Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

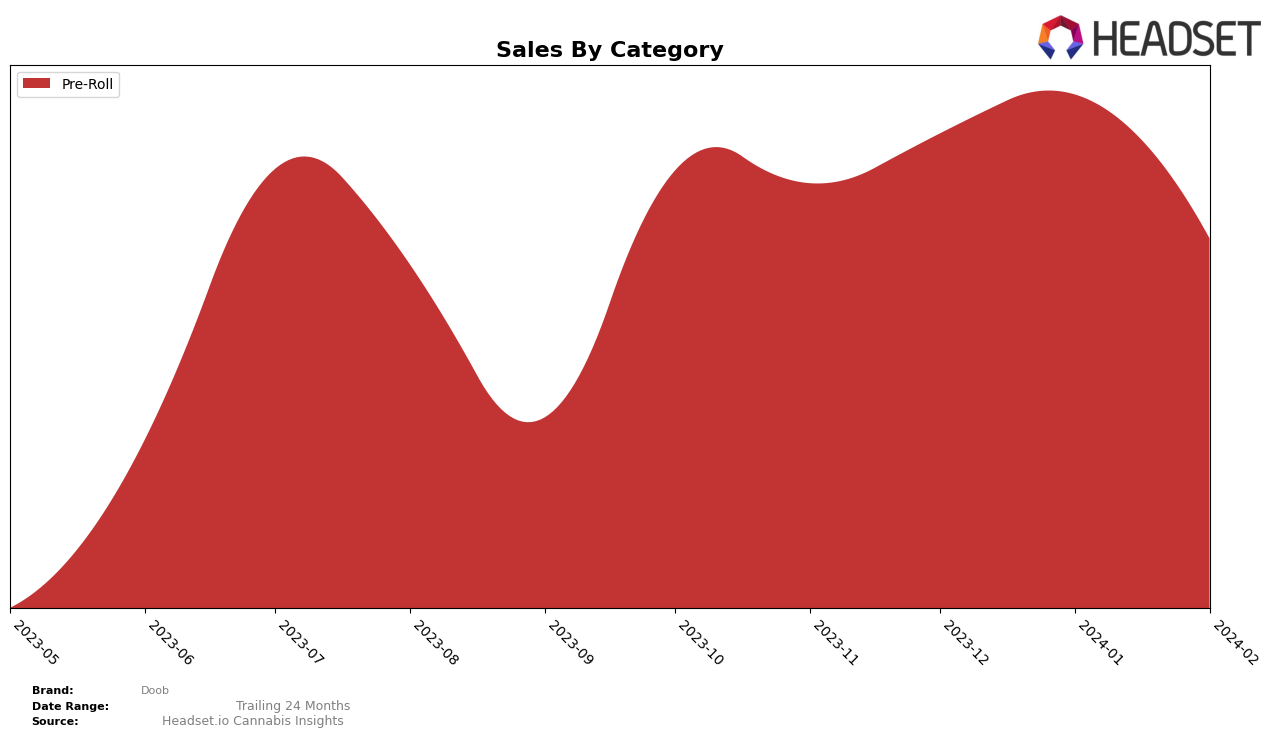

In the competitive cannabis market of Michigan, the brand Doob has shown a noteworthy performance in the Pre-Roll category, albeit with some fluctuations. Starting from November 2023, Doob was not within the top 30 brands, indicated by its initial ranking of 34. However, it demonstrated a positive trajectory by climbing up to the 22nd position by January 2024, before experiencing a slight dip to the 30th position in February 2024. This movement signifies a volatile yet upward trend in their market presence within Michigan's Pre-Roll category. Notably, their sales in November 2023 were recorded at 247,823.0, hinting at a robust demand for Doob's products, despite the fluctuations in ranking.

The journey of Doob in Michigan's Pre-Roll category is a testament to the brand's resilience and potential for growth. The initial absence from the top 30 rankings could have been a significant setback, but the subsequent improvement to the 22nd rank by January 2024 highlights their capability to enhance market share and consumer preference. However, the drop to the 30th rank in February 2024 suggests that maintaining a consistent position within such a competitive landscape remains a challenge. This fluctuation in rankings, combined with the revealed sales figures, offers a glimpse into the dynamic nature of consumer preferences and market competition in the cannabis industry, particularly within the Pre-Roll category in Michigan.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Michigan, Doob has shown a notable performance trajectory, albeit with fluctuations in its ranking. Initially positioned at 34th in November 2023, Doob improved its standing to 22nd by January 2024, before slightly dropping to 30th in February 2024. This fluctuation in rank is indicative of the highly competitive nature of the market and Doob's resilience amidst this. Competitors such as Franklin Fields and Doobies have also experienced shifts in their rankings, with Franklin Fields peaking at 19th in December 2023 before falling to 28th in February 2024, and Doobies moving from 36th to 29th in the same period, showing a more positive trajectory in the latter months. Notably, Play Cannabis, despite not being ranked in November 2023, surged to 31st by February 2024, highlighting the dynamic nature of consumer preferences and the potential for rapid changes in brand standings. Doob's sales trends, while showing an initial increase, faced a decline in February 2024, suggesting the need for strategic adjustments to maintain its competitive edge in this volatile market.

Notable Products

In February 2024, the top-selling product from Doob was the Bee Cookie Pre-Roll (1g) in the Pre-Roll category, securing the first rank with impressive sales of 10,576 units. Following closely, the Motor Breath 15 Pre-Roll (1g) took the second spot, showcasing a notable jump from its fourth position in January. The Rocky Mountain Fire Pre-Roll (1g) landed the third rank, indicating a fluctuation in its sales performance over the past months but still maintaining a strong presence. Sour OG Pre-Roll (1g) and Frosted Cake Pre-Roll (1g) rounded out the top five, securing the fourth and fifth ranks respectively, with the former making a significant leap from its previous fifth position in January. This month's rankings reveal a dynamic competition among Doob's Pre-Roll products, with significant shifts indicating changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.