Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

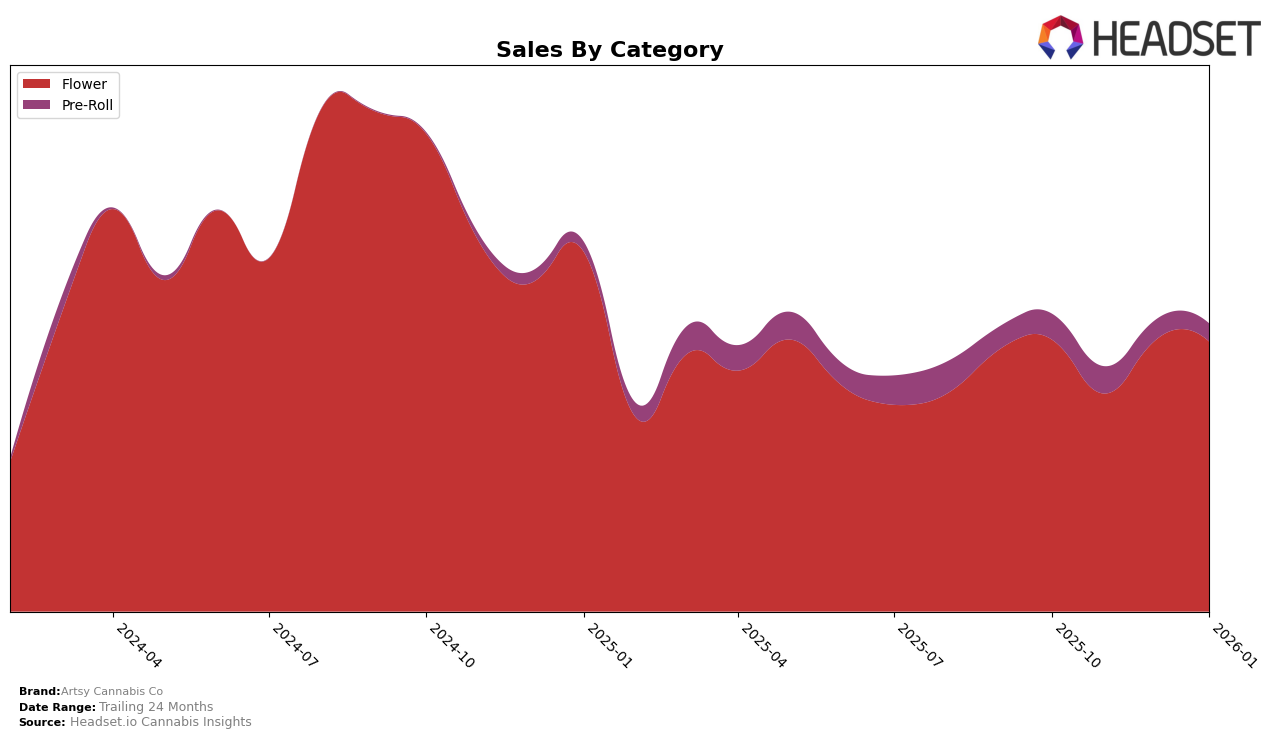

Artsy Cannabis Co has shown a dynamic performance in the Colorado market, particularly in the Flower category. Over the span from October 2025 to January 2026, the brand's ranking fluctuated, starting at 12th, dipping to 16th in November, and then climbing to 11th in December before settling at 13th in January. Despite these shifts in ranking, the sales figures reveal a consistent demand for their Flower products, with notable sales stability between December and January. This suggests a resilient market presence even amidst competitive pressures within the state.

In contrast, Artsy Cannabis Co's performance in the Pre-Roll category in Colorado did not achieve a top 30 ranking, indicating a less dominant position in this segment. The brand's rankings hovered outside the top 30, with a slight improvement from 42nd in October to 38th in November, but then a decline to 47th in December and a modest rise to 45th in January. This inconsistent performance reflects challenges in capturing a significant share of the Pre-Roll market, which could be attributed to either heightened competition or a need for strategic adjustments in product offerings or marketing efforts.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Artsy Cannabis Co has experienced fluctuating rankings, indicative of a dynamic market environment. As of January 2026, Artsy Cannabis Co holds the 13th position, a slight improvement from its 16th place in November 2025, yet a dip from its 11th place in December 2025. This suggests a need for strategic adjustments to maintain upward momentum. Competitors like In The Flow and Silver Lake have shown stronger performance, with In The Flow peaking at 5th place in December 2025 and Silver Lake consistently ranking within the top 10, except for a slight drop to 11th in January 2026. Meanwhile, Natty Rems and Billo demonstrate volatility, with Natty Rems falling to 20th in December 2025 before recovering to 12th in January 2026, and Billo climbing from outside the top 20 in November 2025 to 14th in January 2026. Artsy Cannabis Co's sales figures reflect a stable yet competitive position, necessitating innovative strategies to enhance brand visibility and capture market share from these agile competitors.

Notable Products

In January 2026, the top-performing product for Artsy Cannabis Co was Brisket Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 1949 units. Midnight Moonlight (3.5g) in the Flower category followed closely behind, securing the second position. Moon Suit (3.5g) maintained its third-place rank from December 2025, showing consistent performance in the Flower category. Mandarin Space Cookies (3.5g) dropped slightly to the fourth position, despite being second in November 2025. Superstylin' Pre-Roll (1g) entered the rankings at fifth place in January, suggesting a rise in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.