a strong presence, consistently ranking within the top 15 from October 2025 to January 2026, although there was a slight dip from 11th to 12th position in January. This category also saw a notable decline in sales from $147,877 in November 2025 to $107,112 in January 2026, indicating a potential seasonal fluctuation or increased competition. In contrast, their performance in the edible category was less consistent, with the brand not making the top 30 in November and January, though it did rank 30th in December, suggesting sporadic demand or supply issues.

Organic Remedies faced challenges in the vapor pens category in Maryland, where they experienced a downward trend in rankings, falling from 29th in October 2025 to 41st by January 2026. This decline in rank coincides with a significant drop in sales, from $148,083 in October to $55,495 in January, indicating a potential loss of market share or consumer preference shifting towards other brands or products. The lack of presence in the top 30 for edibles in two out of four months further highlights the brand's uneven performance across categories, suggesting areas for strategic improvement or a need to reassess their product offerings to better align with consumer demand.

Competitive Landscape

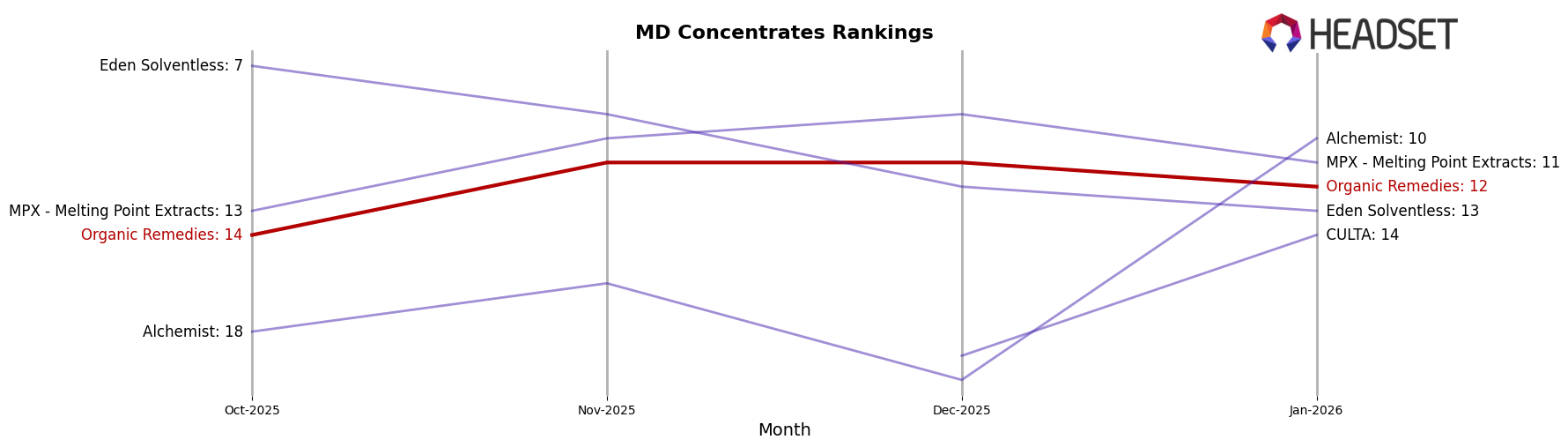

In the Maryland concentrates market, Organic Remedies has shown a fluctuating yet competitive presence, with its rank improving from 14th in October 2025 to 11th by November, maintaining this position through December, before slightly dropping to 12th in January 2026. This performance is noteworthy when compared to competitors like MPX - Melting Point Extracts, which consistently held a higher rank, peaking at 9th in December. Meanwhile, Eden Solventless experienced a decline from 7th in October to 13th by January, indicating a potential opportunity for Organic Remedies to capitalize on shifting consumer preferences. Additionally, Alchemist made a significant leap from 20th in December to 10th in January, suggesting a dynamic market landscape. The absence of CULTA from the top 20 until December, when it ranked 19th, further highlights the competitive volatility. Organic Remedies' sales trajectory, although lower than some competitors, reflects a need for strategic adjustments to enhance market share and capitalize on emerging trends.

Notable Products

In January 2026, the top-performing product for Organic Remedies was Melon Splash FSE M3 Disposable (1g) in the Vapor Pens category, achieving the highest sales with 444 units sold. Following closely was Forest Fire BFS M3 Disposable (1g), also in the Vapor Pens category, ranked second. Citrus Goat Burger Cured Badder (1g) and Icicle Nectar Live Sugar (1g) both shared the third position in the Concentrates category, each with notable sales. Cool Mule Diamond Topper (1g), another product in the Concentrates category, was ranked fourth. This lineup marks a significant shift in rankings from previous months, indicating a growing preference for vapor pens over concentrates in this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.