Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

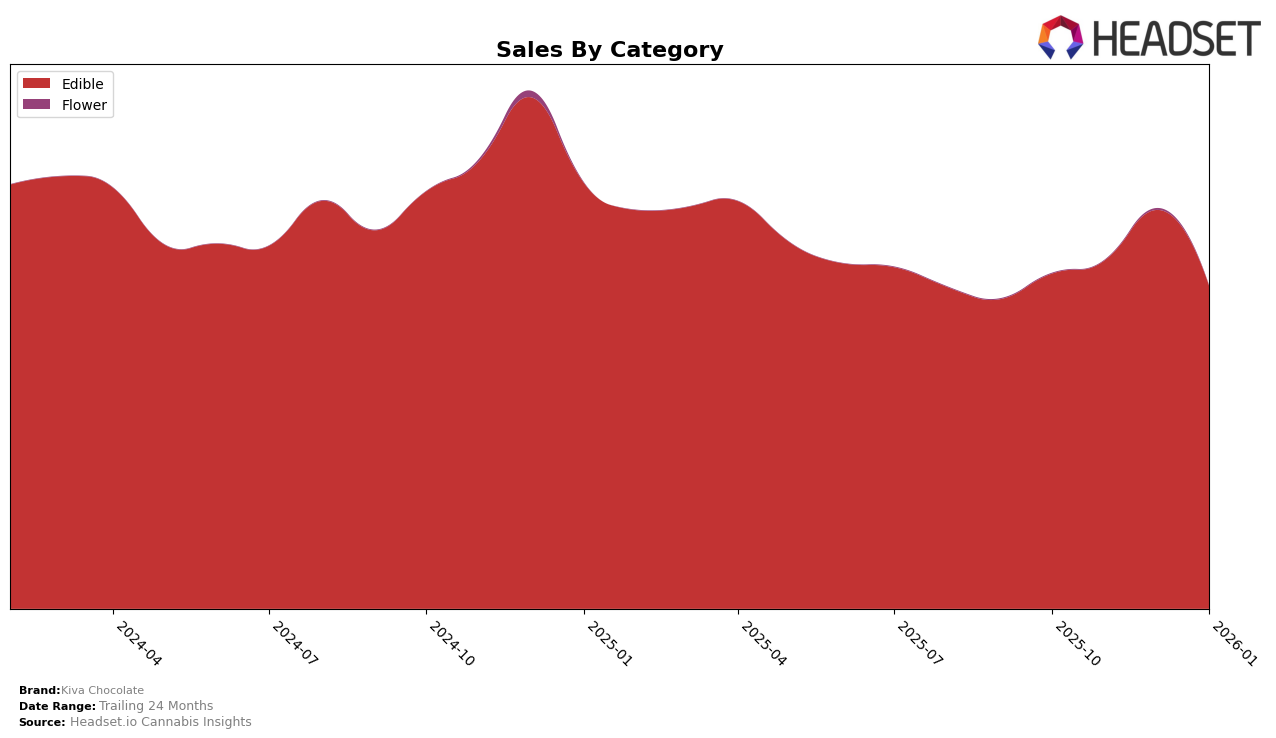

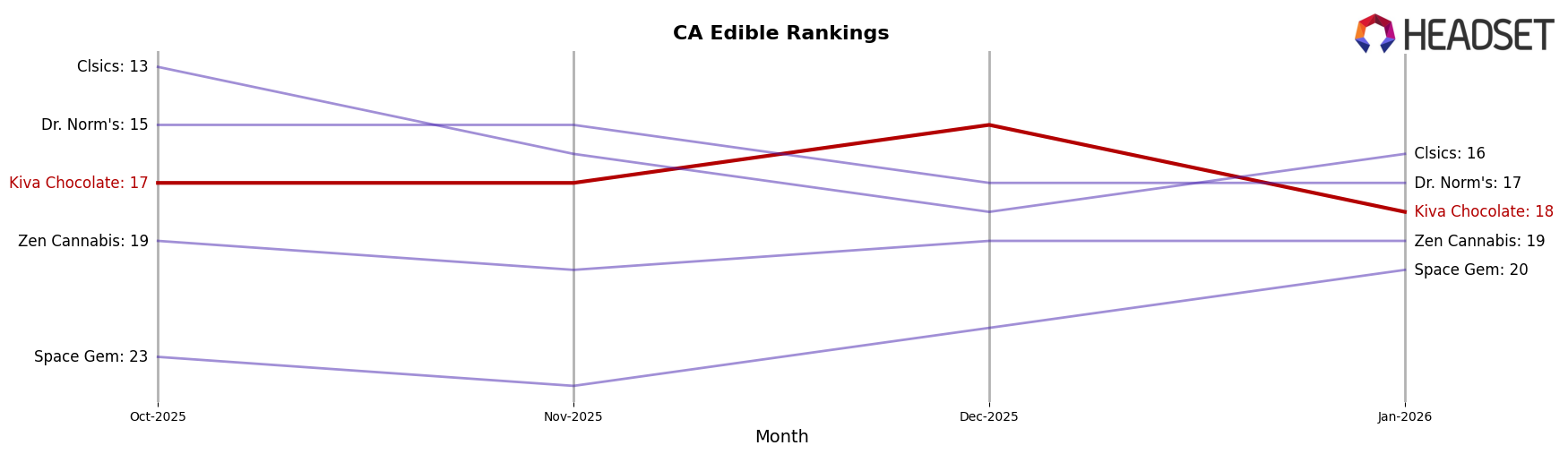

Kiva Chocolate has maintained a relatively stable performance in the Edible category across different states, with notable movements in specific regions. In California, Kiva Chocolate consistently ranked within the top 20, peaking at 15th place in December 2025 before slightly slipping to 18th in January 2026. This fluctuation in rankings correlates with a notable increase in sales during December, suggesting a seasonal spike. Meanwhile, in Michigan, Kiva Chocolate experienced a more volatile trajectory, reaching as high as 27th place in November 2025 before falling to 33rd by January 2026, indicating a competitive market environment. The brand's presence in New York also saw variability, with a dip in rankings from 27th to 34th over the analyzed period, reflecting potential challenges in maintaining market share.

In other states, Kiva Chocolate's performance has been less prominent. For instance, in Illinois, the brand hovered around the 47th to 50th rank, indicating a less competitive position in the Edible category. This consistent lower ranking suggests challenges in gaining traction in the state. Similarly, in Massachusetts, Kiva Chocolate did not make it into the top 30 rankings, highlighting a need for strategic adjustments to enhance visibility and sales. In Ohio, the brand has shown a more consistent presence, maintaining a rank around 30th, with slight improvements noted towards the end of the period. These insights suggest that while Kiva Chocolate has solidified its presence in certain markets, there is room for growth and strategic realignment in others to enhance its competitive standing.