Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

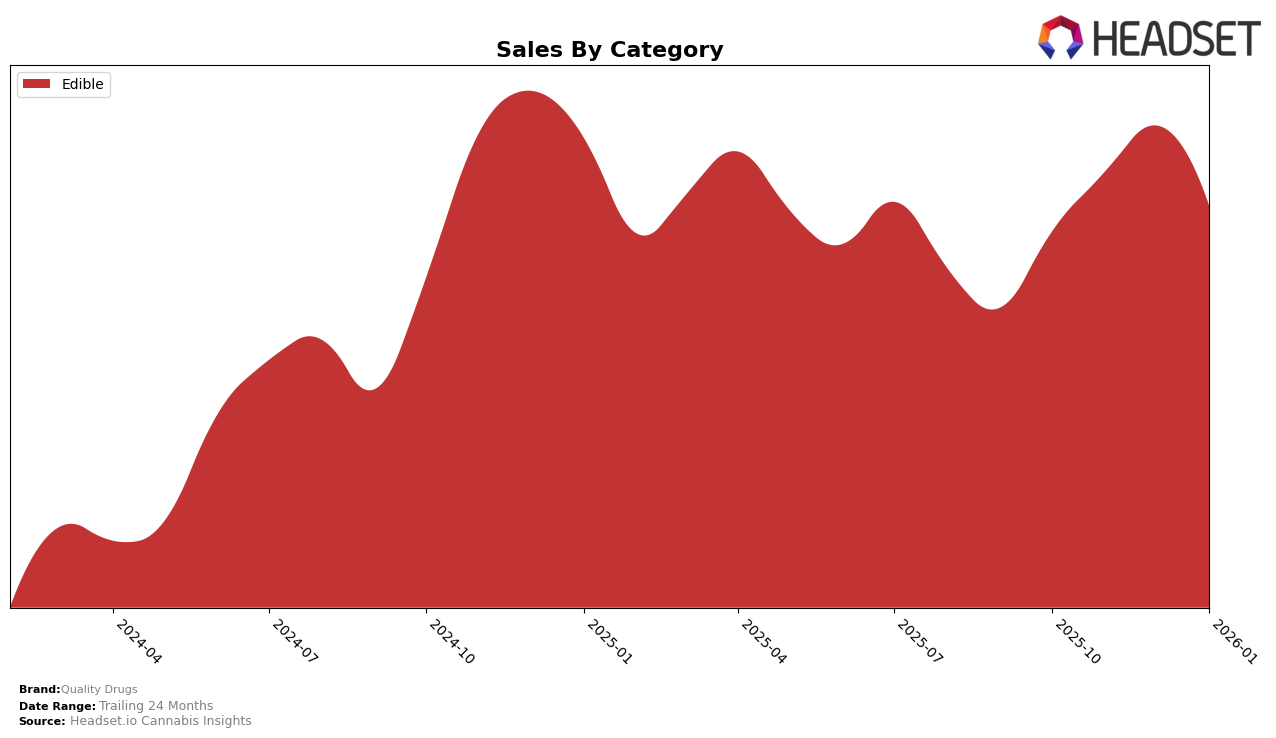

Quality Drugs has shown a dynamic performance in the Edible category within the state of Oregon. Over the past few months, the brand has maintained a steady presence in the top 15, with a significant improvement in November 2025, climbing from an 11th place ranking in October to 7th. This upward trend, however, saw a slight dip in December, moving back to 9th place, and then stabilizing at 10th in January 2026. Despite these fluctuations, the brand's sales figures reveal a positive trajectory, with noticeable growth from October to December before experiencing a slight downturn in January. This pattern suggests a robust demand for Quality Drugs' edibles, although the brand might need to strategize to maintain its top 10 position moving forward.

While Quality Drugs has consistently ranked within the top 30 in Oregon's Edible category, the absence of rankings in other states or categories could be a cause for concern or a potential area for expansion. The lack of presence in the top 30 in other regions or product categories might indicate a more localized success or a need for broader market penetration. Understanding these dynamics is crucial for stakeholders looking to capitalize on Quality Drugs' performance and to explore opportunities for growth beyond Oregon. For a deeper dive into Quality Drugs' performance and market strategies, further analysis of their sales data and market presence across different states and categories would be beneficial.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Quality Drugs has demonstrated notable fluctuations in its ranking over the months from October 2025 to January 2026. Initially positioned at 11th place in October, Quality Drugs made a significant leap to 7th place in November, surpassing Hellavated and Private Stash. However, by December, the brand experienced a slight decline, dropping to 9th place, and further slipped to 10th place in January. Despite these shifts, Quality Drugs consistently maintained a competitive edge over Feel Goods, which remained outside the top 10 throughout this period. The brand's sales trajectory mirrored its ranking changes, with a peak in November before a decline in January, indicating a potential need for strategic marketing efforts to sustain its competitive position and capitalize on its earlier momentum.

Notable Products

In January 2026, the top-performing product for Quality Drugs was Cosmic Pop Gummy (100mg), maintaining its number one position for four consecutive months with impressive sales of 3,684 units. The THC/CBD 2:1 Radiant Raspberry Gummy (100mg THC, 50mg CBD) climbed to the second spot, showing a notable increase in ranking from third place in November 2025. Super Sour Apple Gummy (100mg) slipped from second place in December 2025 to third in January 2026, with sales decreasing to 2,025 units. Mellow Mango Gummy (100mg) saw a drop in its ranking to fourth, while Watermelon Gummy (100mg) re-entered the top five, securing the fifth position. Overall, the rankings reflect a dynamic shift in consumer preferences, with the top-selling products consistently being from the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.