Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

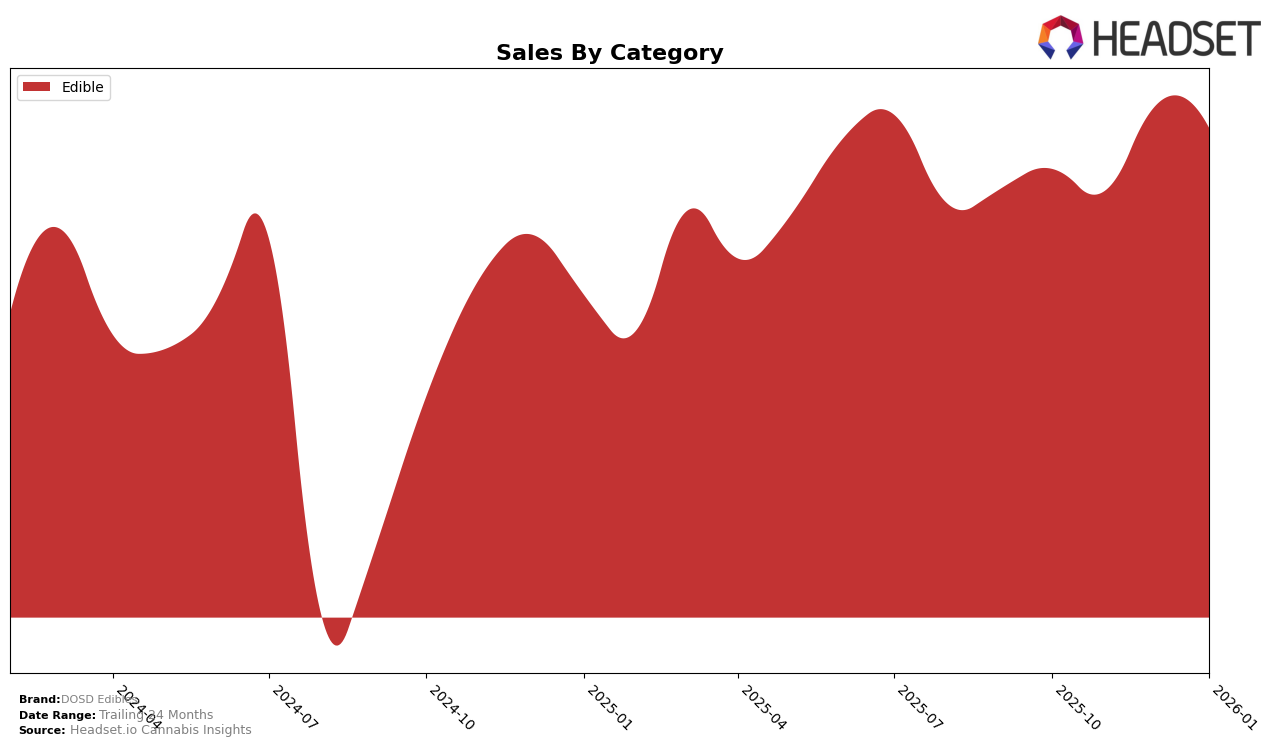

DOSD Edibles has shown varying performance across different states in the past months. In Colorado, the brand maintained a consistent presence in the top 15 edible brands, holding the 11th rank in both October and November of 2025, before slightly declining to 13th in December 2025 and January 2026. This minor drop in the rankings coincides with a decrease in sales from November to January, indicating potential challenges in maintaining market share. However, the consistent presence in the top 15 suggests a stable, if slightly fluctuating, demand for their products in this state.