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Kiva Chocolate has experienced fluctuations in its ranking over the months from October 2025 to January 2026. Notably, Kiva Chocolate maintained a steady position at rank 17 in October and November 2025, improved to rank 15 in December 2025, but then slipped to rank 18 in January 2026. This indicates a dynamic market where Kiva Chocolate faces strong competition from brands like Dr. Norm's, which consistently ranked higher or equal, and Clsics, which showed a similar pattern of rank fluctuation. Despite these challenges, Kiva Chocolate's sales peaked in December 2025, suggesting a successful holiday season, before experiencing a decline in January 2026. Competitors such as Space Gem and Zen Cannabis remained outside the top 20 for some months, highlighting Kiva Chocolate's relative strength in maintaining a top 20 presence consistently, albeit with room for strategic improvements to regain and sustain higher rankings.

Notable Products

In January 2026, the top-performing product for Kiva Chocolate was the Dark Sea Salt Chocolate Bar 20-Pack (100mg), maintaining its first-place ranking from previous months with a sales figure of 8117 units. The Milk Chocolate Bar 20-Pack (100mg) consistently held the second spot, demonstrating steady demand. The Blackberry Dark Chocolate Bar 20-Pack (100mg) improved its position from fifth in November to third in December and retained this rank into January. The THC/CBN 5:2 Midnight Mint Dark Chocolate Bar 20-Pack (100mg THC, 40mg CBN) showed a slight decline, dropping to fourth place in December and remaining there in January. Lastly, the Milk Chocolate High Dose Bar 20-Pack (200mg) consistently ranked fifth, indicating stable, albeit lower, sales compared to its counterparts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.