Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

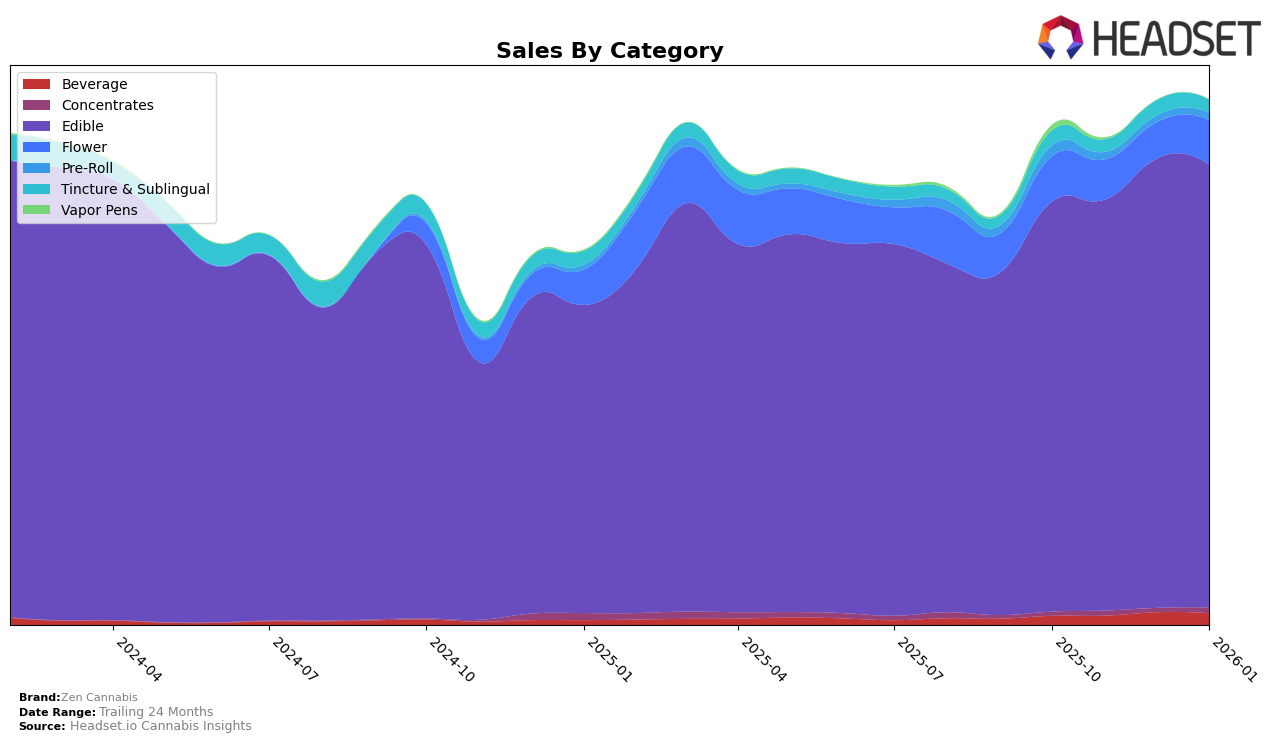

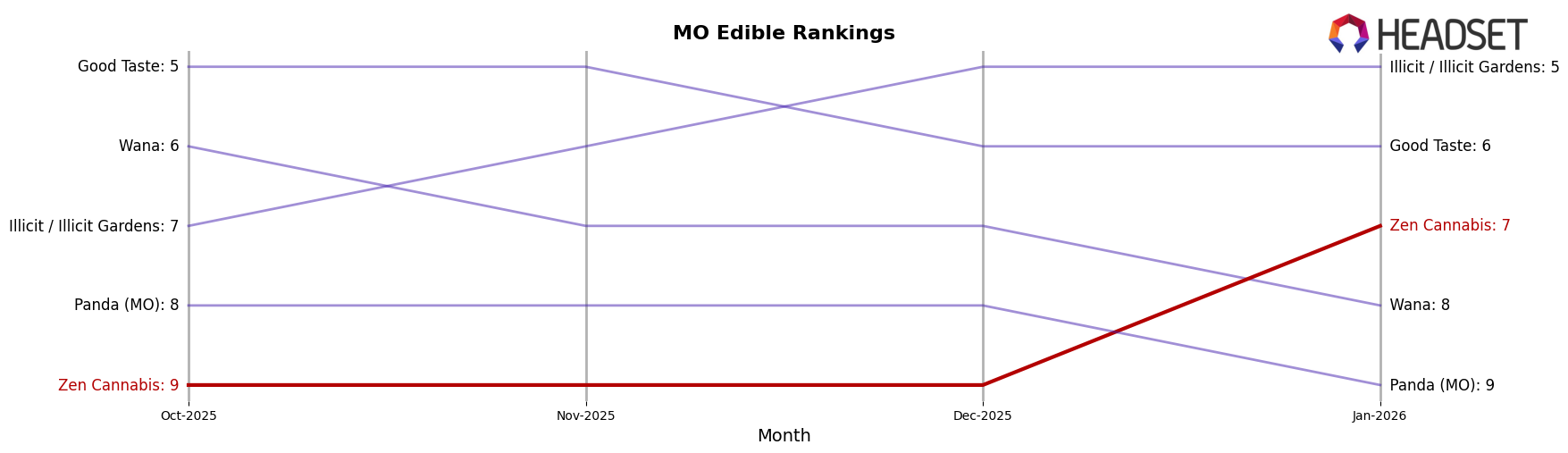

Zen Cannabis has shown a consistent presence in the California edibles market, maintaining a steady rank at 19th place from October 2025 to January 2026. Despite the stable ranking, there was a slight fluctuation in sales, peaking in December before dropping back in January. Meanwhile, in Missouri, Zen Cannabis has made significant strides in the edibles category, climbing from 9th to 7th place over the same period. This upward movement is supported by a clear increase in sales, indicating a growing consumer base and market penetration in the state.

In the tincture and sublingual category in Missouri, Zen Cannabis maintained a strong 2nd position for three months before slipping to 3rd in January 2026. This slight drop, coupled with a decrease in sales, suggests increased competition or shifting consumer preferences. Conversely, in the Washington flower market, Zen Cannabis did not secure a position within the top 30, highlighting a challenging environment for the brand in this category. Despite this, fluctuations in sales suggest ongoing efforts to capture market share, though they have yet to translate into a top-tier ranking.

Competitive Landscape

