Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

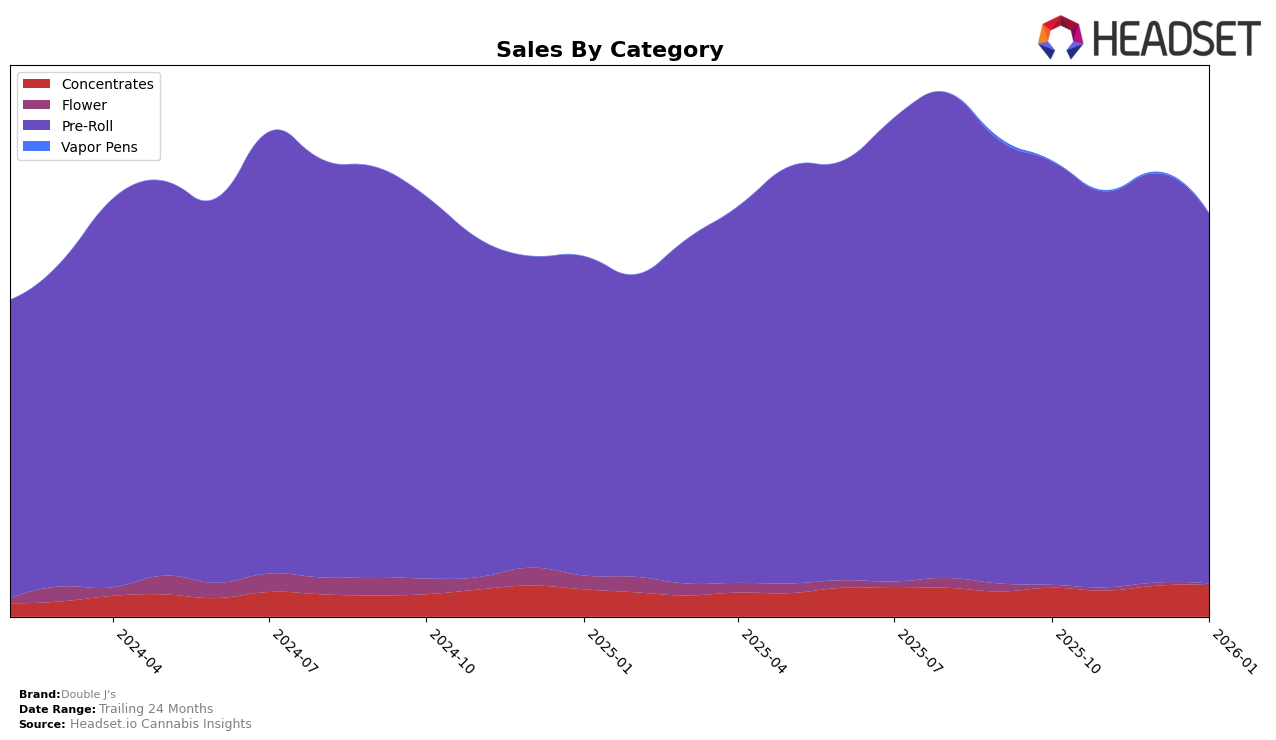

Double J's has shown notable variations in performance across different categories and regions. In the Concentrates category in Ontario, the brand hovered around the 34th rank from October to December 2025, before slightly improving to the 32nd position by January 2026. This upward movement suggests a positive reception or strategic adjustment in this market. However, the fact that they were not in the top 30 indicates there is still significant room for growth in this category. The sales figures reflect a positive trend, with a noticeable increase in January 2026, hinting at potential underlying factors that could be contributing to this growth.

In the Pre-Roll category, Double J's has maintained a more stable presence, consistently ranking 22nd in Ontario from October through December 2025, and slightly improving to the 21st rank in January 2026. This consistent ranking within the top 30 suggests a stronger foothold in the Pre-Roll market compared to Concentrates. Despite a dip in sales from November to January, the brand's ability to maintain its rank indicates a resilient demand or effective positioning strategy. The performance across these categories highlights both the challenges and opportunities for Double J's, with potential strategies to leverage their strengths in the Pre-Roll segment while addressing the competitive landscape in Concentrates.

Competitive Landscape

In the competitive landscape of pre-rolls in Ontario, Double J's has shown a consistent presence, maintaining a steady rank at 22nd place from October to December 2025, before slightly improving to 21st in January 2026. This upward movement suggests a positive trend, albeit modest, in a highly competitive market. Notably, Stunnerz experienced a decline from 14th to 20th place over the same period, indicating potential market share opportunities for Double J's. Meanwhile, 1964 Supply Co held a consistent 19th rank, and The Loud Plug and 3Saints hovered around the lower 20s, with occasional fluctuations. Double J's sales figures, although lower than some competitors, reflect a stable customer base, and the slight rank improvement suggests a potential for growth if strategic marketing efforts are employed to capitalize on competitors' declining ranks.

Notable Products

In January 2026, the top-performing product for Double J's was Cherry Boat Pre-Roll 2-Pack (2g), maintaining its first-place rank consistently since October 2025, with sales of 20,428. TK3k Pre-Roll 2-Pack (2g) held steady at the second position, reflecting consistency from the previous month. Star Cab Cherry Chem Pre-Roll 4-Pack (4g) remained in the third spot, despite a slight sales decline. Pink Sour Pre-Roll 2-Pack (2g) continued its fourth-place streak, showing stable performance over the months. Sungrown Traditional Hash (2g) held the fifth rank, consistent with its position from December 2025, marking a slight increase in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.