Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

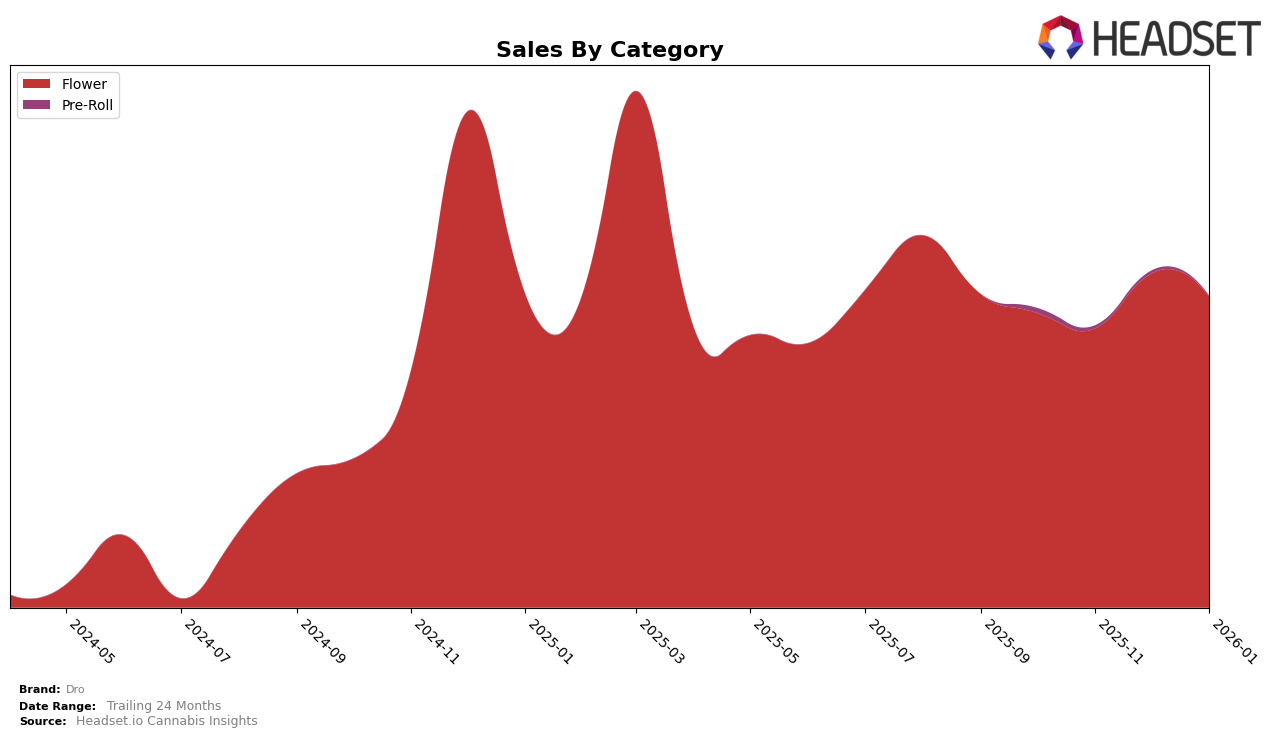

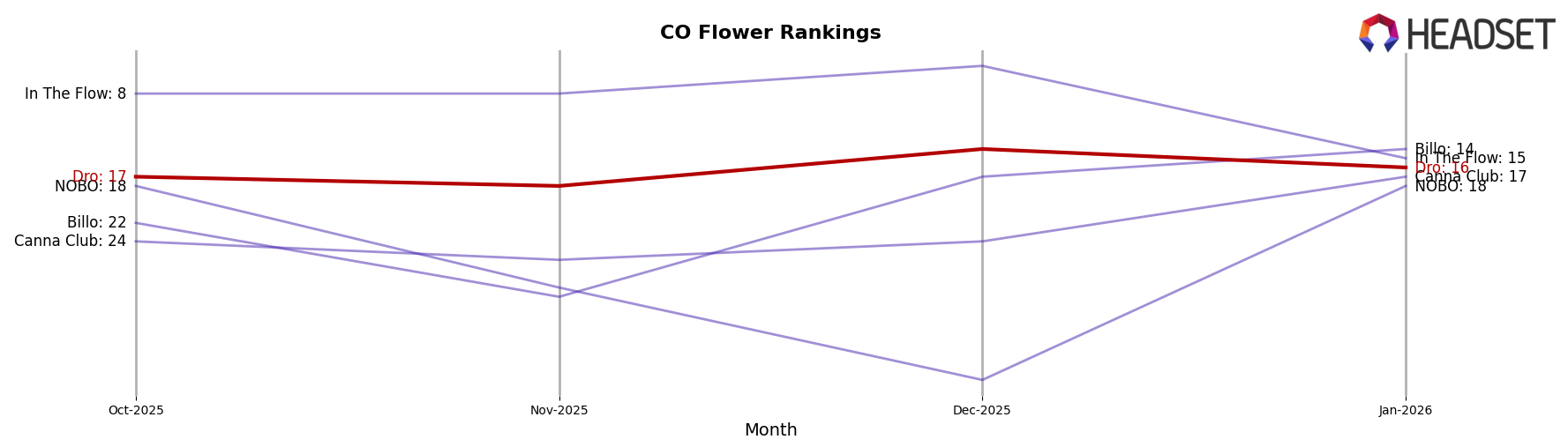

In the state of Colorado, Dro has shown a consistent presence in the Flower category over the past few months. Starting in October 2025, Dro was ranked 17th, and although they experienced a slight dip to 18th place in November, they bounced back to 14th place in December. By January 2026, their rank adjusted slightly to 16th. This movement indicates a resilient performance, especially as Dro managed to climb back into the top 15 by December. The sales figures reveal an interesting trend: despite the fluctuation in rankings, Dro's sales peaked in December, suggesting a strong holiday season performance.

It's noteworthy that Dro has maintained a spot within the top 30 brands in Colorado's Flower category throughout this period, which is a positive indicator of their market presence. However, the absence of Dro in the top 30 in other states or categories could be seen as a potential area for growth or a reflection of their strategic focus on the Colorado market. This consistent presence in Colorado suggests a strong brand loyalty or effective marketing strategies that resonate with local consumers. Observing how Dro adapts and performs in other regions or categories in the future could provide further insights into their broader market strategy and potential for expansion.

```Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Dro has demonstrated a relatively stable performance over the analyzed period, maintaining a consistent presence in the top 20 rankings. In contrast, In The Flow experienced a notable fluctuation, peaking at rank 5 in December 2025 but dropping to rank 15 by January 2026. This volatility could suggest potential opportunities for Dro to capitalize on any market instability. Meanwhile, Billo showed a positive trajectory, improving its rank from 22 in October 2025 to 14 in January 2026, possibly indicating a growing consumer preference or effective marketing strategies. NOBO and Canna Club also showed varying performances, with NOBO's rank fluctuating significantly and Canna Club showing a steady climb. Dro's stable ranking amidst these shifts suggests a solid market position, though the brand may need to innovate or enhance its offerings to outpace competitors like Billo, which are gaining traction.

Notable Products

In January 2026, Banana Man (7g) emerged as the top-performing product for Dro, maintaining its number one rank from November 2025 and achieving sales of 1191 units. Blanco (7g) climbed significantly to the second position, up from fourth in November 2025, with sales reaching 983 units. Blue Nerds (7g) made a notable entry, sharing the second spot in January 2026. Purple Water Ice (7g) followed closely in third place with 945 units sold, marking its debut in the rankings. Honey Banana (7g) slipped to fourth position from third in December 2025, indicating a slight decline in its sales momentum.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.