Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

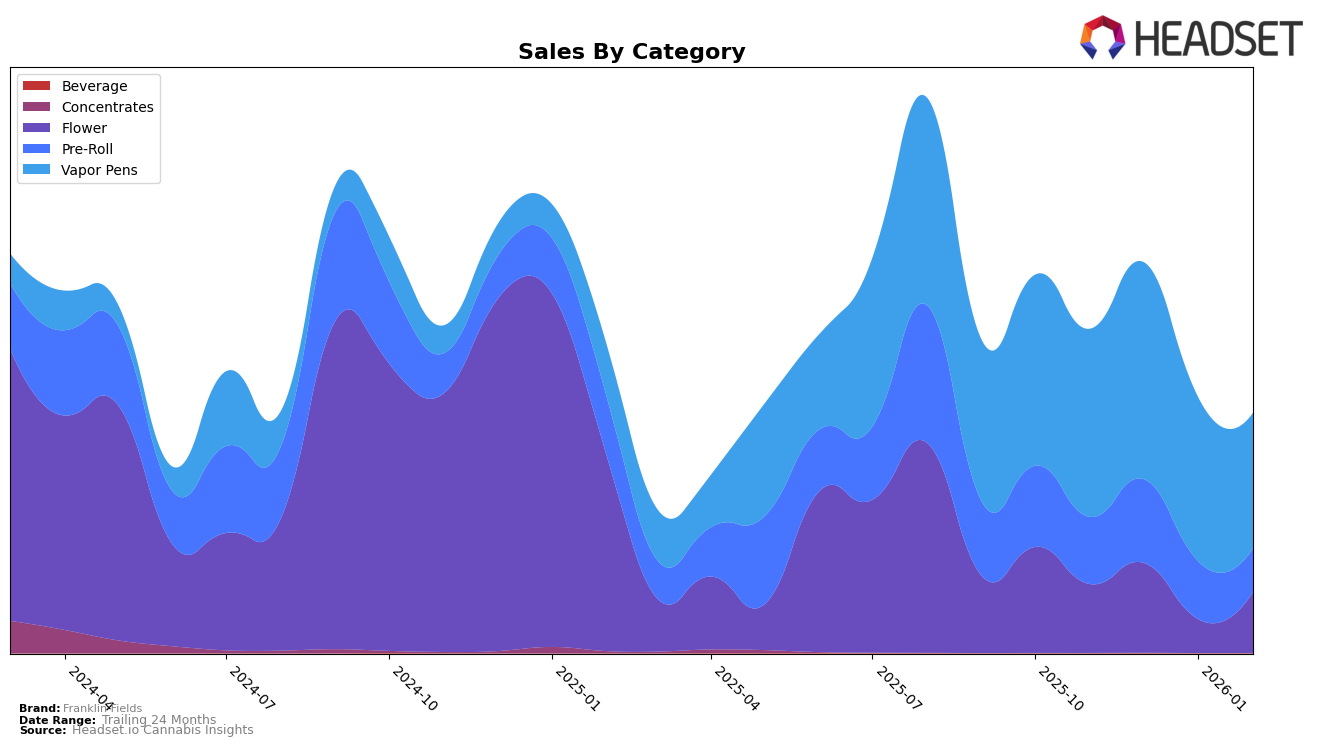

Franklin Fields has shown varied performance across different categories in Michigan. In the Pre-Roll category, the brand has struggled to maintain a strong presence, with rankings slipping from 64th in December 2025 to 84th by February 2026. This decline indicates a potential challenge in sustaining consumer interest or possibly increased competition in the Pre-Roll market. Despite this, the brand saw a notable peak in sales in December 2025, suggesting that there might have been a seasonal or promotional influence that briefly boosted their performance.

In contrast, Franklin Fields has managed to maintain a more consistent presence in the Vapor Pens category within Michigan. Although their rank slightly declined from 26th in November 2025 to 30th in February 2026, they remained within the top 30 brands, indicating a relatively stable consumer base. This steadiness is noteworthy, especially when considering the competitive nature of the Vapor Pens market. The gradual decline in sales from December 2025 to February 2026 may point towards market saturation or changing consumer preferences, but staying within the top 30 suggests resilience in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Franklin Fields has shown a notable performance trajectory over the months from November 2025 to February 2026. Despite facing stiff competition, Franklin Fields maintained a relatively stable rank, fluctuating slightly from 26th to 30th place. This stability is particularly impressive given the volatility seen in competitors like Party Favors, which experienced a more dynamic range from 30th to 27th, and Batch Extracts, which saw a decline from 19th to 29th. While Franklin Fields' sales saw a dip from December to February, this trend was consistent across the board, indicating a broader market contraction rather than a brand-specific issue. Notably, Franklin Fields outperformed Redbud Roots in terms of rank stability, as Redbud Roots fluctuated between 28th and 39th. This suggests that Franklin Fields' market strategies may be more resilient in maintaining customer loyalty and sales consistency in the Michigan vapor pen category.

Notable Products

In February 2026, Franklin Fields' top-performing product was the Orange Candy Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from January with sales of 2,513 units. The First Class Funk Pre-Roll (1g) climbed to the second spot, improving from an unranked position in January. Sugar Cookie Pre-Roll (1g) emerged in third place, marking its first appearance in the top rankings since November. Blue Dream Pre-Roll (1g) moved up to fourth place, showing a recovery from its fifth position in January. Super Boof Pre-Roll (1g) rounded out the top five, maintaining its rank from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.