In the Missouri edible cannabis market, Zen Cannabis has shown a promising upward trajectory in recent months. From October 2025 to January 2026, Zen Cannabis improved its rank from 9th to 7th, indicating a positive shift in market positioning. This advancement is particularly notable given the competitive landscape, where brands like Wana and Illicit / Illicit Gardens have maintained higher ranks consistently. Despite this, Zen Cannabis has managed to increase its sales steadily, even surpassing Panda (MO) in January 2026. The brand's ability to climb the ranks amidst strong competitors such as Good Taste and maintain robust sales growth highlights its potential for continued success in the Missouri market.

Notable Products

In January 2026, Zen Cannabis's top-performing product was the CBD/THC 4:1 Grape NiteNite Gummies 10-Pack, maintaining its position as the number one product from the previous month with sales of 7478. The Indica Mini Fruit Punch Gummies 25-Pack climbed to the second spot, improving from its fifth-place ranking in December 2025. Sativa Mini Fruit Punch Gummies 25-Pack secured the third position, consistently performing well and moving up from fourth place. The newly ranked Hybrid Mini Assorted Flavor Gummies 25-Pack debuted at fourth place, indicating strong sales potential. In contrast, the Sativa Fruit Punch Gummies 10-Pack dropped to the fifth position, showing a decline from its previous second-place ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.