Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

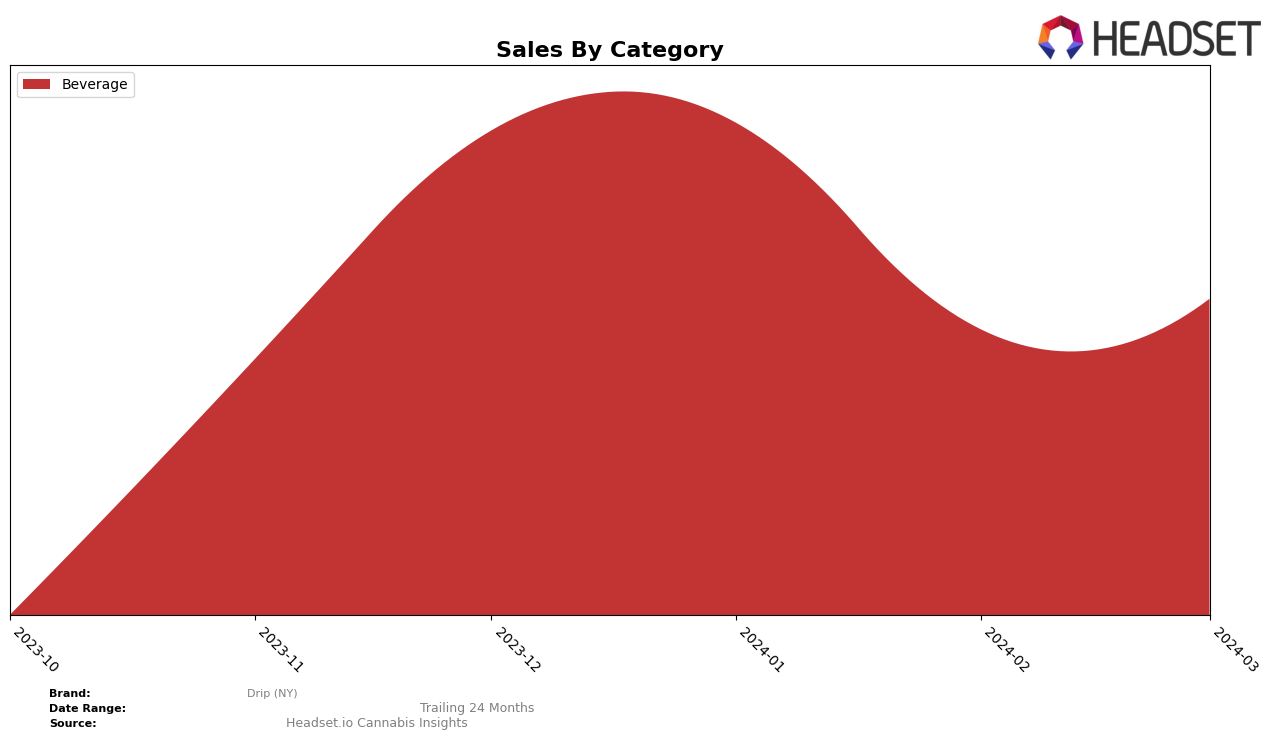

In the competitive cannabis market of New York, Drip (NY) has shown a consistent presence in the Beverage category, maintaining its position among the top brands. Notably, Drip (NY) held the 10th rank in December 2023 and January 2024, before experiencing a slight dip to the 12th position in February and March 2024. This movement indicates a stable demand for their products amidst a crowded market, though the slight drop in rank suggests a need for strategic adjustments to reclaim or improve their standing. Their sales in December 2023, amounting to $3065, reflect a solid consumer base which slightly grew in January 2024 but saw a decrease in the following months, emphasizing the challenges of sustaining growth in such a dynamic sector.

While the data presents a mixed picture of Drip (NY)'s performance, it's crucial to recognize the significance of consistently ranking within the top 15 in a state as competitive as New York. The slight decline in rank from February to March 2024, however, should not be overlooked. This could either signify a normal fluctuation in consumer preferences or highlight a potential area for the brand to strengthen its market strategies. The absence of Drip (NY) from the top 30 brands in other states or categories may indicate a focused strategy on the New York market or an opportunity for expansion. Analyzing these trends provides valuable insights into Drip (NY)'s market position and potential areas for growth and improvement.

Competitive Landscape

In the competitive landscape of the beverage category in New York, Drip (NY) has shown a consistent presence but faced challenges in improving its rank among competitors. From December 2023 to March 2024, Drip (NY) maintained a position in the top 20, moving from 10th to 12th place. This indicates a slight decline in its competitive standing, particularly when compared to brands like Hi5 Seltzer and Nanticoke, which have shown more stability in their rankings. Notably, new entrants such as Wynk and High Peaks have emerged, with Wynk making a significant leap to the 13th position by March 2024, showcasing a dynamic shift in consumer preferences and competitive pressures. The sales trends for Drip (NY) also reflect a need for strategic adjustments, as it experienced a decrease in sales from December 2023 to February 2024, before a slight recovery in March. This performance trajectory suggests that while Drip (NY) maintains a solid base, the brand must innovate and adapt to reclaim and enhance its market position amidst growing competition and evolving consumer tastes in New York's beverage sector.

Notable Products

In March 2024, Drip (NY) saw the THC/CBG 1:1 Lemon Lime Drink Enhancer (90mg THC, 90mg CBG) take the lead in sales with a remarkable figure of 33 units sold, moving up from its previous rank of 4 in February. Following closely, the Citrus Drink Enhancer (90mg THC, 30ml) climbed to the second position, showcasing a significant sales increase from its February rank. The Berry Pomegranate Drink Enhancer (90mg) and Fruit Punch Drink Enhancer (90mg) both tied for the third place, maintaining a consistent performance from the previous month. Interestingly, the Mango Lemonade Drink Enhancer (90mg), despite not being ranked in February, made a notable entry into the fourth position in March. This month's rankings illustrate a dynamic shift in consumer preferences within Drip (NY)'s beverage category, highlighting a growing interest in diverse flavor profiles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.