Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

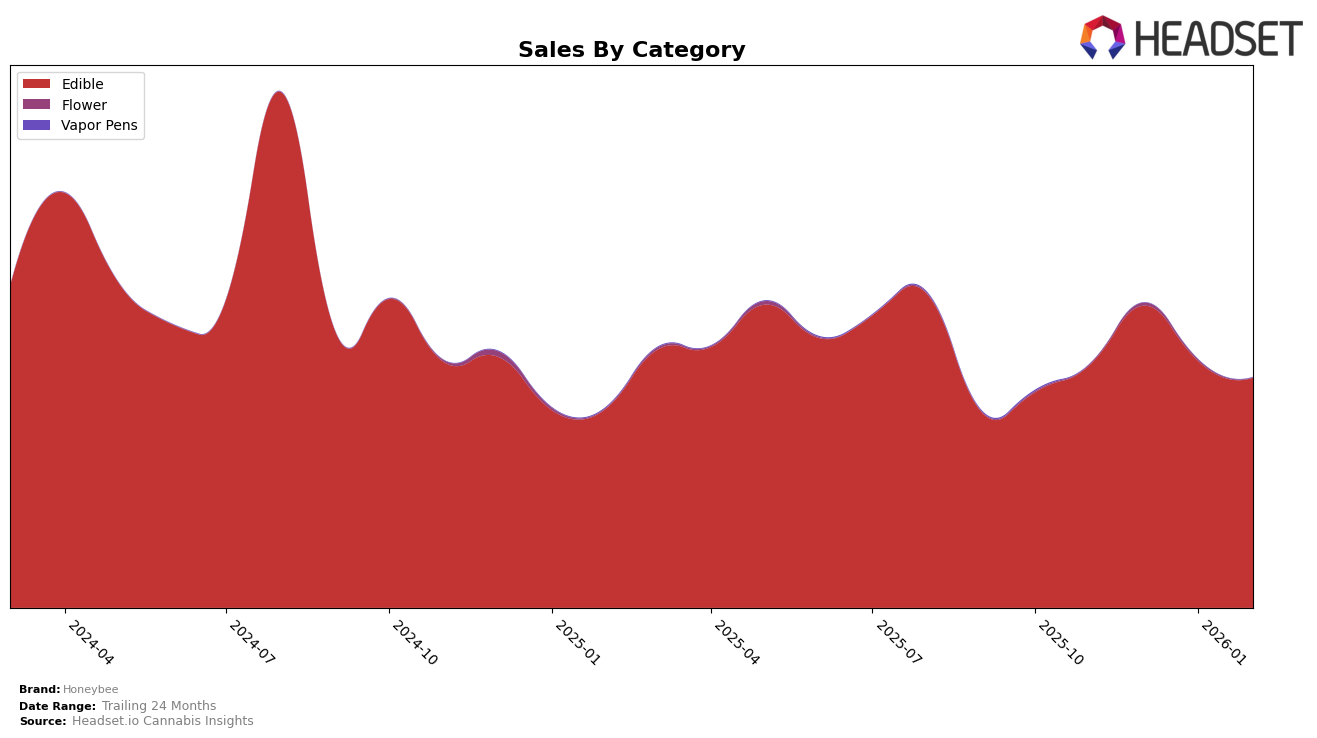

Honeybee's performance in the Missouri market has shown consistency within the Edible category over the past few months. The brand maintained a steady position at rank 12 from November 2025 through December 2025, with a slight dip to rank 13 in January 2026, before returning to rank 12 in February 2026. This indicates a stable presence in the top rankings, though there might be underlying factors affecting the minor fluctuations. The sales figures reflect a peak in December 2025, suggesting a possible seasonal boost or promotional activity that month, followed by a normalization in the subsequent months.

Despite the slight drop in January 2026, Honeybee's ability to regain its position by February 2026 in Missouri can be seen as a positive indicator of resilience and brand loyalty within the Edible category. However, the absence of Honeybee in the top 30 brands for other states or categories during this period could be interpreted as a challenge for the brand's expansion strategy. This suggests that while Honeybee has a solid foothold in Missouri, there is potential for growth in other regions and product categories if strategic adjustments are made.

Competitive Landscape

In the competitive landscape of the Missouri edible market, Honeybee has experienced a dynamic shift in its ranking over the past few months. Starting from November 2025, Honeybee held the 12th position, maintaining this rank through December before slipping to 13th in January 2026, and then regaining its 12th spot in February. This fluctuation in rank is indicative of the competitive pressures from brands like DOSD Edibles and Tsunami, which consistently ranked higher, holding the 10th position throughout this period. Notably, DOSD Edibles showed a strong sales performance, with sales figures consistently higher than Honeybee's, while Ostara Cannabis and Dialed In Gummies closely trailed Honeybee, reflecting a tightly contested market space. These insights suggest that while Honeybee is holding its ground, there is a need for strategic initiatives to enhance its market share and potentially climb the ranks amidst fierce competition.

Notable Products

In February 2026, the top-performing product from Honeybee was Queen Bee - Blood Orange Strawberry Gumdrop Gummies (100mg), which climbed to the number one position from third place in January. Grape Soda Gumdrops 20-Pack (100mg) maintained a strong performance, securing the second rank with sales of 1434 units. Blood Orange Strawberry Gumdrops 20-Pack (100mg) held steady in third place, although it experienced a slight decrease in sales from the previous month. Black Cherry Cola Gumdrops 20-Pack (100mg) dropped to fourth place, showing a notable decline from its previous first-place position. Queen Bee - Black Cherry Cola Gumdrop (100mg) rounded out the top five, having fallen from second place in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.