Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

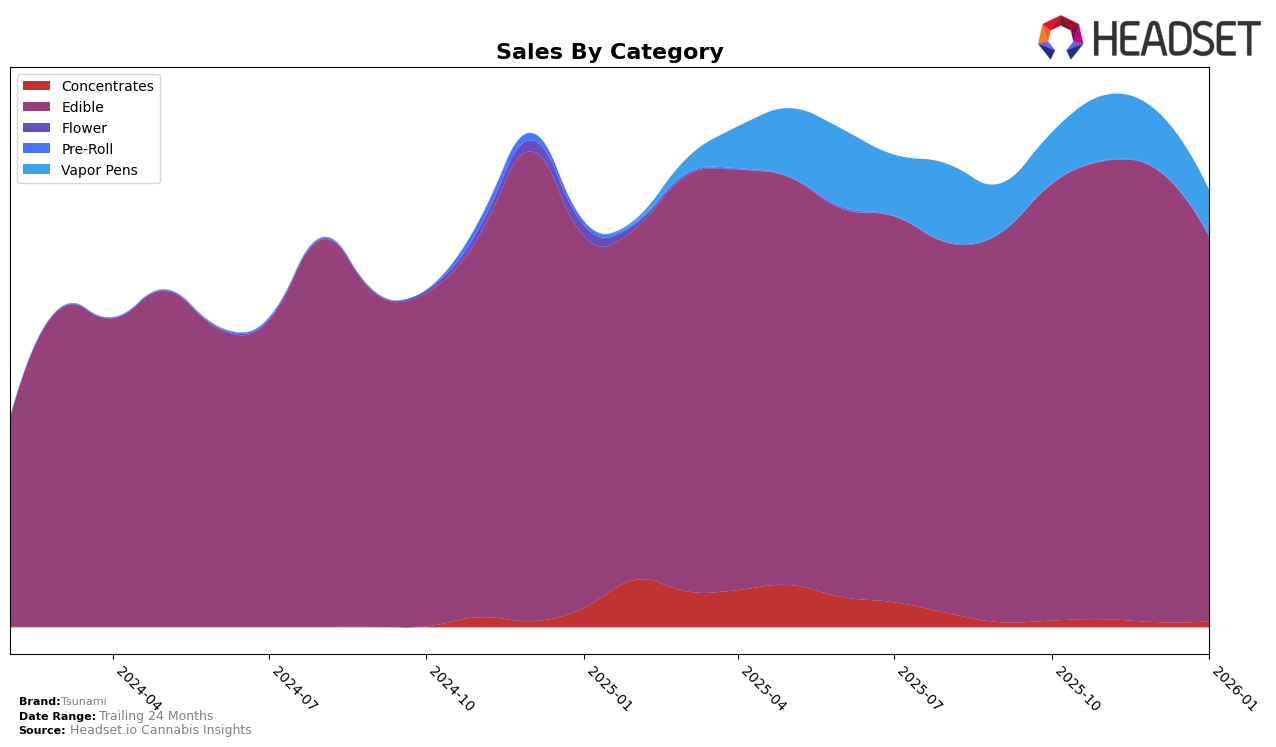

In the state of Missouri, Tsunami has shown a consistent presence in the Edible category, maintaining a top 10 ranking from October to December 2025. However, a slight dip was observed in January 2026, where the brand slipped to the 11th position. This movement could suggest increasing competition or market saturation in the Edible segment. On the other hand, Tsunami's performance in the Vapor Pens category did not make it into the top 30, with rankings ranging from 57th to 61st over the same period. This indicates a potential area for improvement or a strategic reevaluation for the brand in Missouri's Vapor Pens market.

Analyzing the sales figures for Tsunami's Edible category in Missouri, there was a noticeable downward trend from November to January, with sales peaking in November 2025 at $570,432 and then declining to $478,283 by January 2026. This trend might reflect seasonal variations or shifts in consumer preferences. Meanwhile, the Vapor Pens category, despite not breaking into the top 30, saw a peak in sales during November 2025, which then decreased by January 2026. This suggests that while there is some interest in Tsunami's Vapor Pens, it may not be strong enough to impact the rankings significantly, hinting at potential challenges in gaining a foothold in this category.

Competitive Landscape

In the Missouri edible cannabis market, Tsunami has experienced a slight decline in its competitive standing from October 2025 to January 2026. Initially holding a steady 10th rank from October to December 2025, Tsunami slipped to 11th place by January 2026. This shift is notable as DOSD Edibles maintained its 11th position through December before climbing to 10th in January, suggesting a competitive edge over Tsunami. Meanwhile, Ostara Cannabis and Honeybee have shown fluctuations in their rankings, with Ostara Cannabis briefly dropping to 13th in December but regaining its 12th position in January, and Honeybee experiencing a similar rank swap. Despite Tsunami's sales peaking in November 2025, the brand's January 2026 sales figures reflect a notable decrease, which could be a contributing factor to its drop in rank. This competitive landscape highlights the dynamic nature of the Missouri edible market, where maintaining a top position requires consistent performance and strategic adjustments.

Notable Products

In January 2026, the top-performing product for Tsunami was the Pink Drink Swells Gummy (100mg), maintaining its first-place ranking from previous months despite a decrease in sales to 777 units. The Pink Drink Swell Gummy (200mg) secured the second position, re-entering the rankings with 750 units sold. Strawberita Shred Swells Gummy (200mg) climbed to third place, showing a consistent presence after debuting in December 2025. Sour Black Cherry Banzai Gummies 10-Pack (2000mg) held steady in fourth place, although its sales slightly declined. A new entry, Peach Bellini Breeze Swells Gummy (200mg), rounded out the top five, indicating growing interest in this Edible product category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.