Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

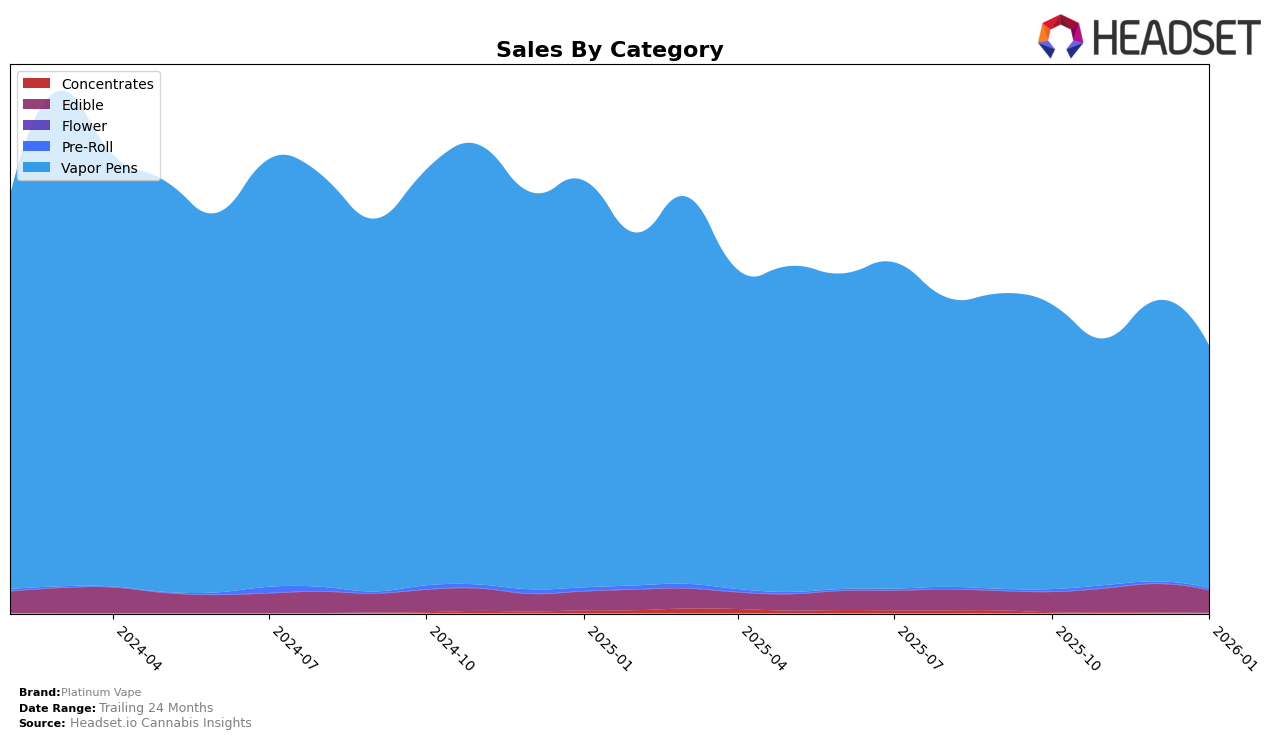

Platinum Vape has demonstrated varied performance across different states and categories, highlighting both opportunities and challenges. In California, the brand's presence in the Vapor Pens category has seen a notable improvement, moving from a rank of 75 in December 2025 to 55 by January 2026. This upward trend is significant, given the competitive nature of the California market. However, in Ontario, the brand's ranking in the Vapor Pens category slipped from 30 in December 2025 to 33 by January 2026, indicating a need to reassess their strategy in the Canadian market.

In Michigan, Platinum Vape has maintained a strong foothold in the Vapor Pens category, consistently ranking in the top 5 over the past four months, which underscores their dominance in this segment. Conversely, their performance in the Edible category in Michigan has shown stability, holding steady at rank 25 from December 2025 to January 2026. Meanwhile, in Missouri, the brand experienced a slight improvement in the Vapor Pens category, moving from rank 21 to 17 from December 2025 to January 2026, suggesting a positive reception in this state. These movements across states and categories highlight the dynamic nature of Platinum Vape's market presence and suggest areas for strategic focus and potential growth.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Platinum Vape has maintained a steady presence, consistently ranking fourth from October 2025 through January 2026, except for a brief dip to fifth in November 2025. Despite this consistency, Platinum Vape faces stiff competition from brands like MKX Oil Company and Muha Meds, which have consistently ranked higher, occupying the top three positions. MKX Oil Company, in particular, has shown robust sales figures, significantly outpacing Platinum Vape, indicating a strong consumer preference. Meanwhile, Drip (MI) and Crude Boys remain close competitors, with Drip (MI) occasionally surpassing Platinum Vape in rank. This competitive pressure suggests that while Platinum Vape holds a solid position, there is a need for strategic initiatives to enhance brand visibility and consumer engagement to climb higher in the rankings and boost sales.

Notable Products

In January 2026, the top-performing product for Platinum Vape was Grape Gummy Coins 10-Pack (200mg) in the Edible category, maintaining its first-place rank from the previous two months with sales of 10,400 units. Berry Gummy Coins 10-Pack (200mg) rose to the second position, showing an improvement from its previous fifth-place ranking in November 2025. The OPP x Smarties Distillate Cartridge (1g) made its debut in the rankings at the third position in the Vapor Pens category. Sativa Green Apple Gummies Coins 10-Pack (200mg) saw a decline, dropping to fourth place from its second position in November 2025. Lastly, Watermelon Gummies Coins 10-Pack (200mg) entered the rankings at fifth place, indicating a growing interest in this edible product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.