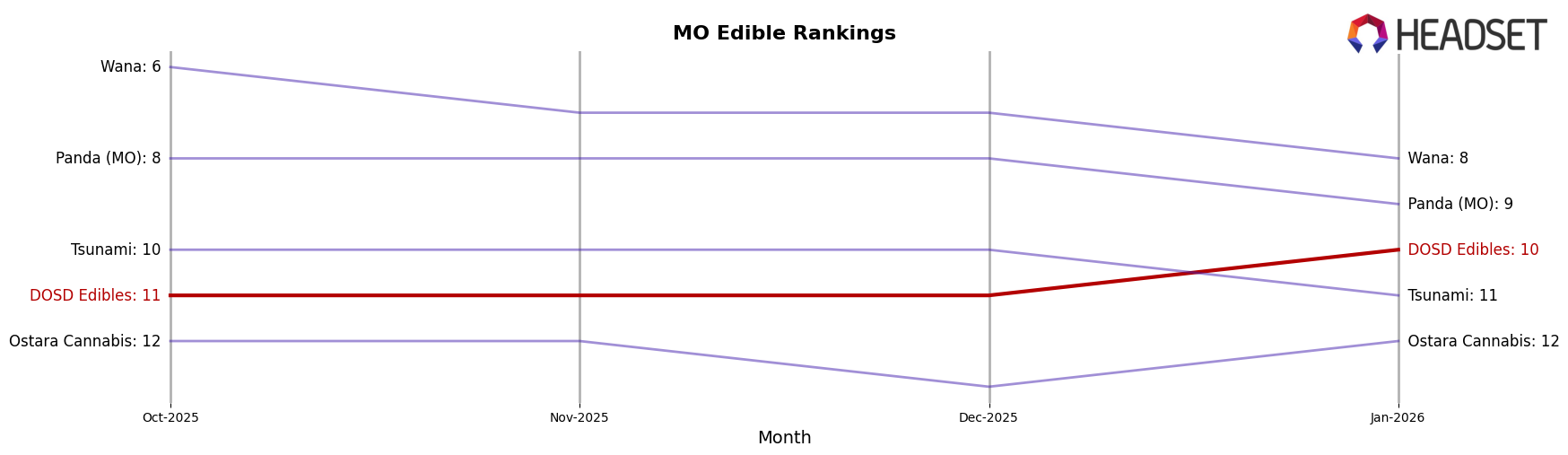

Meanwhile, in Missouri, DOSD Edibles has demonstrated a more robust performance. The brand maintained the 11th rank from October through December 2025, before improving to 10th place in January 2026. This upward movement in rankings is accompanied by a steady increase in sales, peaking in December and maintaining that level into January. This trajectory suggests a strengthening position in the Missouri market, highlighting the brand's potential to climb further in the rankings if the trend continues. Notably, the constant presence in the top 11 indicates a strong foothold in Missouri's edibles category, contrasting with the more variable performance observed in Colorado.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Missouri, DOSD Edibles has demonstrated a steady presence, maintaining its rank at 11th place from October to December 2025, before climbing to 10th in January 2026. This upward movement indicates a positive trend in sales performance, contrasting with competitors like Tsunami, which dropped from 10th to 11th place in the same period. Meanwhile, Wana and Panda (MO) consistently outperformed DOSD Edibles, ranking within the top 8, although both experienced a decline in sales by January 2026. Ostara Cannabis, closely trailing DOSD Edibles, remained mostly stable in rank but saw fluctuating sales figures. The data suggests that while DOSD Edibles is gaining traction, it faces stiff competition from established brands, highlighting the need for strategic marketing efforts to further enhance its market position.

Notable Products

In January 2026, the top-performing product from DOSD Edibles was Nano Bites - Pinkburst Gummies 10-Pack (100mg), maintaining its first-place rank for the second consecutive month with sales reaching 5227 units. The Nano Bites - Mixed Fruit Gummies 10-Pack (100mg) held steady in the second position, showing a slight increase in sales to 3504 units. Night Vibes - CBD/THC 1:1 Blue Raspberry Gummies 10-Pack (100mg CBD, 100mg THC) remained third, continuing its upward trend from fourth place in October 2025. Night Vibes - THC/CBN 1:1 Blue Raspberry Gummies 10-Pack (100mg THC, 100mg CBN) re-entered the rankings at fourth place after missing the list in December 2025. Finally, Nano Bites - THC/CBG 1:1 Citrus Splash Day Vibes Gummies 10-Pack (100mg THC, 100mg CBG) slipped to fifth place, reflecting a consistent decline in sales since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.