Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

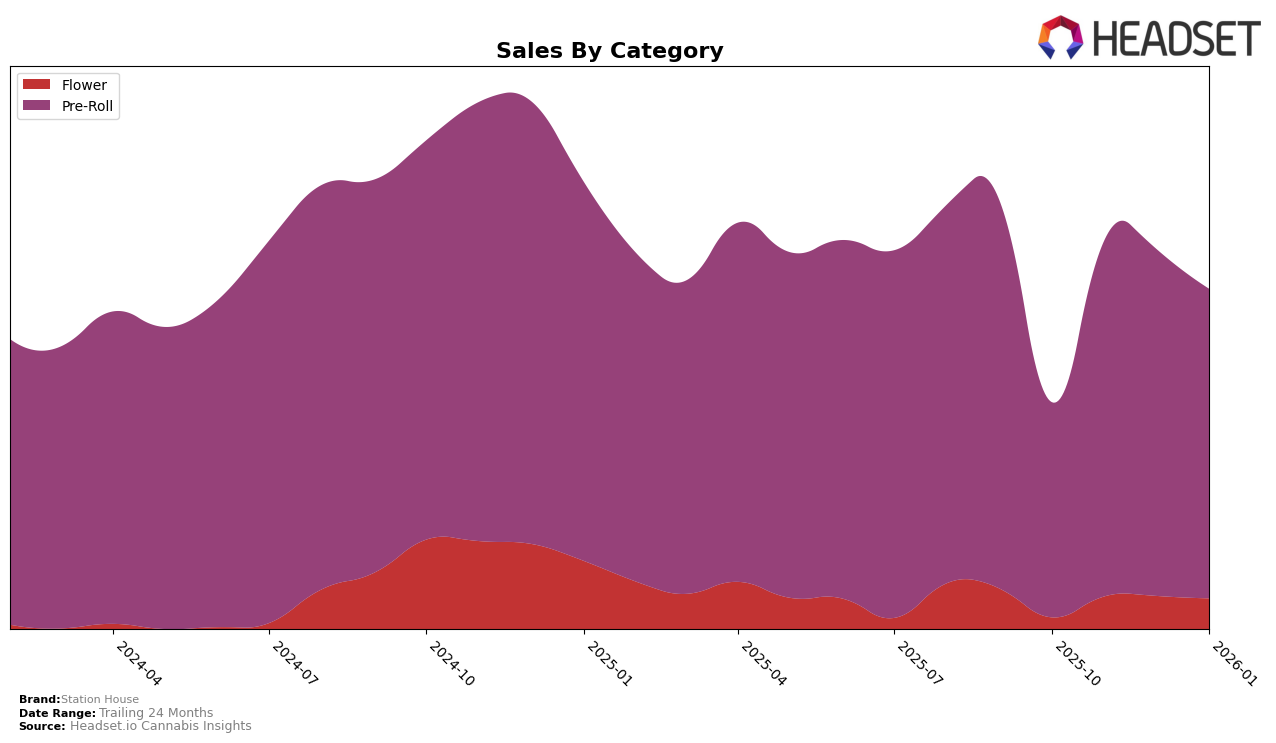

Station House has shown varied performance across different categories and states/provinces. In Alberta, the brand's ranking in the Pre-Roll category has been relatively stable, fluctuating within the top 30. However, the slight dip from 27th in December 2025 to 28th in January 2026 could be a point of concern, especially considering the decrease in sales from October 2025 to January 2026. Meanwhile, in British Columbia, Station House has made notable strides in the Pre-Roll category, climbing from 18th in October 2025 to an impressive 8th by January 2026. This upward trend is supported by a significant increase in sales, indicating strong consumer demand. However, in the Flower category, the brand hasn't broken into the top 30, signaling potential challenges or a focus on other segments.

In Ontario, Station House has maintained a consistent presence in the Pre-Roll category, holding the 25th position from December 2025 to January 2026. Despite this stability, there is a notable drop in sales, which might suggest growing competition or shifting consumer preferences. Conversely, the Flower category in Ontario shows a positive trajectory, with the brand improving its ranking from 61st in October 2025 to 49th by January 2026, alongside an increase in sales. This indicates potential growth opportunities in the Flower segment. Overall, while Station House has experienced both ups and downs, its performance in specific categories and regions suggests areas of strength and potential for strategic improvement.

Competitive Landscape

In the competitive landscape of pre-rolls in British Columbia, Station House has shown a noteworthy upward trajectory in its rankings, moving from 18th place in October 2025 to 8th place by January 2026. This ascent is indicative of a strategic gain in market presence, especially when compared to competitors like Claybourne Co., which fluctuated between 5th and 8th place, and Jeeter, maintaining a steady position around 6th and 7th. Interestingly, Shred also experienced a gradual climb, yet Station House's consistent improvement in rank suggests a more robust growth strategy. Despite Valhalla Flwr starting strong at the top in October, its decline to 10th by January highlights the dynamic shifts within the market, where Station House's enhanced positioning could potentially attract more consumer interest and drive sales further.

Notable Products

In January 2026, the top-performing product for Station House was Blue Dream Pre-Roll (0.5g), maintaining its number one rank consistently since October 2025 with sales of 48,908. Northern Lights Pre-Roll (0.5g) also held steady in second place throughout this period. OG Kush Pre-Roll (0.5g) climbed to third place in November 2025 and has retained that position since. Pink Kush Pre-Roll (0.5g) remained in fourth place from November 2025 onward. Ghost Train Haze Pre-Roll (0.5g) debuted in the rankings in November 2025 at fifth place and has held that position through January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.