Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

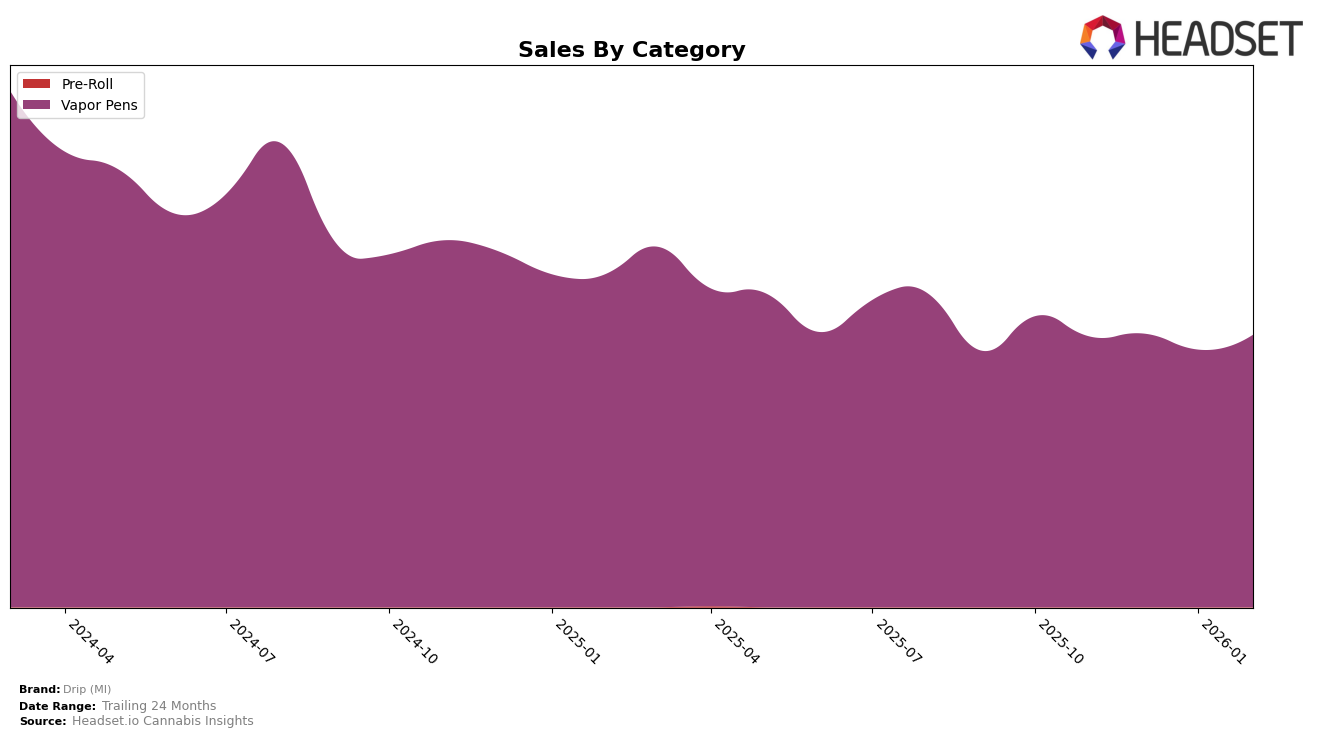

Drip (MI) has demonstrated consistent performance in the Vapor Pens category within the state of Michigan. Over the months from November 2025 to February 2026, Drip (MI) maintained a strong presence, securing the 4th or 5th position consistently. This stability in rankings indicates a robust market presence and customer loyalty in Michigan's competitive Vapor Pens segment. Although there was a slight dip in December 2025, where the brand fell to the 5th position, it quickly regained its 4th place standing in the following months. This suggests an effective response to market dynamics, possibly through strategic marketing or product adjustments.

In terms of sales, Drip (MI) experienced a minor fluctuation, with sales peaking in December 2025 before slightly decreasing in January 2026. Despite this dip, the brand's sales rebounded in February 2026, aligning with its improved ranking. This recovery could be indicative of successful promotional activities or increased consumer demand during that period. It's noteworthy that Drip (MI) consistently remained within the top 5 brands, signifying its strong foothold in Michigan's Vapor Pens market. However, the absence of rankings in other states or categories suggests potential areas for expansion or increased competition where Drip (MI) is not yet a top contender.

Competitive Landscape

In the competitive landscape of Vapor Pens in Michigan, Drip (MI) has maintained a consistent presence, holding the 4th rank in November 2025, January 2026, and February 2026, with a slight dip to 5th in December 2025. This stability in rank suggests a steady performance amidst fluctuating sales figures. Notably, MKX Oil Company consistently leads the market, holding the 2nd position across all months, indicating a significant gap in market dominance that Drip (MI) could aim to bridge. Meanwhile, Platinum Vape and Crude Boys have shown more variability in their rankings, with Platinum Vape improving from 5th to 4th in December 2025 before dropping again, and Crude Boys fluctuating between 5th and 6th. These shifts highlight opportunities for Drip (MI) to capitalize on its competitors' inconsistencies to potentially improve its market position.

Notable Products

For February 2026, the top-performing product from Drip (MI) was Blue Dream Distillate Cartridge (1g) in the Vapor Pens category, maintaining its top rank from January with notable sales of $29,913. Green Crack Distillate Cartridge (1g) climbed to the second position from the fourth in January, showing a consistent increase in popularity. Skywalker OG Distillate Cartridge (1g) held steady in third place, mirroring its January rank. Meanwhile, Granddaddy Purple Distillate Cartridge (1g) dropped to fourth position, having been consistently second in the previous three months. Super Lemon Haze Distillate Cartridge (1g) remained in fifth place, reflecting stable performance despite a slight increase in sales from January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.